Answered step by step

Verified Expert Solution

Question

1 Approved Answer

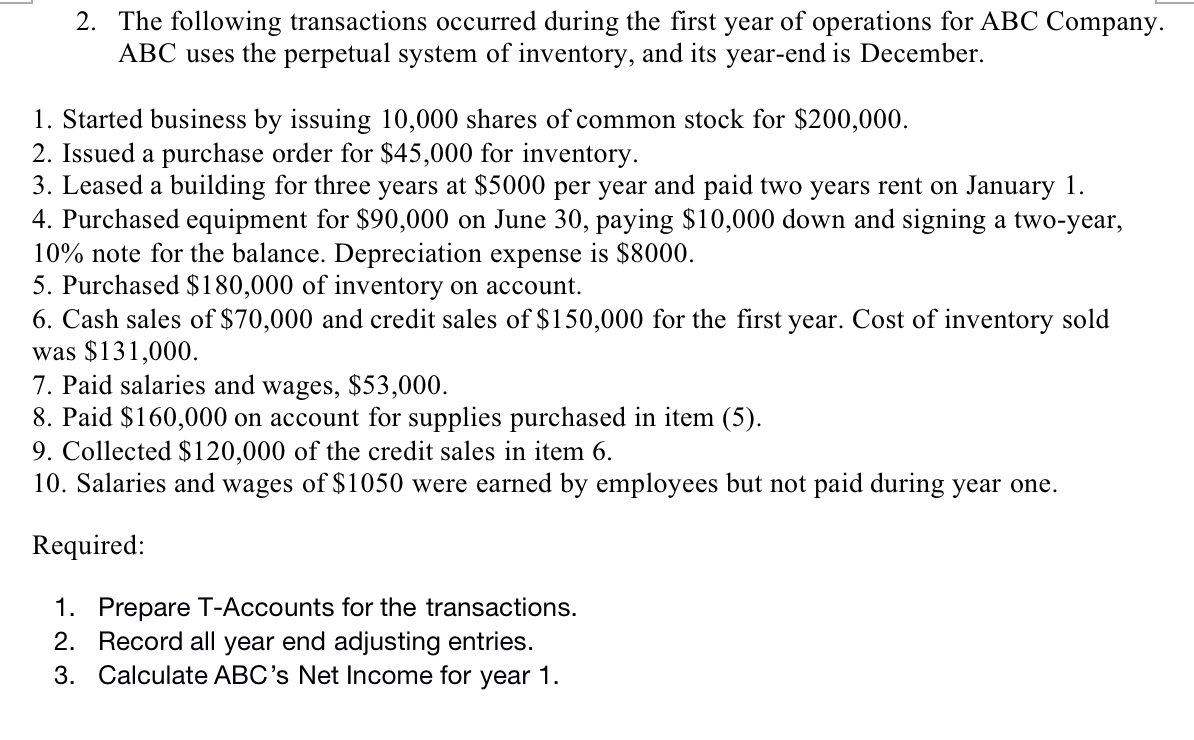

2. The following transactions occurred during the first year of operations for ABC Company. ABC uses the perpetual system of inventory, and its year-end is

2. The following transactions occurred during the first year of operations for ABC Company. ABC uses the perpetual system of inventory, and its year-end is December. 1. Started business by issuing 10,000 shares of common stock for $200,000. 2. Issued a purchase order for $45,000 for inventory. 3. Leased a building for three years at $5000 per year and paid two years rent on January 1. 4. Purchased equipment for $90,000 on June 30 , paying $10,000 down and signing a two-year, 10% note for the balance. Depreciation expense is $8000. 5. Purchased $180,000 of inventory on account. 6. Cash sales of $70,000 and credit sales of $150,000 for the first year. Cost of inventory sold was $131,000. 7. Paid salaries and wages, $53,000. 8. Paid $160,000 on account for supplies purchased in item (5). 9. Collected $120,000 of the credit sales in item 6 . 10. Salaries and wages of $1050 were earned by employees but not paid during year one. Required: 1. Prepare T-Accounts for the transactions. 2. Record all year end adjusting entries. 3. Calculate ABC's Net Income for year 1

2. The following transactions occurred during the first year of operations for ABC Company. ABC uses the perpetual system of inventory, and its year-end is December. 1. Started business by issuing 10,000 shares of common stock for $200,000. 2. Issued a purchase order for $45,000 for inventory. 3. Leased a building for three years at $5000 per year and paid two years rent on January 1. 4. Purchased equipment for $90,000 on June 30 , paying $10,000 down and signing a two-year, 10% note for the balance. Depreciation expense is $8000. 5. Purchased $180,000 of inventory on account. 6. Cash sales of $70,000 and credit sales of $150,000 for the first year. Cost of inventory sold was $131,000. 7. Paid salaries and wages, $53,000. 8. Paid $160,000 on account for supplies purchased in item (5). 9. Collected $120,000 of the credit sales in item 6 . 10. Salaries and wages of $1050 were earned by employees but not paid during year one. Required: 1. Prepare T-Accounts for the transactions. 2. Record all year end adjusting entries. 3. Calculate ABC's Net Income for year 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started