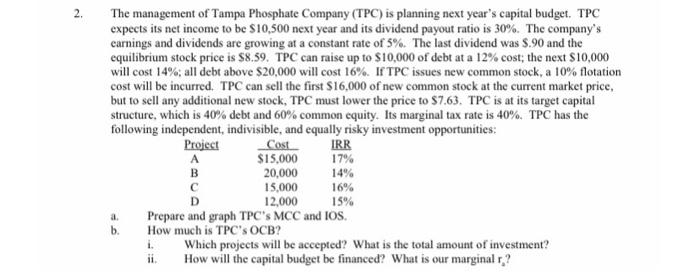

2. The management of Tampa Phosphate Company (TPC) is planning next year's capital budget. TPC expects its net income to be $10,500 next year and its dividend payout ratio is 30%. The company's earnings and dividends are growing at a constant rate of 5%. The last dividend was 9.90 and the equilibrium stock price is $8.59. TPC can raise up to $10,000 of debt at a 12% cost; the next $10,000 will cost 14%; all debt above $20,000 will cost 16%. If TPC issues new common stock, a 10% flotation cost will be incurred. TPC can sell the first $16,000 of new common stock at the current market price, but to sell any additional new stock, TPC must lower the price to $7.63. TPC is at its target capital structure, which is 40% debt and 60% common equity. Its marginal tax rate is 40%. TPC has the following independent, indivisible, and equally risky investment opportunities: Project Cost IRR A $15,000 17% B 20,000 15,000 16% D 12,000 15% Prepare and graph TPC's MCC and IOS. How much is TPC's OCB? i. Which projects will be accepted? What is the total amount of investment? How will the capital budget be financed? What is our marginal r.? a. b. 2. The management of Tampa Phosphate Company (TPC) is planning next year's capital budget. TPC expects its net income to be $10,500 next year and its dividend payout ratio is 30%. The company's earnings and dividends are growing at a constant rate of 5%. The last dividend was 9.90 and the equilibrium stock price is $8.59. TPC can raise up to $10,000 of debt at a 12% cost; the next $10,000 will cost 14%; all debt above $20,000 will cost 16%. If TPC issues new common stock, a 10% flotation cost will be incurred. TPC can sell the first $16,000 of new common stock at the current market price, but to sell any additional new stock, TPC must lower the price to $7.63. TPC is at its target capital structure, which is 40% debt and 60% common equity. Its marginal tax rate is 40%. TPC has the following independent, indivisible, and equally risky investment opportunities: Project Cost IRR A $15,000 17% B 20,000 15,000 16% D 12,000 15% Prepare and graph TPC's MCC and IOS. How much is TPC's OCB? i. Which projects will be accepted? What is the total amount of investment? How will the capital budget be financed? What is our marginal r.? a. b