Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. The Wiley Pharma Company sells an AIDS vaccine in Rich Countries (R) and in Africa (A). It spends a lot of money in period

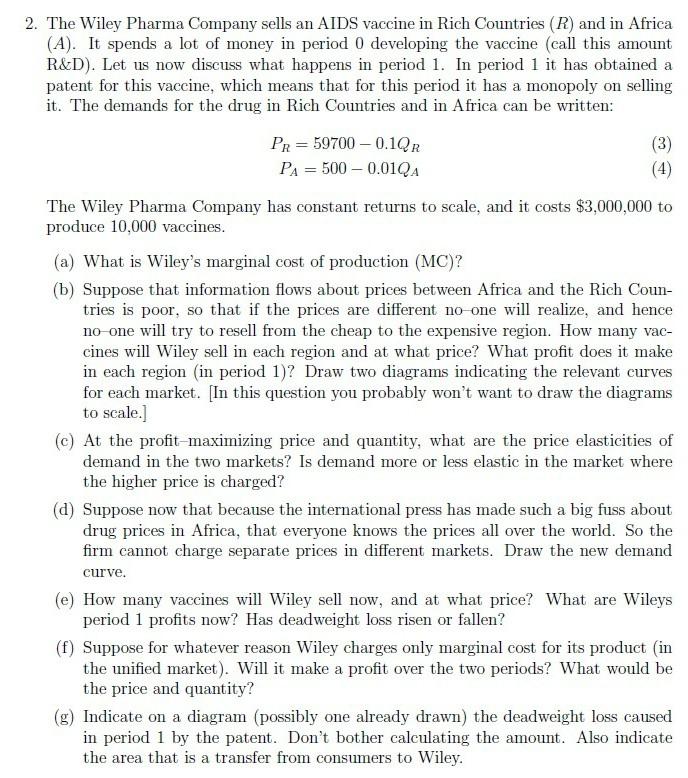

2. The Wiley Pharma Company sells an AIDS vaccine in Rich Countries (R) and in Africa (A). It spends a lot of money in period 0 developing the vaccine (call this amount R&D). Let us now discuss what happens in period 1. In period 1 it has obtained a patent for this vaccine, which means that for this period it has a monopoly on selling it. The demands for the drug in Rich Countries and in Africa can be written: Pr = 59700 -0.1QR (3) PA = 500 -0.010A The Wiley Pharma Company has constant returns to scale, and it costs $3,000,000 to produce 10,000 vaccines. (a) What is Wiley's marginal cost of production (MC)? (b) Suppose that information flows about prices between Africa and the Rich Coun- tries is poor, so that if the prices are different no one will realize, and hence no one will try to resell from the cheap to the expensive region. How many vac- cines will Wiley sell in each region and at what price? What profit does it make in each region (in period 1)? Draw two diagrams indicating the relevant curves for each market. [In this question you probably won't want to draw the diagrams to scale.) (c) At the profit maximizing price and quantity, what are the price elasticities of demand in the two markets? Is demand more or less elastic in the market where the higher price is charged? (d) Suppose now that because the international press has made such a big fuss about drug prices in Africa, that everyone knows the prices all over the world. So the firm cannot charge separate prices in different markets. Draw the new demand curve. (e) How many vaccines will Wiley sell now, and at what price? What are Wileys period 1 profits now? Has deadweight loss risen or fallen? (f) Suppose for whatever reason Wiley charges only marginal cost for its product (in the unified market). Will it make a profit over the two periods? What would be the price and quantity? (g) Indicate on a diagram (possibly one already drawn) the deadweight loss caused in period 1 by the patent. Don't bother calculating the amount. Also indicate the area that is a transfer from consumers to Wiley. 2. The Wiley Pharma Company sells an AIDS vaccine in Rich Countries (R) and in Africa (A). It spends a lot of money in period 0 developing the vaccine (call this amount R&D). Let us now discuss what happens in period 1. In period 1 it has obtained a patent for this vaccine, which means that for this period it has a monopoly on selling it. The demands for the drug in Rich Countries and in Africa can be written: Pr = 59700 -0.1QR (3) PA = 500 -0.010A The Wiley Pharma Company has constant returns to scale, and it costs $3,000,000 to produce 10,000 vaccines. (a) What is Wiley's marginal cost of production (MC)? (b) Suppose that information flows about prices between Africa and the Rich Coun- tries is poor, so that if the prices are different no one will realize, and hence no one will try to resell from the cheap to the expensive region. How many vac- cines will Wiley sell in each region and at what price? What profit does it make in each region (in period 1)? Draw two diagrams indicating the relevant curves for each market. [In this question you probably won't want to draw the diagrams to scale.) (c) At the profit maximizing price and quantity, what are the price elasticities of demand in the two markets? Is demand more or less elastic in the market where the higher price is charged? (d) Suppose now that because the international press has made such a big fuss about drug prices in Africa, that everyone knows the prices all over the world. So the firm cannot charge separate prices in different markets. Draw the new demand curve. (e) How many vaccines will Wiley sell now, and at what price? What are Wileys period 1 profits now? Has deadweight loss risen or fallen? (f) Suppose for whatever reason Wiley charges only marginal cost for its product (in the unified market). Will it make a profit over the two periods? What would be the price and quantity? (g) Indicate on a diagram (possibly one already drawn) the deadweight loss caused in period 1 by the patent. Don't bother calculating the amount. Also indicate the area that is a transfer from consumers to Wiley

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started