Answered step by step

Verified Expert Solution

Question

1 Approved Answer

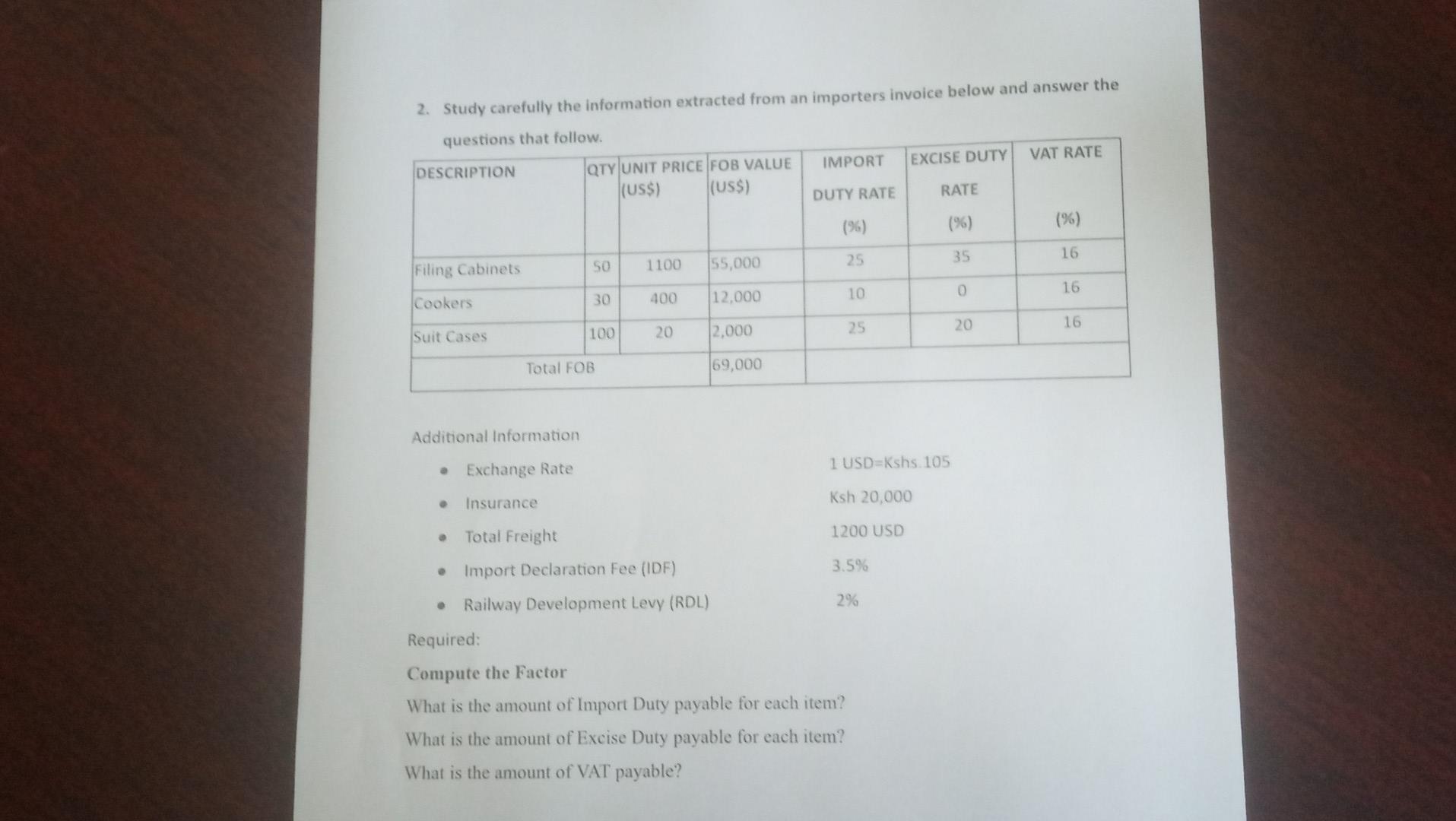

2. Study carefully the information extracted from an importers invoice below and answer the questions that follow. DESCRIPTION QTY UNIT PRICE FOB VALUE IMPORT EXCISE

2. Study carefully the information extracted from an importers invoice below and answer the questions that follow. DESCRIPTION QTY UNIT PRICE FOB VALUE IMPORT EXCISE DUTY VAT RATE (US$) (US$) DUTY RATE RATE (96) (%) (9) 16 35 50 55,000 1100 25 Filing Cabinets 0 16 30 Cookers 400 10 12.000 20 16 100 25 Suit Cases 20 2,000 Total FOB 69,000 Additional Information 1 USD=Kshs 105 Exchange Rate Insurance Ksh 20,000 . Total Freight 1200 USD Import Declaration Fee (IDF) 3.5% Railway Development Levy (RDL) 2% Required: Compute the Factor What is the amount of Import Duty payable for each item? What is the amount of Excise Duty payable for each item? What is the amount of VAT payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started