Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively: a. Compute the

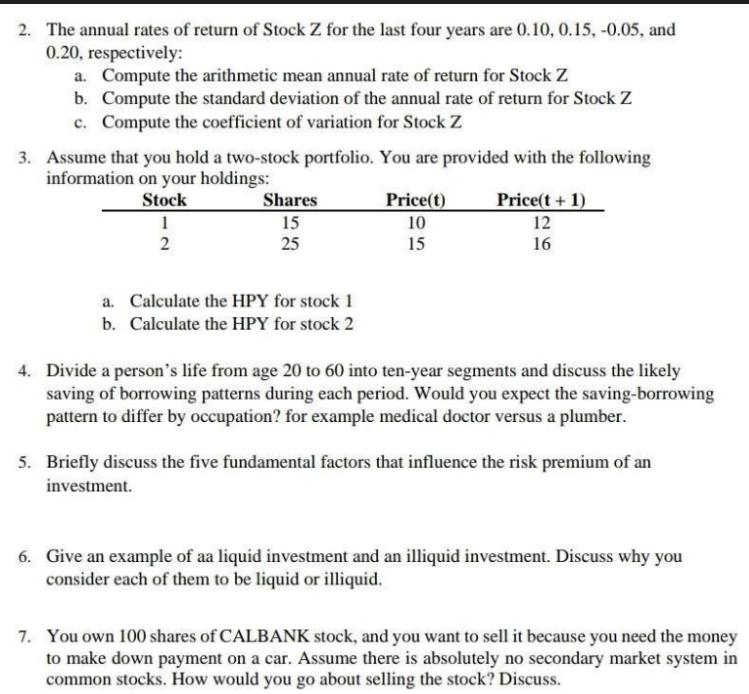

2. The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively: a. Compute the arithmetic mean annual rate of return for Stock Z b. Compute the standard deviation of the annual rate of return for Stock Z c. Compute the coefficient of variation for Stock Z 3. Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings: Stock 1 2 Shares 15 25 a. Calculate the HPY for stock 1 b. Calculate the HPY for stock 2 Price(t) 10 15 Price(t + 1) 12 16 4. Divide a person's life from age 20 to 60 into ten-year segments and discuss the likely saving of borrowing patterns during each period. Would you expect the saving-borrowing pattern to differ by occupation? for example medical doctor versus a plumber. 5. Briefly discuss the five fundamental factors that influence the risk premium of an investment. 6. Give an example of aa liquid investment and an illiquid investment. Discuss why you consider each of them to be liquid or illiquid. 7. You own 100 shares of CALBANK stock, and you want to sell it because you need the money to make down payment on a car. Assume there is absolutely no secondary market system in common stocks. How would you go about selling the stock? Discuss. 2. The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively: a. Compute the arithmetic mean annual rate of return for Stock Z b. Compute the standard deviation of the annual rate of return for Stock Z c. Compute the coefficient of variation for Stock Z 3. Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings: Stock 1 2 Shares 15 25 a. Calculate the HPY for stock 1 b. Calculate the HPY for stock 2 Price(t) 10 15 Price(t + 1) 12 16 4. Divide a person's life from age 20 to 60 into ten-year segments and discuss the likely saving of borrowing patterns during each period. Would you expect the saving-borrowing pattern to differ by occupation? for example medical doctor versus a plumber. 5. Briefly discuss the five fundamental factors that influence the risk premium of an investment. 6. Give an example of aa liquid investment and an illiquid investment. Discuss why you consider each of them to be liquid or illiquid. 7. You own 100 shares of CALBANK stock, and you want to sell it because you need the money to make down payment on a car. Assume there is absolutely no secondary market system in common stocks. How would you go about selling the stock? Discuss. 2. The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively: a. Compute the arithmetic mean annual rate of return for Stock Z b. Compute the standard deviation of the annual rate of return for Stock Z c. Compute the coefficient of variation for Stock Z 3. Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings: Stock 1 2 Shares 15 25 a. Calculate the HPY for stock 1 b. Calculate the HPY for stock 2 Price(t) 10 15 Price(t + 1) 12 16 4. Divide a person's life from age 20 to 60 into ten-year segments and discuss the likely saving of borrowing patterns during each period. Would you expect the saving-borrowing pattern to differ by occupation? for example medical doctor versus a plumber. 5. Briefly discuss the five fundamental factors that influence the risk premium of an investment. 6. Give an example of aa liquid investment and an illiquid investment. Discuss why you consider each of them to be liquid or illiquid. 7. You own 100 shares of CALBANK stock, and you want to sell it because you need the money to make down payment on a car. Assume there is absolutely no secondary market system in common stocks. How would you go about selling the stock? Discuss.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

2 The annual rates of return of Stock Z for the last four years are 010 015 005 and 020 respectively a Compute the arithmetic mean annual rate of return for Stock Z The arithmetic mean is calculated b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started