Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Suppose a private equity fund has $100 million in total committed capital and its investors have agreed to a 1.50% annual management fee.

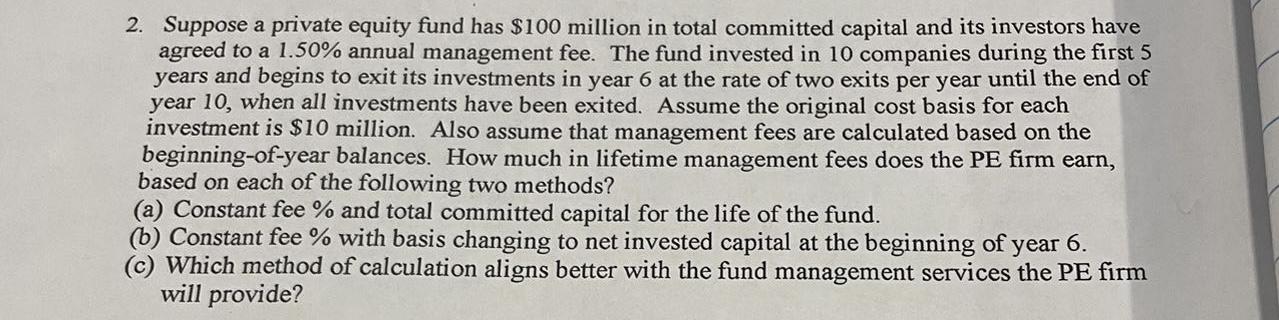

2. Suppose a private equity fund has $100 million in total committed capital and its investors have agreed to a 1.50% annual management fee. The fund invested in 10 companies during the first 5 years and begins to exit its investments in year 6 at the rate of two exits per year until the end of year 10, when all investments have been exited. Assume the original cost basis for each investment is $10 million. Also assume that management fees are calculated based on the beginning-of-year balances. How much in lifetime management fees does the PE firm earn, based on each of the following two methods? (a) Constant fee % and total committed capital for the life of the fund. (b) Constant fee % with basis changing to net invested capital at the beginning of year 6. (c) Which method of calculation aligns better with the fund management services the PE firm will provide?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Under the Constant Fee and Total Committed Capital method the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started