Answered step by step

Verified Expert Solution

Question

1 Approved Answer

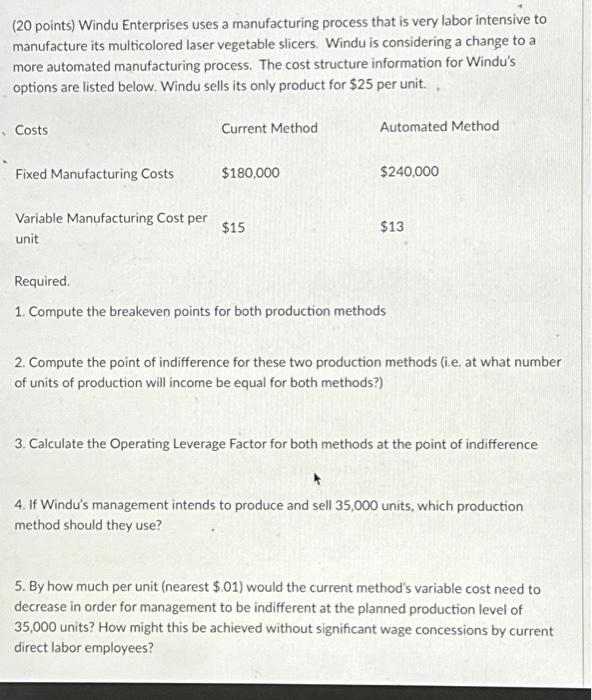

(20 points) Windu Enterprises uses a manufacturing process that is very labor intensive to manufacture its multicolored laser vegetable slicers. Windu is considering a change

(20 points) Windu Enterprises uses a manufacturing process that is very labor intensive to manufacture its multicolored laser vegetable slicers. Windu is considering a change to a more automated manufacturing process. The cost structure information for Windu's options are listed below. Windu sells its only product for ( $ 25 ) per unit. Required. 1. Compute the breakeven points for both production methods 2. Compute the point of indifference for these two production methods (i.e. at what number of units of production will income be equal for both methods?) 3. Calculate the Operating Leverage Factor for both methods at the point of indifference 4. If Windu's management intends to produce and sell 35,000 units, which production method should they use? 5. By how much per unit (nearest ( $ .01 ) ) would the current method's variable cost need to decrease in order for management to be indifferent at the planned production level of 35,000 units? How might this be achieved without significant wage concessions by current direct labor employees?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started