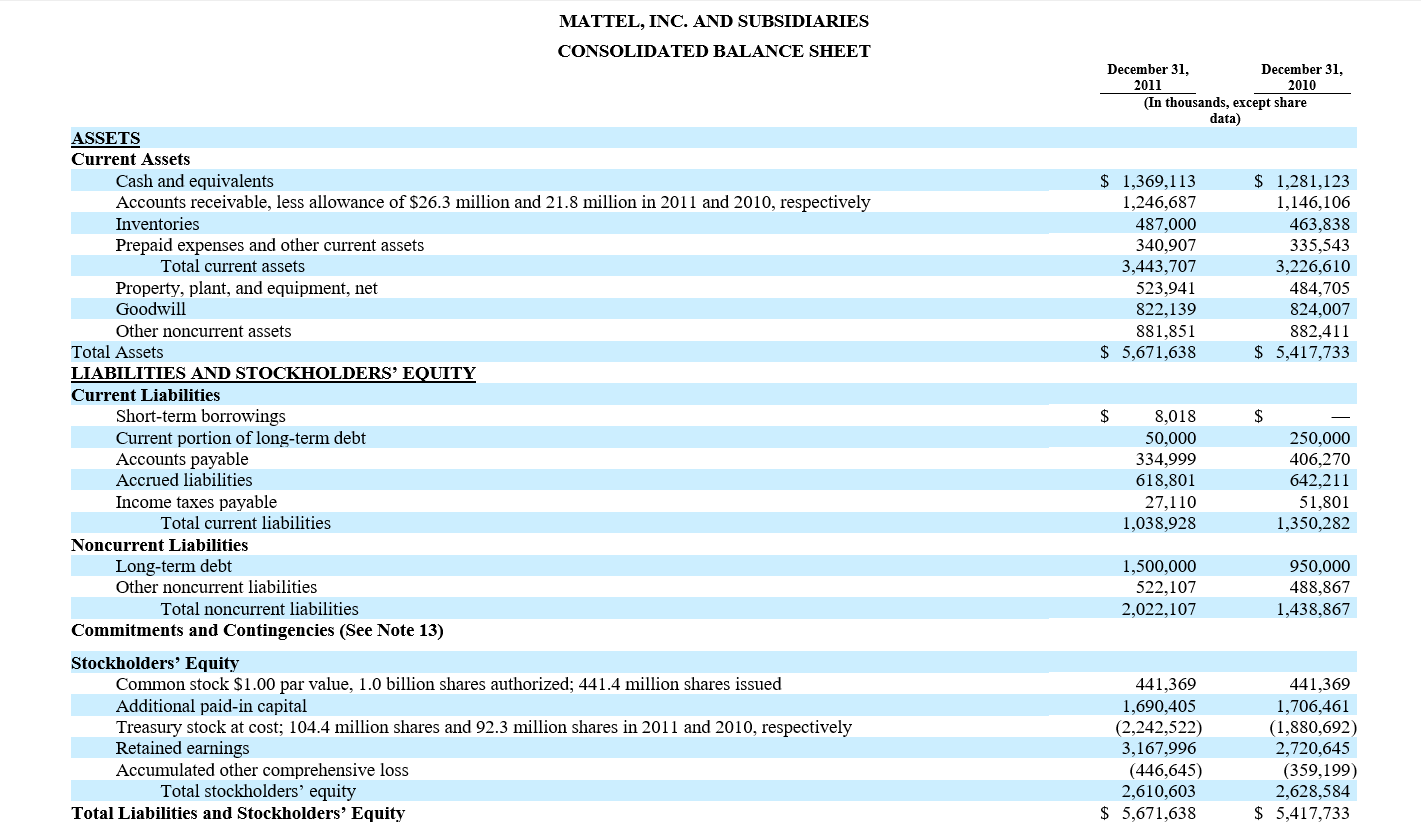

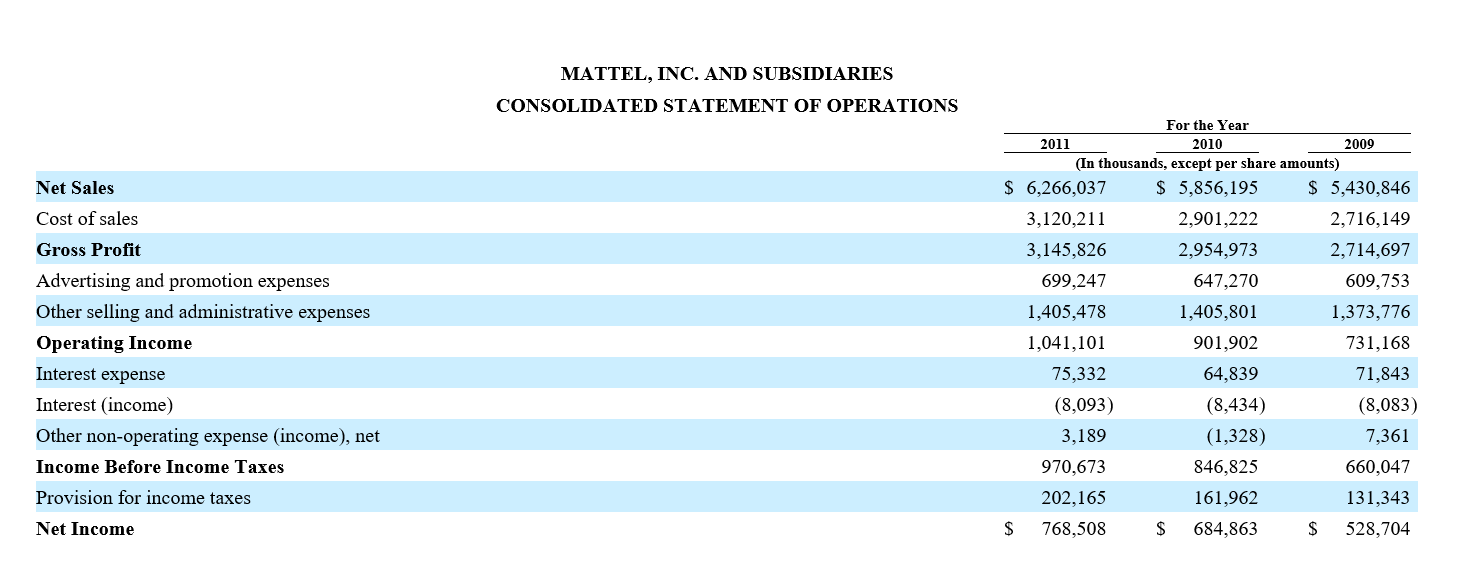

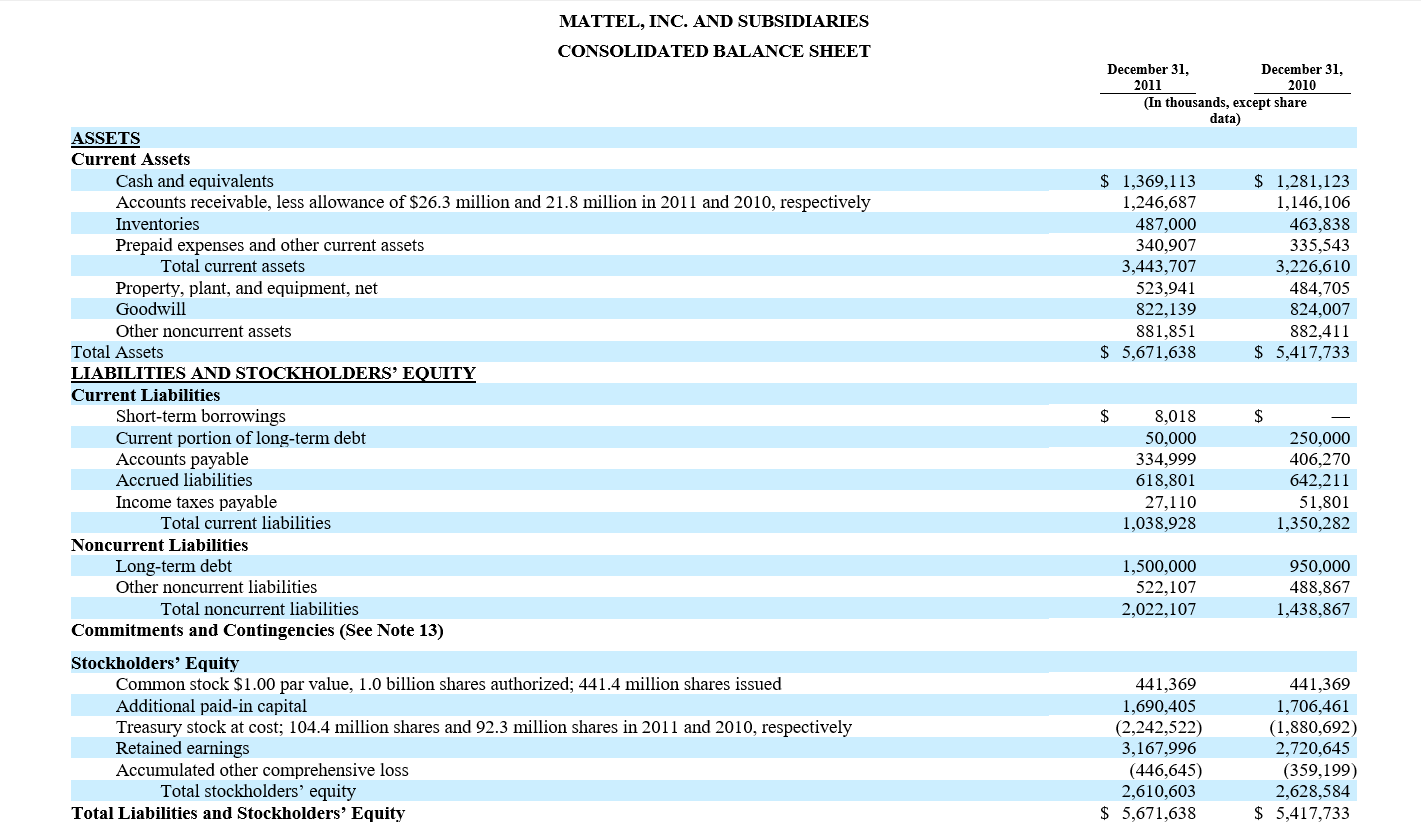

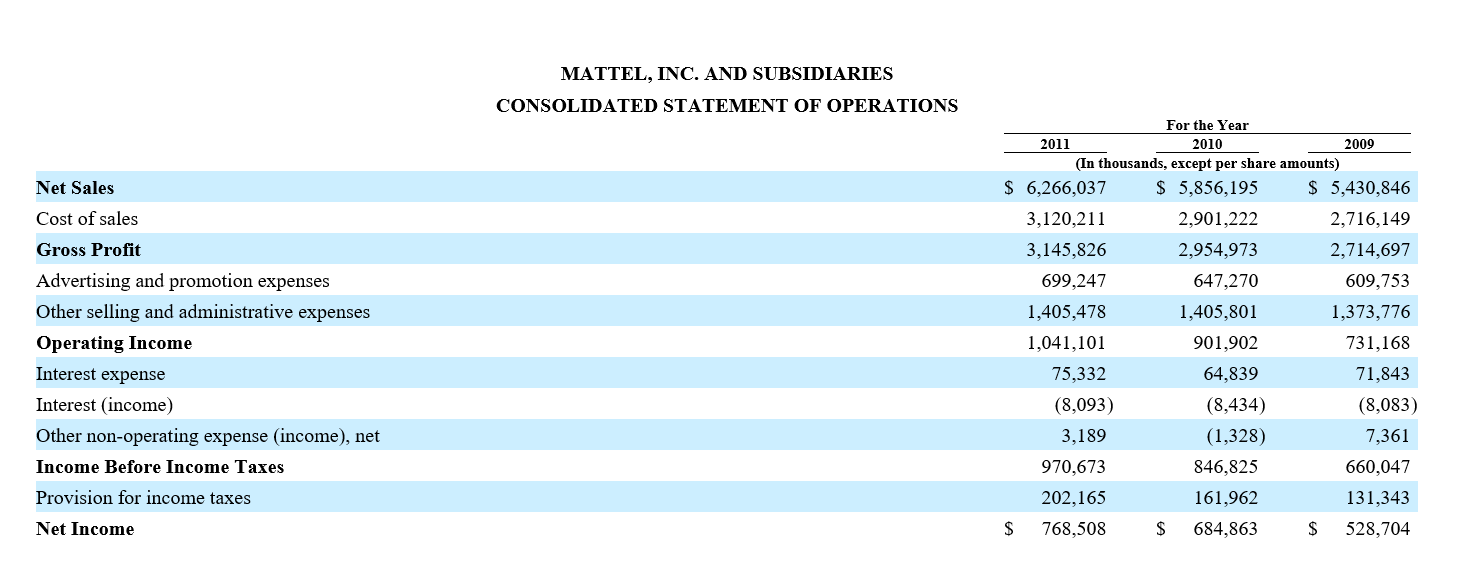

#2. Use the Balance Sheet and Income Statement that has been provided for Mattel Corporation to answer the following questions. Be sure to show all calculations otherwise you will receive no credit for the answer. a.) Calculate Mattel's Current Ratio for 2011 AND 2010. b.) As measured by the Current Ratio, in which year was Mattel's liquidity better? Circle one: 2011 or 2010 c.) Calculate Mattel's Debt to Asset for 2011 AND 2010. d.) As measured by the Debt to Asset Ratio, in which year was Mattel's solvency better? Circle one: 2011 or 2010 e.) Calculate Mattel's Return on Equity Ratio