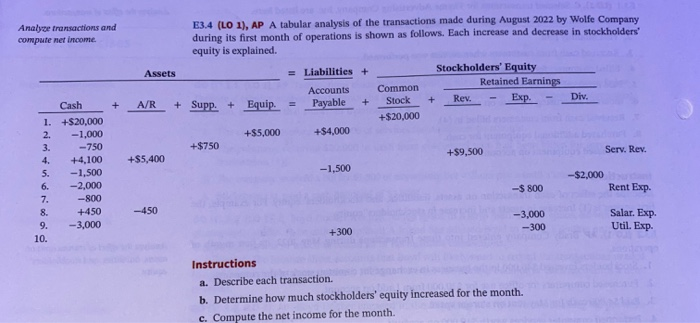

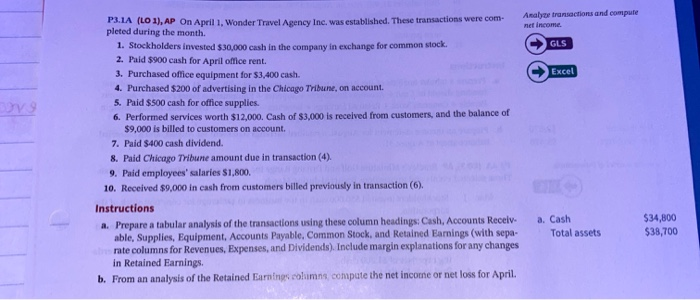

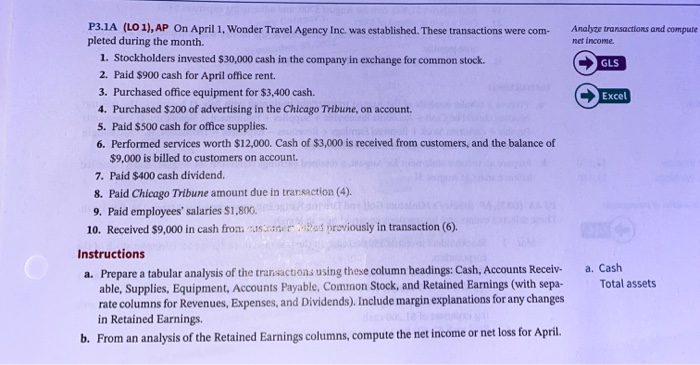

Analyse transactions and compute net income + + Cash 1. +$20,000 2. -1,000 3. -750 +4,100 5. - 1,500 6. -2,000 7. -800 8. +450 9. -3,000 10. E3.4 (LO 1), AP A tabular analysis of the transactions made during August 2022 by Wolfe Company during its first month of operations is shown as follows. Each increase and decrease in stockholders' equity is explained. Assets = Liabilities + Stockholders' Equity Retained Earnings Accounts Common A/R + Supp. + Equip. Payable + Stock Rev. Exp. Div. +$20,000 +$5,000 +$4,000 +$750 +$5,400 +$9,500 Serv. Rev. - 1,500 -$2,000 -$ 800 -450 -3,000 +300 -300 Rent Exp. Salar. Exp. Util. Exp. Instructions a. Describe each transaction. b. Determine how much stockholders' equity increased for the month. c. Compute the net income for the month. Analyse transactions and compute net income GLS Excel org P3.1A (LO 1), AP on April 1, Wonder Travel Agency Inc. was established. These transactions were com pleted during the month. 1. Stockholders invested $30,000 cash in the company in exchange for common stock. 2. Paid $900 cash for April office rent. 3. Purchased office equipment for $3,400 cash. 4. Purchased $200 of advertising in the Chicago Tribune, on account 5. Paid $500 cash for office supplies. 6. Performed services worth $12,000. Cash of $3,000 is received from customers, and the balance of $9,000 is billed to customers on account. 7. Paid $400 cash dividend. 8. Paid Chicago Tribune amount due in transaction (4) 9. Paid employees' salaries S1,800 10. Received $9,000 in cash from customers billed previously in transaction (6). Instructions a. Prepare a tabular analysis of the transactions using these column headings: Cash, Accounts Receiv. able, Supplies, Equipment, Accounts Payable, Common Stock, and Retained Earnings (with sepa rate columns for Revenues, Expenses, and Dividends). Include margin explanations for any changes in Retained Earnings. b. From an analysis of the Retained Earnings columns, compute the net income or net loss for April. a. Cash $34,800 $38,700 Total assets Analyze transactions and compute net income GLS Excel P3.1A (LO 1), AP on April 1, Wonder Travel Agency Inc. was established. These transactions were com- pleted during the month. 1. Stockholders invested $30,000 cash in the company in exchange for common stock. 2. Paid $900 cash for April office rent. 3. Purchased office equipment for $3,400 cash. 4. Purchased $200 of advertising in the Chicago Tribune, on account. 5. Paid $500 cash for office supplies. 6. Performed services worth $12,000. Cash of $3,000 is received from customers, and the balance of $9,000 is billed to customers on account. 7. Paid $400 cash dividend. 8. Paid Chicago Tribune amount due in transaction (4). 9. Paid employees' salaries $1,800. 10. Received $9,000 in cash from uso proviously in transaction (6). Instructions a. Prepare a tabular analysis of the transactions using these column headings: Cash, Accounts Receiv- able, Supplies, Equipment, Accounts Payable, Common Stock, and Retained Earnings (with sepa- rate columns for Revenues, Expenses, and Dividends). Include margin explanations for any changes in Retained Earnings. b. From an analysis of the Retained Earnings columns, compute the net income or net loss for April a. Cash Total assets