Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. The most you would be willing to pay is the present value of $12000 per year for 10 years at a 15% discount

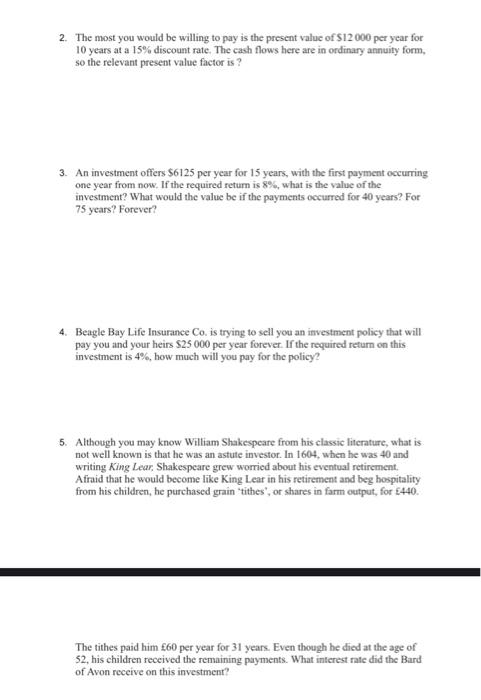

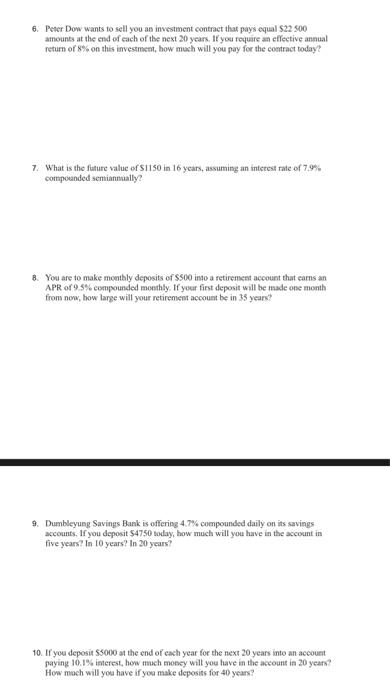

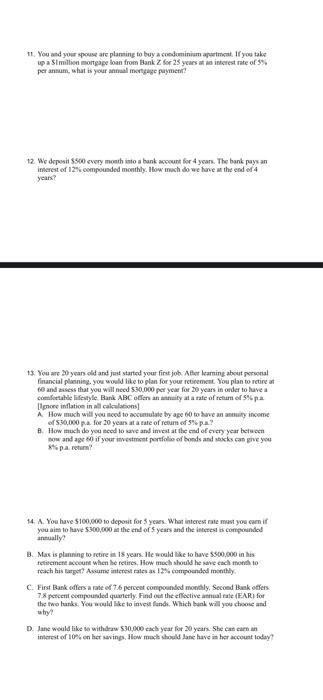

2. The most you would be willing to pay is the present value of $12000 per year for 10 years at a 15% discount rate. The cash flows here are in ordinary annuity form, so the relevant present value factor is? 3. An investment offers $6125 per year for 15 years, with the first payment occurring one year from now. If the required return is 8%, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years? Forever? 4. Beagle Bay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $25 000 per year forever. If the required return on this investment is 4%, how much will you pay for the policy? 5. Although you may know William Shakespeare from his classic literature, what is not well known is that he was an astute investor. In 1604, when he was 40 and writing King Lear, Shakespeare grew worried about his eventual retirement. Afraid that he would become like King Lear in his retirement and beg hospitality from his children, he purchased grain "tithes', or shares in farm output, for 440. The tithes paid him 60 per year for 31 years. Even though he died at the age of 52, his children received the remaining payments. What interest rate did the Bard of Avon receive on this investment? 6. Peter Dow wants to sell you an investment contract that pays equal $22 500 amounts at the end of each of the next 20 years. If you require an effective annual return of 8% on this investment, how much will you pay for the contract today? 7. What is the future value of $1150 in 16 years, assuming an interest rate of 7.9% compounded semiannually? 8. You are to make monthly deposits of $500 into a retirement account that earns an APR of 9.5% compounded monthly. If your first deposit will be made one month from now, how large will your retirement account be in 35 years? 9. Dumbleyung Savings Bank is offering 4.7% compounded daily on its savings accounts. If you deposit $4750 today, how much will you have in the account in five years? In 10 years? In 20 years? 10. If you deposit $5000 at the end of each year for the next 20 years into an account paying 10.1% interest, how much money will you have in the account in 20 years? How much will you have if you make deposits for 40 years? 11. You and your spouse are planning to buy a condominium apartment. If you take upa Simillion mortgage loan from Bank Z for 25 years at an interest rate of 5% per annum, what is your annual mortgage payment? 12. We deposit $500 every month into a bank account for 4 years. The bank pays an interest of 12% compounded monthly. How much do we have at the end of 4 years? 13. You are 20 years old and just started your first job. After learning about personal financial planning, you would like to plan for your retirement. You plan to retire at 60 and assess that you will need $30,000 per year for 20 years in order to have a comfortable lifestyle. Bank ABC offers an annuity at a rate of retum of 5% pa Ignore inflation in all calculations] A How much will you need to accumulate by age 60 to have an annuity income of $30,000 pa for 20 years at a rate of retum of 5% p..? B. How much do you need to save and invest at the end of every year between now and age 60 if your investment portfolio of bonds and stocks can give you 8% pa return 14. A. You have $100,000 to deposit for 5 years. What interest rate mast you carnif you aim to have $300,000 at the end of 5 years and the interest is compounded annually? B. Max is planning to retire in 18 years. He would like to have $500,000 in his retirement account when he retires. How much should he save each month to reach his target? Assume interest rates as 12% compounded monthly. C. First Bank offers a rate of 7.6 percent compounded monthly. Second Bank offers 7.8 percent compounded quarterly. Find out the effective annual rate (FAR) for the two banks. You would like to invest funds. Which bank will you choose and why? D. Jane would like to withdraw $30,000 each year for 20 years. She can earn an interest of 10% on her savings. How much should Jane have in her account today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

2 The present value factor for an ordinary annuity of 1 per period for n periods at a discount rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started