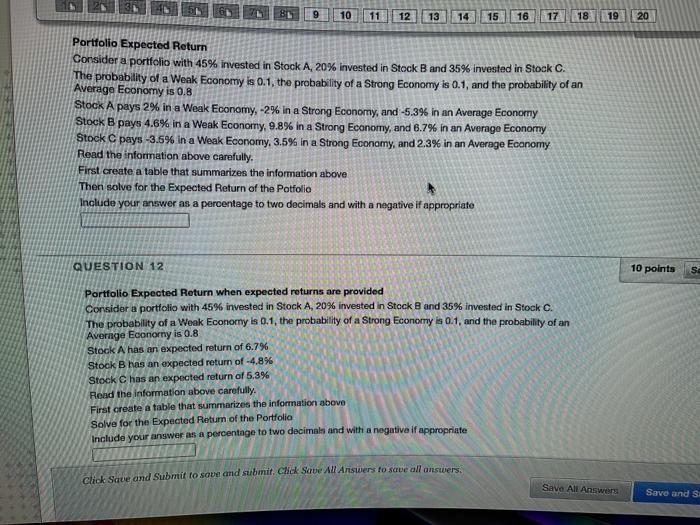

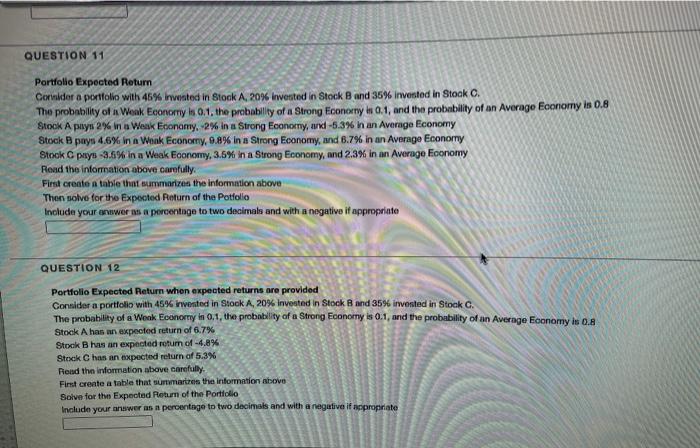

20 81 9 10 11 12 13 14 15 16 17 18 19 20 Portfolio Expected Return Consider a portfolio with 45% invested in Stock A, 20% invested in Stock Band 35% invested in Stock C. The probability of a Weak Economy is 0.1, the probability of a Strong Economy is 0.1, and the probability of an Average Economy is 0.8 Stock A pays 2% in a Weak Economy, -2% in a Strong Economy, and -5.3% in an Average Economy Stock B pays 4.6% in a Weak Economy, 9.8% in a Strong Economy, and 6.7% in an Average Economy Stock C pays -3.5% in a Weak Economy, 3.5% in a Strong Economy, and 2.3% in an Average Economy Read the information above carefully. First create a table that summarizes the information above Then solve for the Expected Return of the Potfolio Include your answer as a percentage to two decimals and with a negative if appropriate QUESTION 12 10 points S. Portfolio Expected Return when expected returns are provided Consider a portfolio with 45% invested in Stock A, 20% invested in Stock Band 35% invested in Stock C. The probability of a Weak Economy is 0.1, the probability of a Strong Economy is 0.1, and the probability of an Average Econorny is 0.8 Stock A has an expected return of 6.7% Stock Bhas an expected return of -4.8% Stock C has an expected return of 5.3% Read the information above carefully. First create a table that summarizes the information above Solve for the Expected Return of the Portfolio Include your answer as a percentage to two decimals and with a negative if appropriate Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and S QUESTION 11 Portfolio Expected Return Cornidet a portfolio with 46% invented in Stock A, 20% invested in Stock Band 35% invented in Stock C. The probabilley of a Wonk Economy is 01, the probability of a Strong Ficonerny s 0.1, and the probability of an Average Economy is 0.8 Stock A pays 2% in a Weak Economy. 2% in a Strong Economy, and -6.3%h an Average Economy Stock B payn 4.6% in a Weak Economy, 9.8% in a Strong Economy, and 8.7% in an Average Economy Stock C prys -3.6% in a Weak Economy, 3.5% in a Strong Economy, and 2.3% in an Average Economy Read the information above carefully First create a table that summarized the information above Then solve for the expected Return of the Potfolio Include your armwer as a percentage to two decimals and with a negative if appropriate QUESTION 12 Portfolio Expected Return when expected returns are provided Consider a portfolio with 45% invented in Stock A, 20% invested in Stock Band 35% invested in Stock C. The probability of a Wook Economy in 0.1, the probability of a Strong Economy is 0.1, and the probability of an Average Economy is 0.8 Stock A has an expected return of 6.7% Stock Bhas an expected return of -4.8% Steck C has an expected return of 5.3% Read the information above carefully First crente a table that summarizes the information above Solve for the Expected Return of the Portfolio Include your answer as a percentage to two decimals and with a negative if appropriate