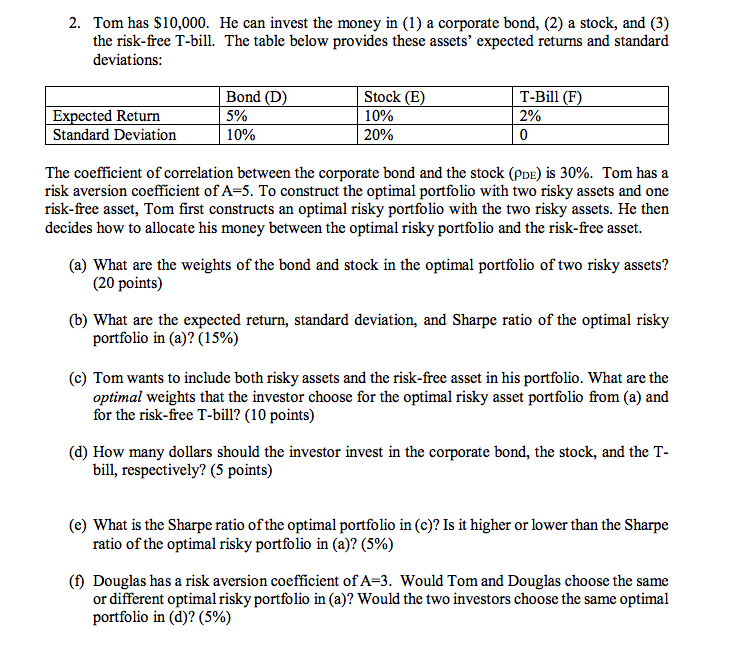

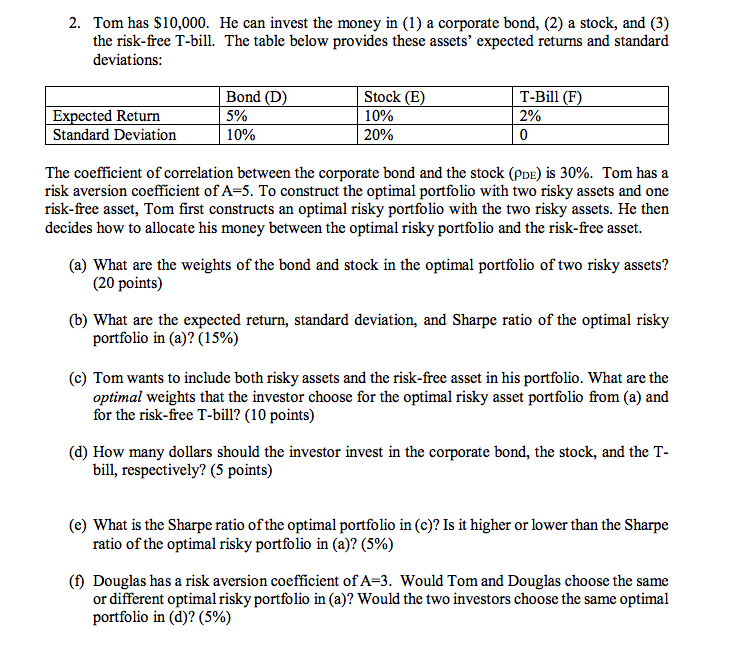

2. Tom has $10,000. He can invest the money in (1) a corporate bond, (2) a stock, and (3) the risk-free T-bill. The table below provides these assets' expected returns and standard deviations: Bond (D) 5% 10% Expected Return Standard Deviation Stock (E) 10% 20% T-Bill (F) 2% The coefficient of correlation between the corporate bond and the stock (PDE) is 30%. Tom has a risk aversion coefficient of A=5. To construct the optimal portfolio with two risky assets and one risk-free asset, Tom first constructs an optimal risky portfolio with the two risky assets. He then decides how to allocate his money between the optimal risky portfolio and the risk-free asset. (a) What are the weights of the bond and stock in the optimal portfolio of two risky assets? (20 points) (b) What are the expected return, standard deviation, and Sharpe ratio of the optimal risky portfolio in (a)? (15%) (c) Tom wants to include both risky assets and the risk-free asset in his portfolio. What are the optimal weights that the investor choose for the optimal risky asset portfolio from (a) and for the risk-free T-bill? (10 points) (d) How many dollars should the investor invest in the corporate bond, the stock, and the T- bill, respectively? (5 points) (e) What is the Sharpe ratio of the optimal portfolio in (c)? Is it higher or lower than the Sharpe ratio of the optimal risky portfolio in (a)? (5%) (f) Douglas has a risk aversion coefficient of A=3. Would Tom and Douglas choose the same or different optimal risky portfolio in (a)? Would the two investors choose the same optimal portfolio in (d)? (5%) 2. Tom has $10,000. He can invest the money in (1) a corporate bond, (2) a stock, and (3) the risk-free T-bill. The table below provides these assets' expected returns and standard deviations: Bond (D) 5% 10% Expected Return Standard Deviation Stock (E) 10% 20% T-Bill (F) 2% The coefficient of correlation between the corporate bond and the stock (PDE) is 30%. Tom has a risk aversion coefficient of A=5. To construct the optimal portfolio with two risky assets and one risk-free asset, Tom first constructs an optimal risky portfolio with the two risky assets. He then decides how to allocate his money between the optimal risky portfolio and the risk-free asset. (a) What are the weights of the bond and stock in the optimal portfolio of two risky assets? (20 points) (b) What are the expected return, standard deviation, and Sharpe ratio of the optimal risky portfolio in (a)? (15%) (c) Tom wants to include both risky assets and the risk-free asset in his portfolio. What are the optimal weights that the investor choose for the optimal risky asset portfolio from (a) and for the risk-free T-bill? (10 points) (d) How many dollars should the investor invest in the corporate bond, the stock, and the T- bill, respectively? (5 points) (e) What is the Sharpe ratio of the optimal portfolio in (c)? Is it higher or lower than the Sharpe ratio of the optimal risky portfolio in (a)? (5%) (f) Douglas has a risk aversion coefficient of A=3. Would Tom and Douglas choose the same or different optimal risky portfolio in (a)? Would the two investors choose the same optimal portfolio in (d)? (5%)