Answered step by step

Verified Expert Solution

Question

1 Approved Answer

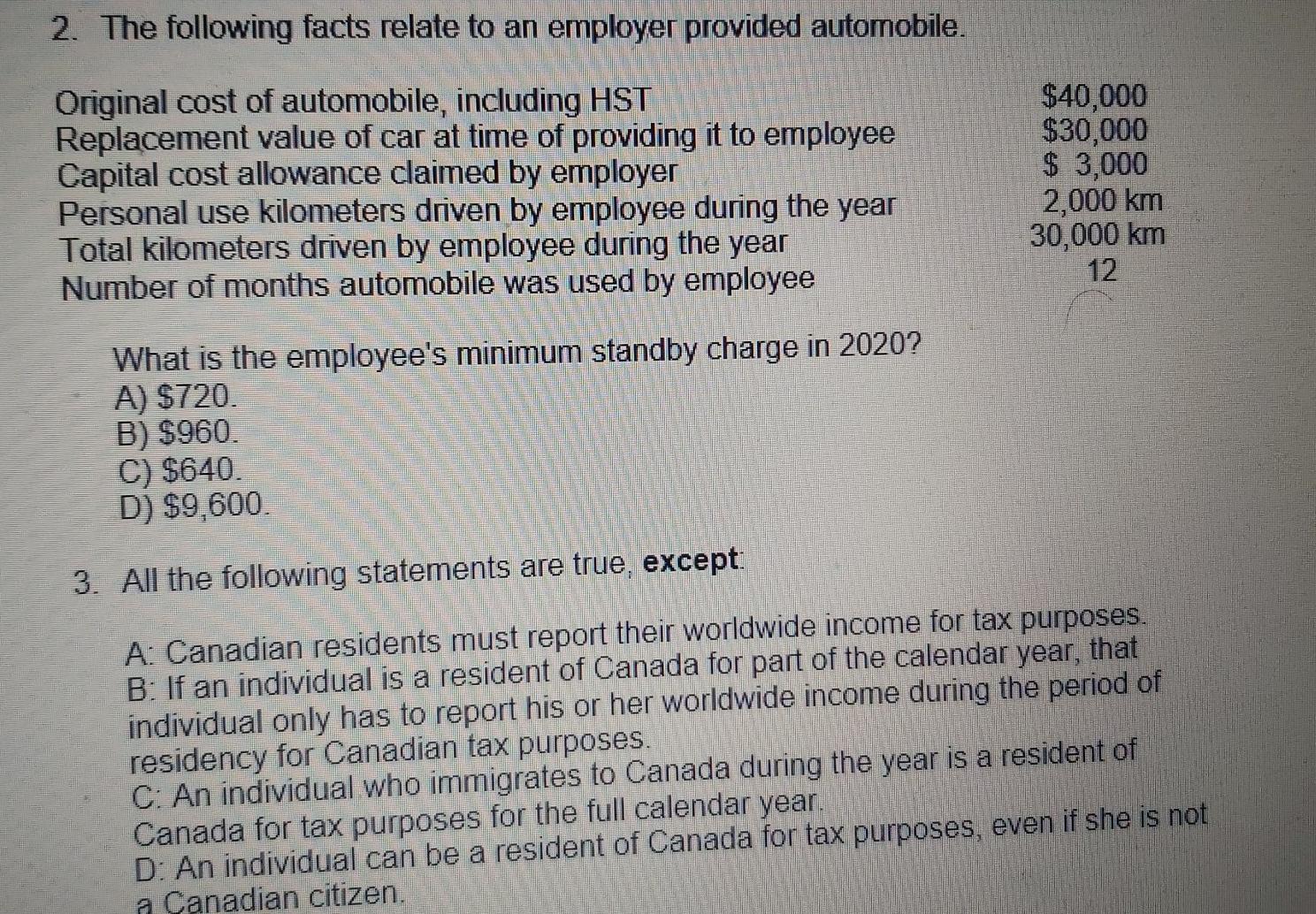

2. The following facts relate to an employer provided automobile. Original cost of automobile, including HST Replacement value of car at time of providing it

2. The following facts relate to an employer provided automobile. Original cost of automobile, including HST Replacement value of car at time of providing it to employee Capital cost allowance claimed by employer Personal use kilometers driven by employee during the year Total kilometers driven by employee during the year Number of months automobile was used by employee $40,000 $30,000 $ 3,000 2,000 km 30,000 km 12 What is the employee's minimum standby charge in 2020? A) $720. B) $960 C) $640. D) $9,600 3. All the following statements are true, except: A: Canadian residents must report their worldwide income for tax purposes. B: If an individual is a resident of Canada for part of the calendar year, that individual only has to report his or her worldwide income during the period of residency for Canadian tax purposes. C: An individual who immigrates to Canada during the year is a resident of Canada for tax purposes for the full calendar year. D: An individual can be a resident of Canada for tax purposes, even if she is not a Canadian citizen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started