Answered step by step

Verified Expert Solution

Question

1 Approved Answer

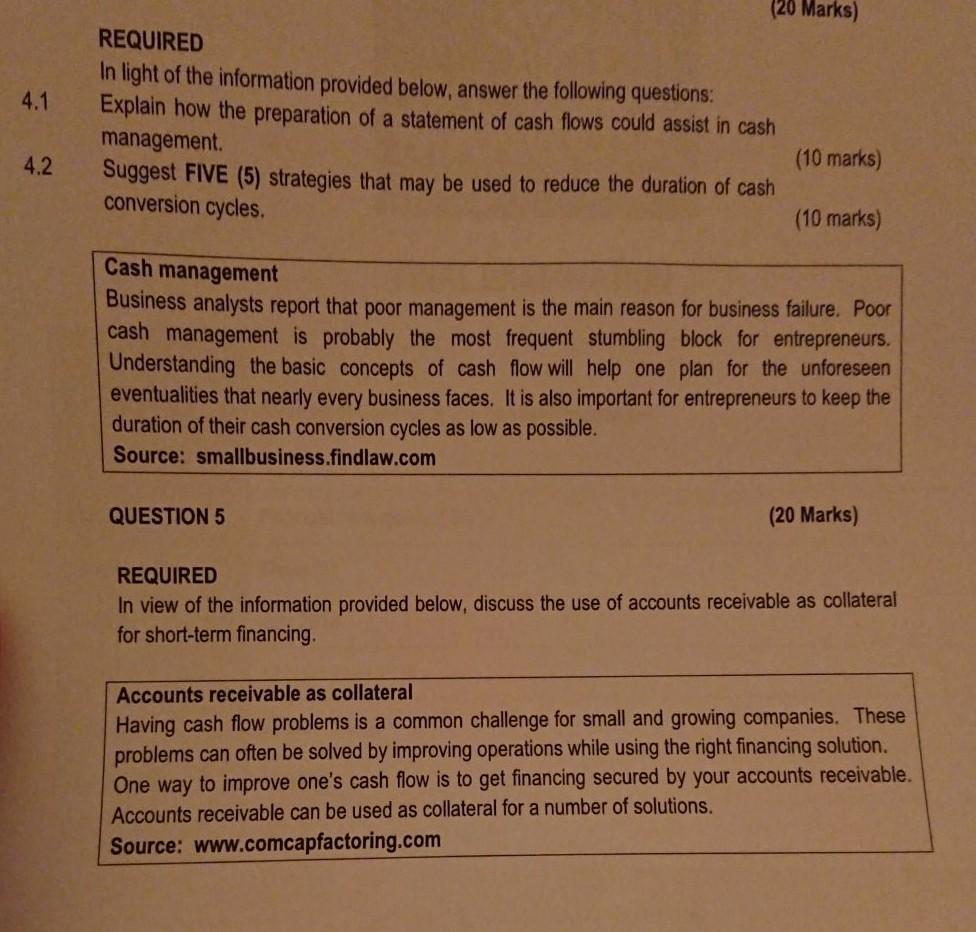

(20 Marks) 4.1 REQUIRED In light of the information provided below, answer the following questions: Explain how the preparation of a statement of cash flows

(20 Marks) 4.1 REQUIRED In light of the information provided below, answer the following questions: Explain how the preparation of a statement of cash flows could assist in cash management Suggest FIVE (5) strategies that may be used to reduce the duration of cash conversion cycles. 4.2 (10 marks) (10 marks) Cash management Business analysts report that poor management is the main reason for business failure. Poor cash management is probably the most frequent stumbling block for entrepreneurs. Understanding the basic concepts of cash flow will help one plan for the unforeseen eventualities that nearly every business faces. It is also important for entrepreneurs to keep the duration of their cash conversion cycles as low as possible. Source: smallbusiness.findlaw.com QUESTION 5 (20 Marks) REQUIRED In view of the information provided below, discuss the use of accounts receivable as collateral for short-term financing. Accounts receivable as collateral Having cash flow problems is a common challenge for small and growing companies. These problems can often be solved by improving operations while using the right financing solution. One way to improve one's cash flow is to get financing secured by your accounts receivable. Accounts receivable can be used as collateral for a number of solutions. Source: www.comcapfactoring.com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started