Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20 1 point Kronlund Inc. is about to start a two year project. It will require an upfront investment of $200,000 in a new

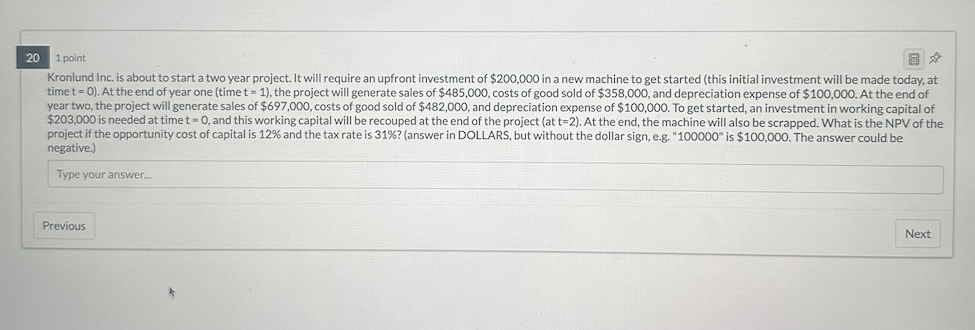

20 1 point Kronlund Inc. is about to start a two year project. It will require an upfront investment of $200,000 in a new machine to get started (this initial investment will be made today, at time t = 0). At the end of year one (time t = 1), the project will generate sales of $485,000, costs of good sold of $358,000, and depreciation expense of $100,000. At the end of year two, the project will generate sales of $697,000, costs of good sold of $482,000, and depreciation expense of $100,000. To get started, an investment in working capital of $203,000 is needed at time t = 0, and this working capital will be recouped at the end of the project (at t-2). At the end, the machine will also be scrapped. What is the NPV of the project if the opportunity cost of capital is 12% and the tax rate is 31% ? (answer in DOLLARS, but without the dollar sign, e.g. "100000" is $100,000. The answer could be negative.) Type your answer... Previous Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started