Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Record the required Journal Entry to complete the BRS Question 3- 10 Marks Bobby's bookstore reports the following: 1. June 30, 2020 Bank balance

2. Record the required Journal Entry to complete the BRS

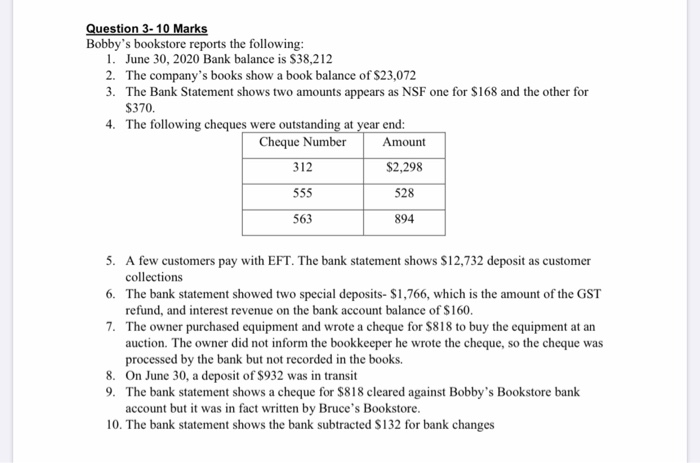

Question 3- 10 Marks Bobby's bookstore reports the following: 1. June 30, 2020 Bank balance is $38,212 2. The company's books show a book balance of $23,072 3. The Bank Statement shows two amounts appears as NSF one for $168 and the other for $370. 4. The following cheques were outstanding at year end: Cheque Number Amount 312 $2,298 528 555 563 894 5. A few customers pay with EFT. The bank statement shows $12,732 deposit as customer collections 6. The bank statement showed two special deposits- $1,766, which is the amount of the GST refund, and interest revenue on the bank account balance of $160. 7. The owner purchased equipment and wrote a cheque for $818 to buy the equipment at an auction. The owner did not inform the bookkeeper he wrote the cheque, so the cheque was processed by the bank but not recorded in the books. 8. On June 30, a deposit of $932 was in transit 9. The bank statement shows a cheque for $818 cleared against Bobby's Bookstore bank account but it was in fact written by Bruce's Bookstore. 10. The bank statement shows the bank subtracted $132 for bank changes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started