Question

2. Select Mutual Funds or ETFs (1 point) Refer to the Funds table in appendix B. Using any stock picker (consider morningstar.com if you dont

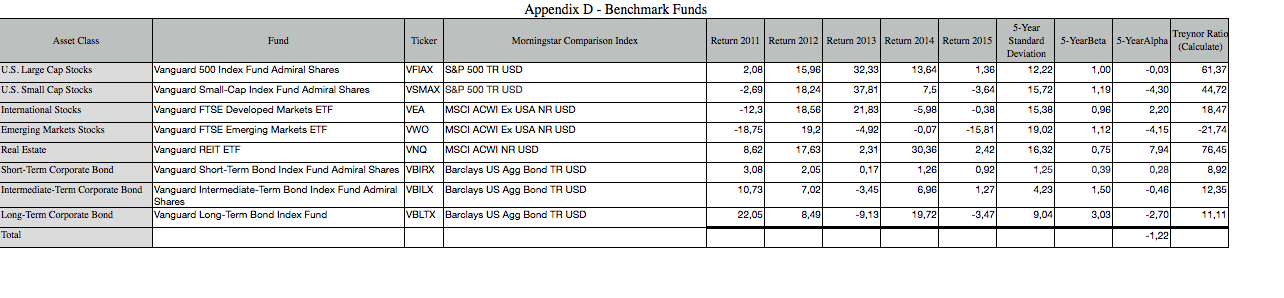

2. Select Mutual Funds or ETFs (1 point) Refer to the Funds table in appendix B. Using any stock picker (consider morningstar.com if you dont know of one), select one mutual fund or ETF for each asset class (no individual stocks or bonds). Note that appendix D - Benchmark Funds, provides an example of the required data. a) Identify the name of the fund. b) Identify the ticker symbol. c) Using morningstar.com, identify returns for 2010 through 2014 for each fund (this data is on the performance tab). If the fund does not have 5 years of data, select a different fund. d) Using morninstar.com, identify the Morningstar comparison index, as well as the 5- Year standard deviation, beta and alpha for each fund (this data is on the Ratings & Risk tab under the MPT Statistics section). e) Total the alpha column. f) Calculate the average Treynor ratio for all 5 years for each fund using 0.8% as the risk-free rate of return. Do not use the Treynor ratios found on Morningstar.

2. Select Mutual Funds or ETFs (1 point) Refer to the Funds table in appendix B. Using any stock picker (consider morningstar.com if you dont know of one), select one mutual fund or ETF for each asset class (no individual stocks or bonds). Note that appendix D - Benchmark Funds, provides an example of the required data. a) Identify the name of the fund. b) Identify the ticker symbol. c) Using morningstar.com, identify returns for 2010 through 2014 for each fund (this data is on the performance tab). If the fund does not have 5 years of data, select a different fund. d) Using morninstar.com, identify the Morningstar comparison index, as well as the 5- Year standard deviation, beta and alpha for each fund (this data is on the Ratings & Risk tab under the MPT Statistics section). e) Total the alpha column. f) Calculate the average Treynor ratio for all 5 years for each fund using 0.8% as the risk-free rate of return. Do not use the Treynor ratios found on Morningstar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started