Answered step by step

Verified Expert Solution

Question

1 Approved Answer

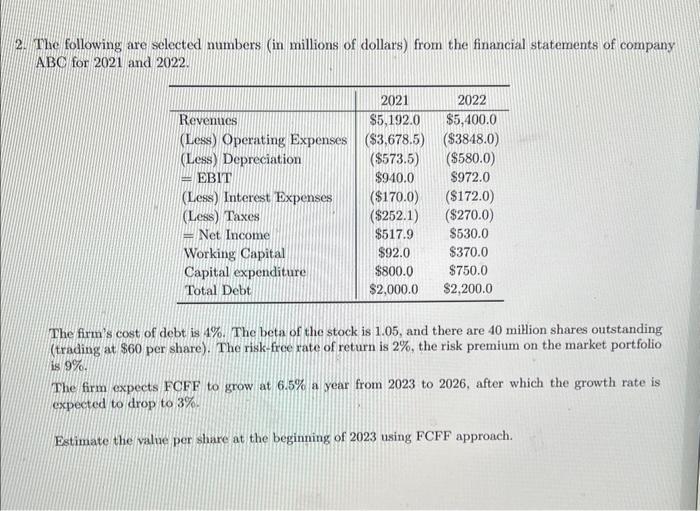

2. The following are selected numbers (in millions of dollars) from the financial statements of company ABC for 2021 and 2022. 2021 Revenues $5,192.0

2. The following are selected numbers (in millions of dollars) from the financial statements of company ABC for 2021 and 2022. 2021 Revenues $5,192.0 (Less) Operating Expenses ($3,678.5) (Less) Depreciation ($573.5) EBIT $940.0 (Less) Interest Expenses (Less) Taxes Net Income Working Capital Capital expenditure Total Debt TH ($170.0) ($252.1) $517.9 $92.0 $800.0 $2,000.0 2022 $5,400.0 ($3848.0) ($580.0) $972.0 ($172.0) ($270.0) $530.0 $370.0 $750.0 $2,200.0 The firm's cost of debt is 4%. The beta of the stock is 1.05, and there are 40 million shares outstanding (trading at $60 per share). The risk-free rate of return is 2%, the risk premium on the market portfolio is 9%. The firm expects FCFF to grow at 6.5% a year from 2023 to 2026, after which the growth rate is expected to drop to 3%. Estimate the value per share at the beginning of 2023 using FCFF approach.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started