Answered step by step

Verified Expert Solution

Question

1 Approved Answer

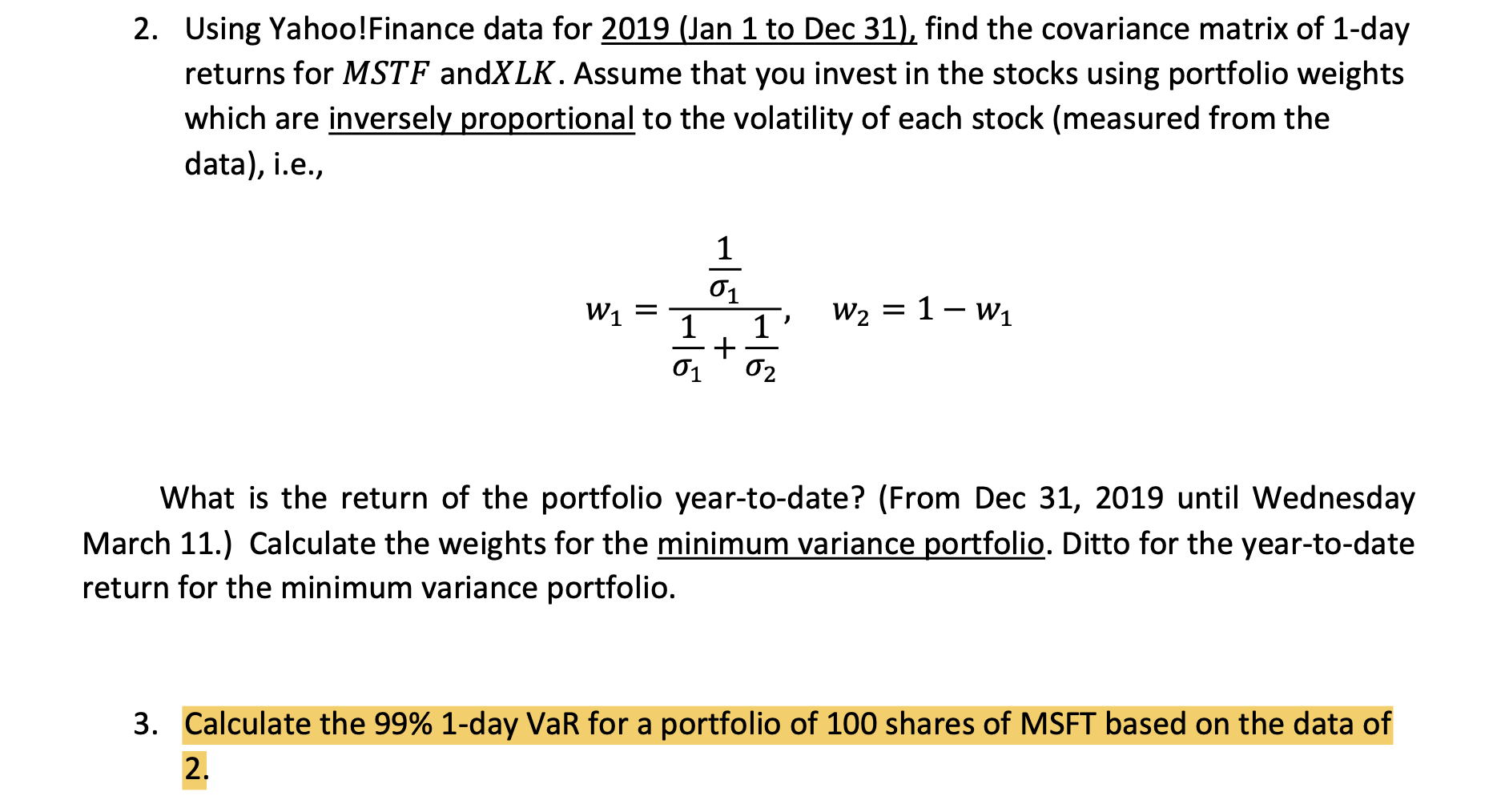

2. Using Yahoo! Finance data for 2019 (Jan 1 to Dec 31), find the covariance matrix of 1-day returns for MSTF andXLK. Assume that

2. Using Yahoo! Finance data for 2019 (Jan 1 to Dec 31), find the covariance matrix of 1-day returns for MSTF andXLK. Assume that you invest in the stocks using portfolio weights which are inversely proportional to the volatility of each stock (measured from the data), i.e., 01 W = 1 1 + W = 1-W1 01 02 What is the return of the portfolio year-to-date? (From Dec 31, 2019 until Wednesday March 11.) Calculate the weights for the minimum variance portfolio. Ditto for the year-to-date return for the minimum variance portfolio. 3. Calculate the 99% 1-day VaR for a portfolio of 100 shares of MSFT based on the data of 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Covariance Matrix To calculate the covariance matrix of 1day returns for MSTF and XLK you would need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started