Question

Supreme Electronics Limited (SEL) is engaged in the assembly of LCD/LED TV, Plasma TV, Colour TV, Music Systems, DVD Players, Home Theatre Systems and Two-in-one/Car

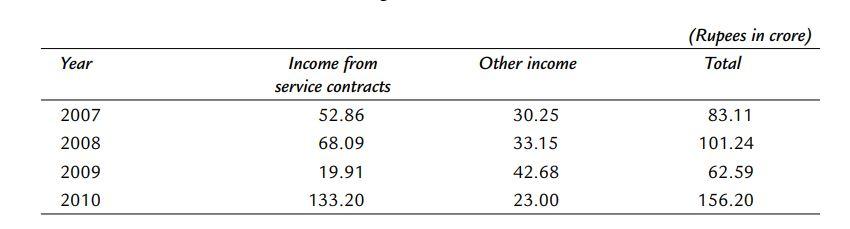

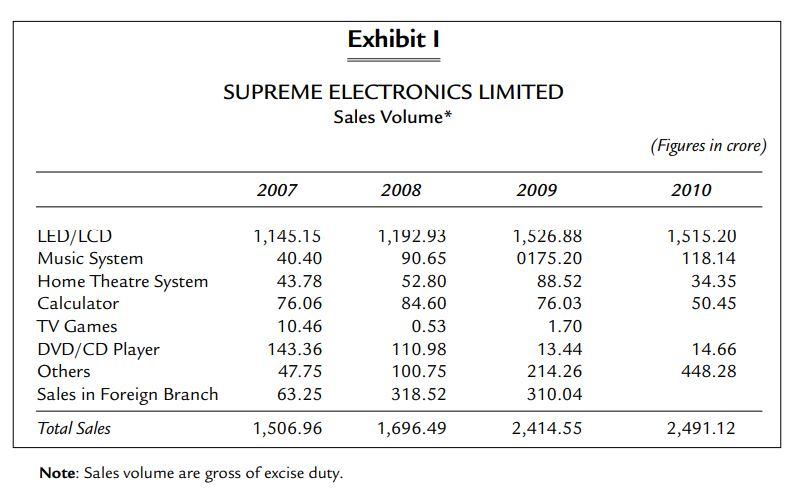

Supreme Electronics Limited (SEL) is engaged in the assembly of LCD/LED TV, Plasma TV, Colour TV, Music Systems, DVD Players, Home Theatre Systems and Two-in-one/Car Stereos. Its factory is situated in a cosmopolitan city in Northern India. The company was incorporated initially as private limited in late sixties and was converted into a public limited company in the year 1976 in pursuance of Section 43 A of the Companies Act, 1956, with an authorised capital of Rs. 12.50 crore. In the year 1980, its authorised capital and its paid-up capital were Rs. 50 crore and Rs. 23.15 crore respectively, SEL is a closely-held company, and all the shares are held by the members of the same family. SELs sales have shown an increasing trend during the period 200710. However, the profitability of the company has been quite low. Accordingly, it has become necessary for the management to ascertain the reasons for the declining profitability of the company. SALES AND PRODUCTION Exhibit 1 contains the year-wise data on the volume of sales of different products. Besides sales of these products, a direct source of income is service charges. The income of the company from service contracts and other sources during 200710 is as follows:

The company has a formal arrangement for selling its sets to M/s Suman Electronics, an associate company, which in turn sells them to its branches in U.P., Panjab and Haryana. The branches record these transactions as purchases and sales.

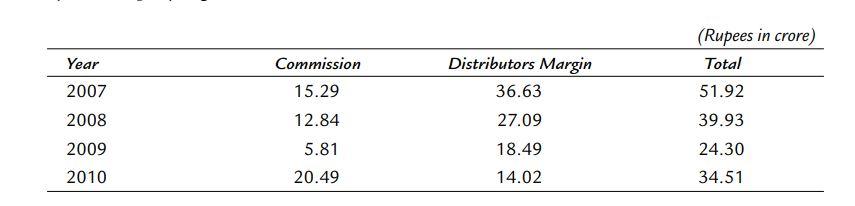

A review of Exhibit I indicates that the company recorded the highest gross sales of Rs. 2,491.12 crore in the year 2010. The marketing and sales department of the company is supervised by the managing director himself. Under him, sales are supervised by two managersin charge of marketing and exports respectively. The marketing manager is being assisted by four regional managers and two assistant managers. The distribution channels are the branches, spread all over India, with distributors appointed at various cities, besides an overseas branch. The branches of the company have a network of dealers in most cities in the country. Suman Electronics, the associate company, also acts as an indenting agent for branches. As a result of the sustained publicity and promotional campaign, the company has been able to establish a distinct brand image. Another crucial factor contributing to the successful marketing efforts in this kind of industry is the ability to provide prompt and efficient after-sales service. SEL has stationed trained and experienced technicians at various branches meet after-sales service needs of their customers. Sales to distributors are based on keeping a margin against each product. The margin varies for different products. No overriding commission is allowed to any distributors for sales in his territory. However, Suman electronics is paid a commission of one-fourth per cent on sales for acting as indenting agent for branches. The company pays commission to dealers in addition to margin allowed to distributors. No uniform policy is followed in this regard. An account of the commission and margins allowed by the company is given below:

It is evident that the commission and margin allowed by the company have varied erratically.

1. Calculate liquidity, activity, and capital structure and profitability ratios for SEL. Also do a trend analysis for important financial analysis.

2. From your analysis of ratios indicate the areas which need further investigation and managerial interventions.

\begin{tabular}{cccc} & & & (Rupees in crore) \\ \hline Year & Income from service contracts & Other income & Total \\ \hline 2007 & 52.86 & 30.25 & 83.11 \\ 2008 & 68.09 & 33.15 & 101.24 \\ 2009 & 19.91 & 42.68 & 62.59 \\ 2010 & 133.20 & 23.00 & 156.20 \\ \hline \end{tabular} (Rupees in crore) \begin{tabular}{lccc} \hline Year & Commission & Distributors Margin & Total \\ \hline 2007 & 15.29 & 36.63 & 51.92 \\ 2008 & 12.84 & 27.09 & 39.93 \\ 2009 & 5.81 & 18.49 & 24.30 \\ 2010 & 20.49 & 14.02 & 34.51 \\ \hline \end{tabular} Note: Sales volume are gross of excise duty. \begin{tabular}{cccc} & & & (Rupees in crore) \\ \hline Year & Income from service contracts & Other income & Total \\ \hline 2007 & 52.86 & 30.25 & 83.11 \\ 2008 & 68.09 & 33.15 & 101.24 \\ 2009 & 19.91 & 42.68 & 62.59 \\ 2010 & 133.20 & 23.00 & 156.20 \\ \hline \end{tabular} (Rupees in crore) \begin{tabular}{lccc} \hline Year & Commission & Distributors Margin & Total \\ \hline 2007 & 15.29 & 36.63 & 51.92 \\ 2008 & 12.84 & 27.09 & 39.93 \\ 2009 & 5.81 & 18.49 & 24.30 \\ 2010 & 20.49 & 14.02 & 34.51 \\ \hline \end{tabular} Note: Sales volume are gross of excise dutyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started