Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You are assigned to evaluate the proposed acquisition of an equipment, which has a base price of $1,550,000, for supporting a 2-year expansion project.

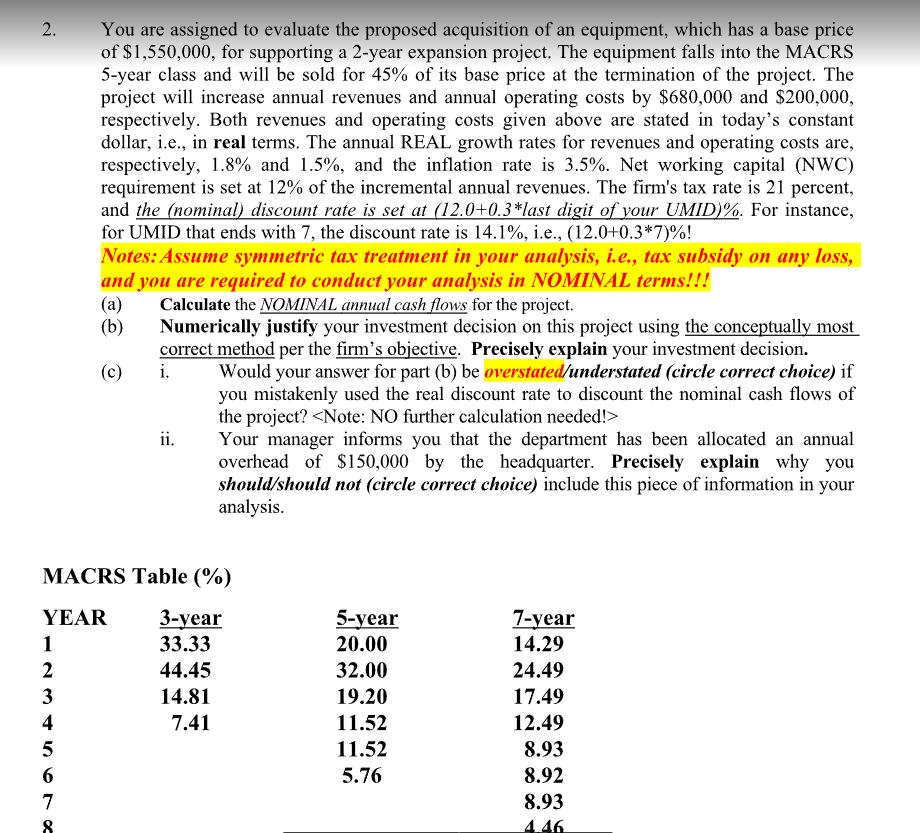

2. You are assigned to evaluate the proposed acquisition of an equipment, which has a base price of $1,550,000, for supporting a 2-year expansion project. The equipment falls into the MACRS 5 -year class and will be sold for 45% of its base price at the termination of the project. The project will increase annual revenues and annual operating costs by $680,000 and $200,000, respectively. Both revenues and operating costs given above are stated in today's constant dollar, i.e., in real terms. The annual REAL growth rates for revenues and operating costs are, respectively, 1.8% and 1.5%, and the inflation rate is 3.5%. Net working capital (NWC) requirement is set at 12% of the incremental annual revenues. The firm's tax rate is 21 percent, and the (nominal) discount rate is set at (12.0+0.3 last digit of your UMID)\%. For instance, for UMID that ends with 7, the discount rate is 14.1%, i.e., (12.0+0.37)% ! Notes: Assume symmetric tax treatment in your analysis, i.e., tax subsidy on any loss, and you are required to conduct your analysis in NOMINAL terms!!! (a) Calculate the NOMINAL annual cash flows for the project. (b) Numerically justify your investment decision on this project using the conceptually most correct method per the firm's objective. Precisely explain your investment decision. (c) i. Would your answer for part (b) be overstated/understated (circle correct choice) if you mistakenly used the real discount rate to discount the nominal cash flows of the project? > ii. Your manager informs you that the department has been allocated an annual overhead of $150,000 by the headquarter. Precisely explain why you should/should not (circle correct choice) include this piece of information in your analysis. MACRS Table (\%)

2. You are assigned to evaluate the proposed acquisition of an equipment, which has a base price of $1,550,000, for supporting a 2-year expansion project. The equipment falls into the MACRS 5 -year class and will be sold for 45% of its base price at the termination of the project. The project will increase annual revenues and annual operating costs by $680,000 and $200,000, respectively. Both revenues and operating costs given above are stated in today's constant dollar, i.e., in real terms. The annual REAL growth rates for revenues and operating costs are, respectively, 1.8% and 1.5%, and the inflation rate is 3.5%. Net working capital (NWC) requirement is set at 12% of the incremental annual revenues. The firm's tax rate is 21 percent, and the (nominal) discount rate is set at (12.0+0.3 last digit of your UMID)\%. For instance, for UMID that ends with 7, the discount rate is 14.1%, i.e., (12.0+0.37)% ! Notes: Assume symmetric tax treatment in your analysis, i.e., tax subsidy on any loss, and you are required to conduct your analysis in NOMINAL terms!!! (a) Calculate the NOMINAL annual cash flows for the project. (b) Numerically justify your investment decision on this project using the conceptually most correct method per the firm's objective. Precisely explain your investment decision. (c) i. Would your answer for part (b) be overstated/understated (circle correct choice) if you mistakenly used the real discount rate to discount the nominal cash flows of the project? > ii. Your manager informs you that the department has been allocated an annual overhead of $150,000 by the headquarter. Precisely explain why you should/should not (circle correct choice) include this piece of information in your analysis. MACRS Table (\%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started