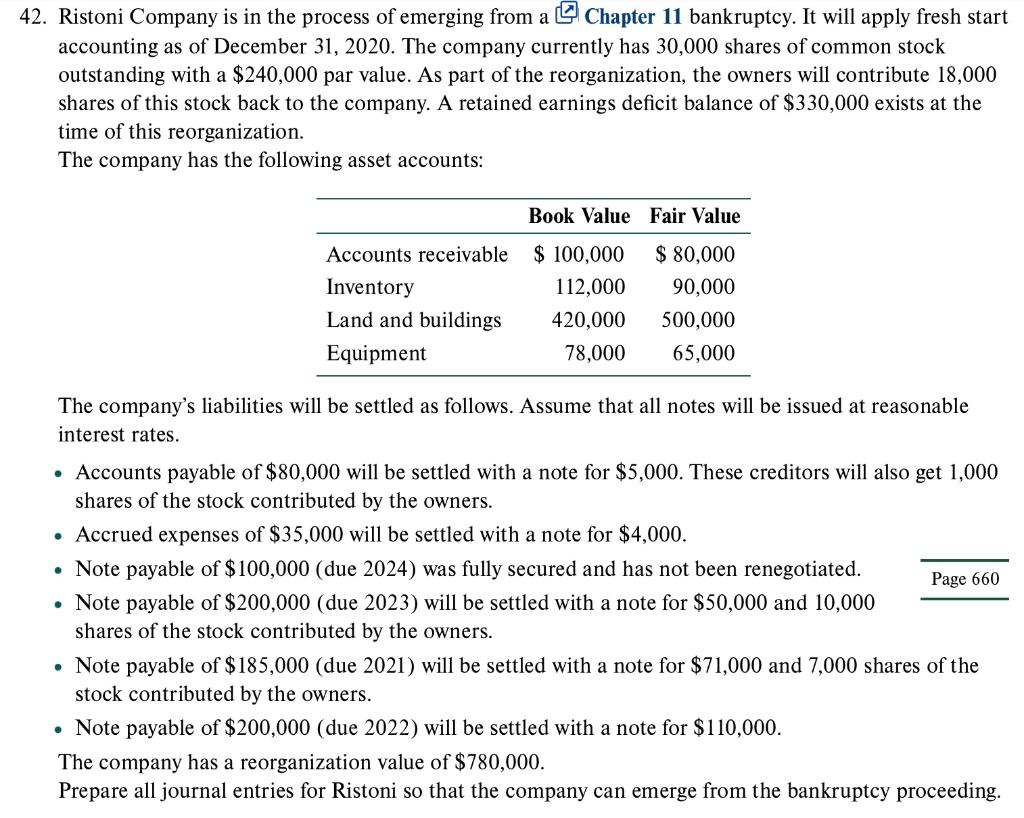

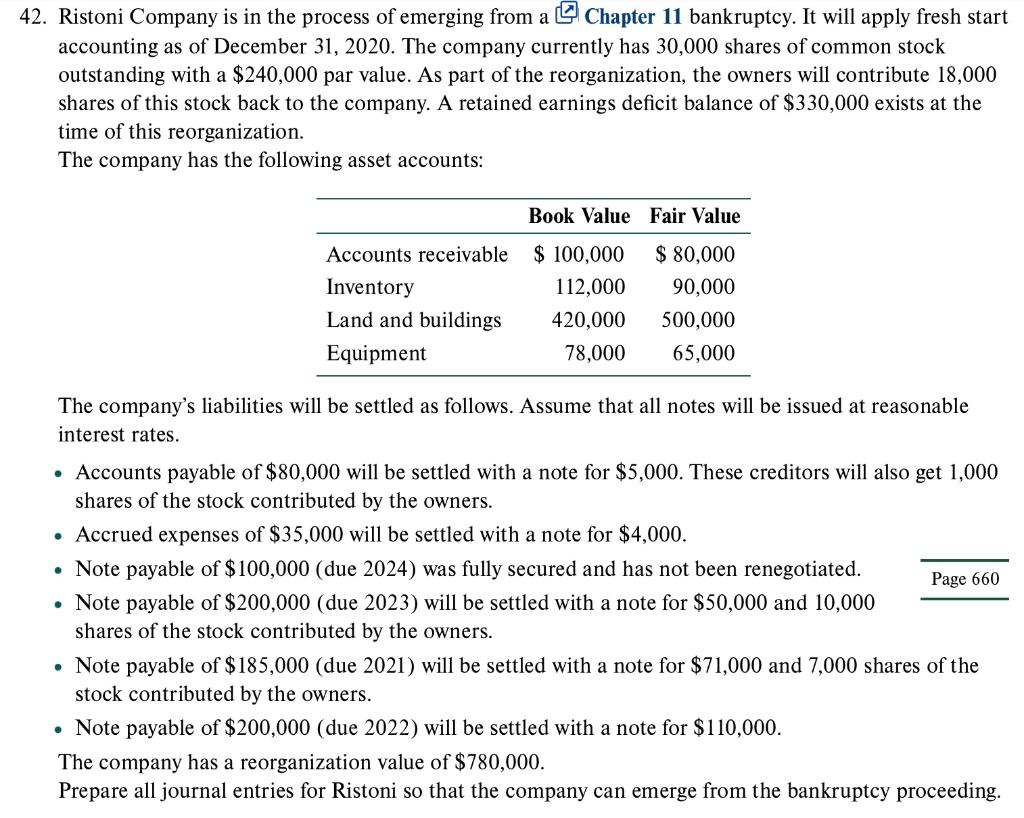

2. Ristoni Company is in the process of emerging from a [ Chapter 11 bankruptcy. It will apply fresh start accounting as of December 31, 2020. The company currently has 30,000 shares of common stock outstanding with a $240,000 par value. As part of the reorganization, the owners will contribute 18,000 shares of this stock back to the company. A retained earnings deficit balance of $330,000 exists at the time of this reorganization. The company has the following asset accounts: The company's liabilities will be settled as follows. Assume that all notes will be issued at reasonable interest rates. - Accounts payable of $80,000 will be settled with a note for $5,000. These creditors will also get 1,000 shares of the stock contributed by the owners. - Accrued expenses of $35,000 will be settled with a note for $4,000. - Note payable of $100,000 (due 2024) was fully secured and has not been renegotiated. - Note payable of $200,000 (due 2023) will be settled with a note for $50,000 and 10,000 shares of the stock contributed by the owners. - Note payable of $185,000 (due 2021) will be settled with a note for $71,000 and 7,000 shares of the stock contributed by the owners. - Note payable of $200,000 (due 2022) will be settled with a note for $110,000. The company has a reorganization value of $780,000. Prepare all journal entries for Ristoni so that the company can emerge from the bankruptcy proceeding. 2. Ristoni Company is in the process of emerging from a [ Chapter 11 bankruptcy. It will apply fresh start accounting as of December 31, 2020. The company currently has 30,000 shares of common stock outstanding with a $240,000 par value. As part of the reorganization, the owners will contribute 18,000 shares of this stock back to the company. A retained earnings deficit balance of $330,000 exists at the time of this reorganization. The company has the following asset accounts: The company's liabilities will be settled as follows. Assume that all notes will be issued at reasonable interest rates. - Accounts payable of $80,000 will be settled with a note for $5,000. These creditors will also get 1,000 shares of the stock contributed by the owners. - Accrued expenses of $35,000 will be settled with a note for $4,000. - Note payable of $100,000 (due 2024) was fully secured and has not been renegotiated. - Note payable of $200,000 (due 2023) will be settled with a note for $50,000 and 10,000 shares of the stock contributed by the owners. - Note payable of $185,000 (due 2021) will be settled with a note for $71,000 and 7,000 shares of the stock contributed by the owners. - Note payable of $200,000 (due 2022) will be settled with a note for $110,000. The company has a reorganization value of $780,000. Prepare all journal entries for Ristoni so that the company can emerge from the bankruptcy proceeding