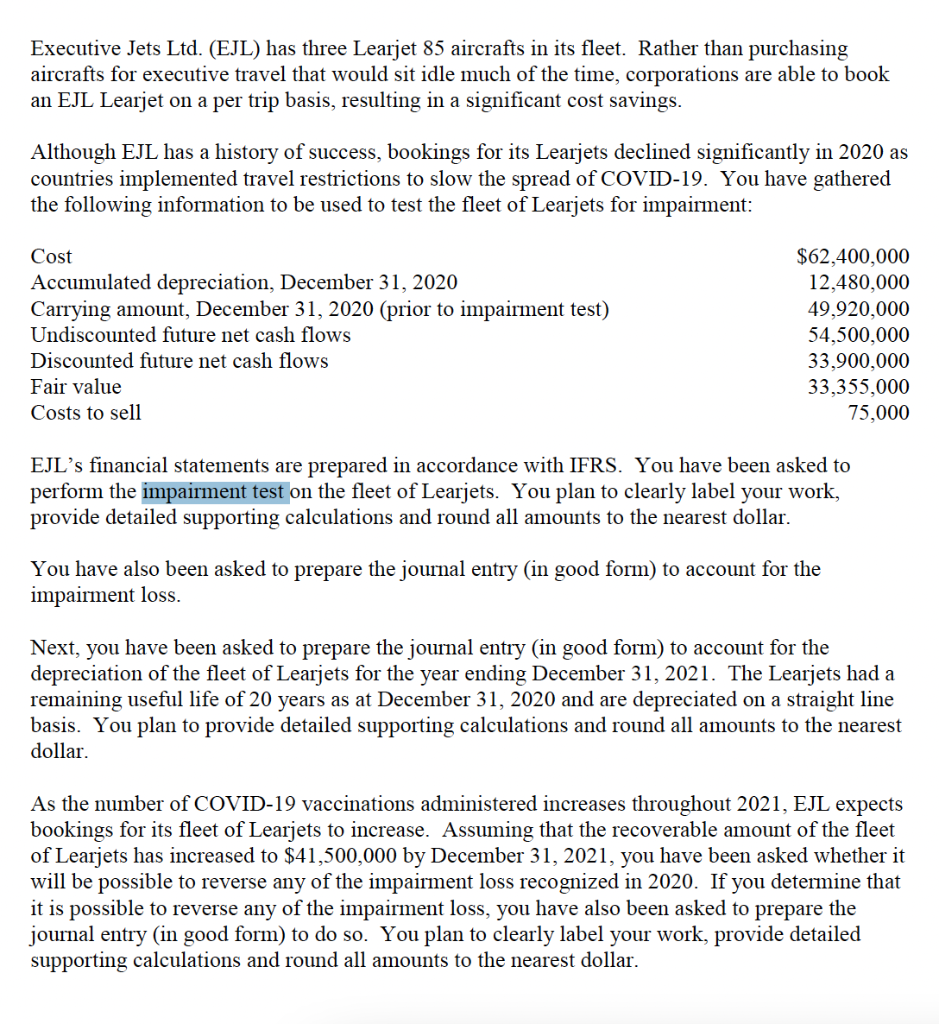

Executive Jets Ltd. (EJL) has three Learjet 85 aircrafts in its fleet. Rather than purchasing aircrafts for executive travel that would sit idle much of the time, corporations are able to book an EJL Learjet on a per trip basis, resulting in a significant cost savings. Although EJL has a history of success, bookings for its Learjets declined significantly in 2020 as countries implemented travel restrictions to slow the spread of COVID-19. You have gathered the following information to be used to test the fleet of Learjets for impairment: Cost Accumulated depreciation, December 31, 2020 Carrying amount, December 31, 2020 (prior to impairment test) Undiscounted future net cash flows Discounted future net cash flows Fair value Costs to sell $62,400,000 12,480,000 49,920,000 54,500,000 33,900,000 33,355,000 75,000 EJL's financial statements are prepared in accordance with IFRS. You have been asked to perform the impairment test on the fleet of Learjets. You plan to clearly label your work, provide detailed supporting calculations and round all amounts to the nearest dollar. You have also been asked to prepare the journal entry (in good form) to account for the impairment loss. Next, you have been asked to prepare the journal entry (in good form) to account for the depreciation of the fleet of Learjets for the year ending December 31, 2021. The Learjets had a remaining useful life of 20 years as at December 31, 2020 and are depreciated on a straight line basis. You plan to provide detailed supporting calculations and round all amounts to the nearest dollar. As the number of COVID-19 vaccinations administered increases throughout 2021, EJL expects bookings for its fleet of Learjets to increase. Assuming that the recoverable amount of the fleet of Learjets has increased to $41,500,000 by December 31, 2021, you have been asked whether it will be possible to reverse any of the impairment loss recognized in 2020. If you determine that it is possible to reverse any of the impairment loss, you have also been asked to prepare the journal entry (in good form) to do so. You plan to clearly label your work, provide detailed supporting calculations and round all amounts to the nearest dollar