for only 2011. f.) If Mattel's Return on Equity in 2010 was 30% in which year was it's profitability better as measured by this ratio? Circle one: 2011 or 2010 MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET December 31, December 31, 2011 2010 (In thousands, except share data) $ 1,369,113 1,246,687 487,000 340,907 3,443,707 523,941 822,139 881.851 $ 5,671,638 $ 1,281,123 1,146,106 463,838 335,543 3,226.610 484.705 824,007 882,411 $ 5,417,733 $ $ ASSETS Current Assets Cash and equivalents Accounts receivable, less allowance of $26.3 million and 21.8 million in 2011 and 2010, respectively Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net Goodwill Other noncurrent assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Income taxes payable Total current liabilities Noncurrent Liabilities Long-term debt Other noncurrent liabilities Total noncurrent liabilities Commitments and Contingencies (See Note 13) Stockholders' Equity Common stock $1.00 par value, 1.0 billion shares authorized; 441.4 million shares issued Additional paid-in capital Treasury stock at cost; 104.4 million shares and 92.3 million shares in 2011 and 2010, respectively Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total Liabilities and Stockholders' Equity 8,018 50,000 334,999 618,801 27,110 1,038,928 250.000 406,270 642,211 51,801 1,350,282 1,500,000 522,107 2,022,107 950,000 488,867 1,438,867 441,369 1,690,405 (2,242,522) 3,167,996 (446,645) 2,610,603 $ 5,671,638 441,369 1,706,461 (1,880,692) 2,720,645 (359,199) 2,628,584 $ 5,417,733 MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENT OF OPERATIONS Net Sales Cost of sales Gross Profit Advertising and promotion expenses Other selling and administrative expenses Operating Income Interest expense Interest (income) Other non-operating expense (income), net Income Before Income Taxes Provision for income taxes Net Income For the Year 2011 2010 2009 (In thousands, except per share amounts) $ 6,266,037 $ 5,856,195 $ 5,430,846 3,120,211 2,901,222 2 ,716,149 3,145,826 2,954,973 2,714,697 699,247 647.270 609,753 1,405,478 1,405,801 1,373,776 1,041,101 901,902 731,168 75,332 64,839 71,843 (8,093) (8,434) (8,083) 3,189 (1,328) 7,361 970,673 846,825 660,047 202,165 161,962 131,343 $ 768,508 $ 684,863 $ 528,704