Question

2. Suppose a borrower of $100,000 has risk characteristics that put the firm in a risk class that has experienced an average historical default rate

2. Suppose a borrower of $100,000 has risk characteristics that put the firm in a risk class that has experienced an average historical default rate of 0.2 percent. However, one year in every 100 (or 1 percent of the time), such as in a major recession, the bank expects 4 percent of these types of loans to default. This 4 percent can be viewed as the unexpected or 1 in 100 years default rate. Moreover, upon default, the FI has historically recovered only 20 percent of the defaulted loans. As a result, the loss given default is 80 percent.

a. For this borrower, what is the loan loss risk per dollar lent?

b. What is the value (or capital) at risk to the FI (the denominator of the RAROC equation)?

c. Suppose the cost of funds for the FI is 9.80 percent and the loan rate is 10 percent on the $100,000 loan. After adjusting for fees of 0.10 percent, what is the expected one-year income on the loan, or the numerator of the RAROC equation?

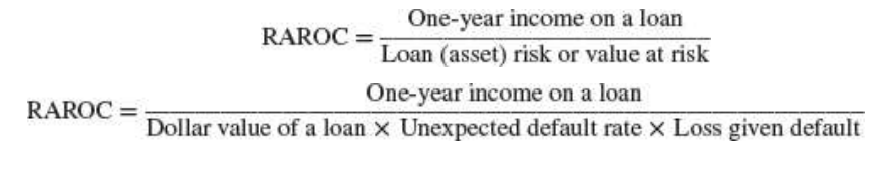

d. What is the RAROC on this loan? If the FIs ROE is 9%, should the loan officer accept the loan? If the FIs ROE is 9.5%, should the loan still be accepted? Recall the formula for RAROC:

RAROC=Loan(asset)riskorvalueatriskOne-yearincomeonaloanRAROC=DollarvalueofaloanUnexpecteddefaultrateLossgivendefaultOne-yearincomeonaloan

RAROC=Loan(asset)riskorvalueatriskOne-yearincomeonaloanRAROC=DollarvalueofaloanUnexpecteddefaultrateLossgivendefaultOne-yearincomeonaloan Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started