Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20, A company purchased a del September I. Yean for $28,000 with a salvage valae of s1 (00 gn method, how much depreciation s 5

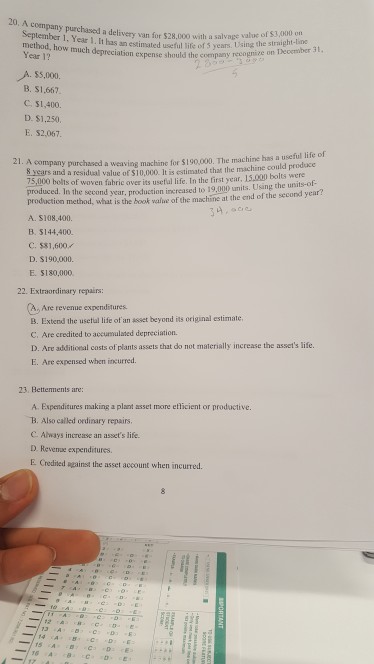

20, A company purchased a del September I. Yean for $28,000 with a salvage valae of s1 (00 gn method, how much depreciation s 5 years. Using the straight-line Year 1? abon expense should the company recogne on A. $5,000. B. S1,667 C $1,400. D. $1.250. E. 52,067. ny purchased a weaving machine for S190,000. The machine has a useful life of and a residual value of $10,000. It is estimated that the machine could prodce 8 years 15.000 bolts of woven fabric over its useful life. In the tirst year, 15.00 bolts were produced. In the second year, production increased to 19.000 units. Using production method, what is the book valwe of the machine at the end of the second year? A. S108,400. B. S144,400. C. $81,600 D. $190,000. E. $180,000 22. Extraordinary repairs: ,Are revenue expenditures B. Extend the usetul life of an asset beyond its original estimate C. Are credited to accumulated depreciation. D. Are additional costs of plants assets that do not materially increase the asset's life E. Are expensed when incurred. 23. Hetterments are A. Expenditures making a plant asset more etticient or productive. B. Also called ordinary repairs. C Always increase an asset's life. D Revenae expenditures. E Credited wgainst the asset account when incurred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started