Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Your option portfolio has European style put options on stock of ABC Ltd. with a notional value of $10 million. You are asked

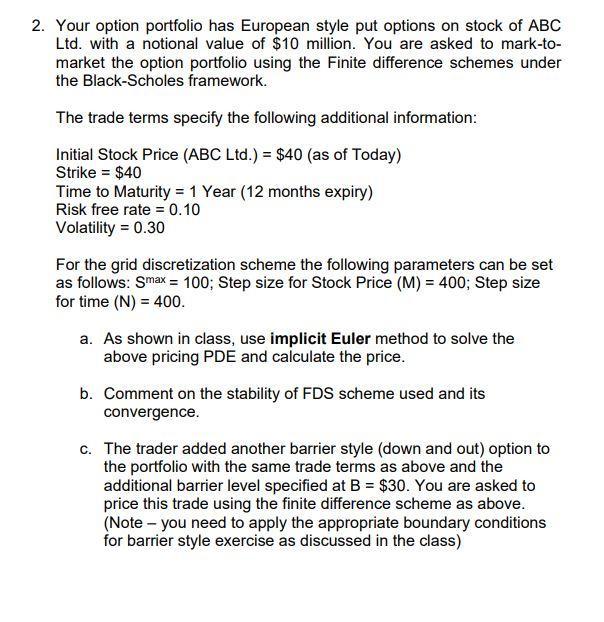

2. Your option portfolio has European style put options on stock of ABC Ltd. with a notional value of $10 million. You are asked to mark-to- market the option portfolio using the Finite difference schemes under the Black-Scholes framework. The trade terms specify the following additional information: Initial Stock Price (ABC Ltd.) = $40 (as of Today) Strike = $40 Time to Maturity = 1 Year (12 months expiry) Risk free rate = 0.10 Volatility = 0.30 For the grid discretization scheme the following parameters can be set as follows: Smax = 100; Step size for Stock Price (M) = 400; Step size for time (N) = 400. a. As shown in class, use implicit Euler method to solve the above pricing PDE and calculate the price. b. Comment on the stability of FDS scheme used and its convergence. c. The trader added another barrier style (down and out) option to the portfolio with the same trade terms as above and the additional barrier level specified at B = $30. You are asked to price this trade using the finite difference scheme as above. (Note - you need to apply the appropriate boundary conditions for barrier style exercise as discussed in the class)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To solve the pricing PDE using the implicit Euler method we first need to discretize the stock price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started