2. Rhianna is buying a car for $18,300. She has a $1500 trade-in allowance and will make a $2000 down payment. She will finance

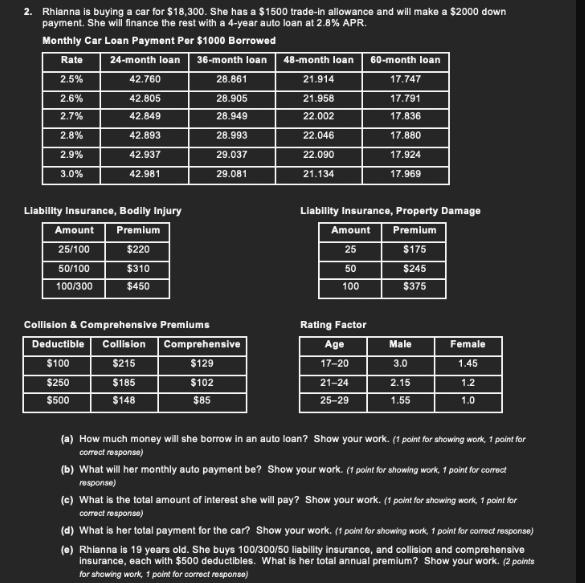

2. Rhianna is buying a car for $18,300. She has a $1500 trade-in allowance and will make a $2000 down payment. She will finance the rest with a 4-year auto loan at 2.8% APR. Monthly Car Loan Payment Per $1000 Borrowed Rate 24-month loan 36-month loan 48-month loan 60-month loan 2.5% 42.760 28.861 21.914 17.747 2.6% 42.805 28.905 21.958 17.791 2.7% 42.849 28.949 22.002 17.836 2.8% 42.893 28.993 22.046 17.880 2.9% 42.937 29.037 22.090 17.924 3.0% 42.981 29.081 21.134 17.969 Liability Insurance, Bodily Injury Amount Premium 25/100 $220 50/100 $310 100/300 $450 Liability Insurance, Property Damage Amount Premium 25 $175 50 $245 100 $375 Collision & Comprehensive Premiums Rating Factor Deductible Collision Comprehensive Age Male Female $100 $215 $129 17-20 3.0 1.45 $250 $185 $102 21-24 2.15 1.2 $500 $148 $85 25-29 1.55 1.0 (a) How much money will she borrow in an auto loan? Show your work. (1 point for showing work, 1 point for correct response) (b) What will her monthly auto payment be? Show your work. (1 point for showing work, 1 point for correct response) (c) What is the total amount of interest she will pay? Show your work. (1 point for showing work, 1 point for correct response) (d) What is her total payment for the car? Show your work. (1 point for showing work, 1 point for correct response) () Rhianna is 19 years old. She buys 100/300/50 liability insurance, and collision and comprehensive insurance, each with $500 deductibles. What is her total annual premium? Show your work. (2 points for showing work, 1 point for correct response)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the amount of money Rhianna will borrow in an auto loan we need to subtract her tradein allowance and down payment from the total car p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started