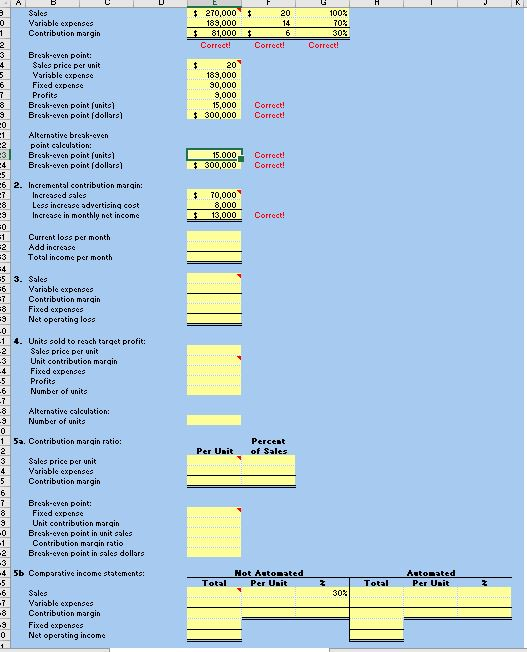

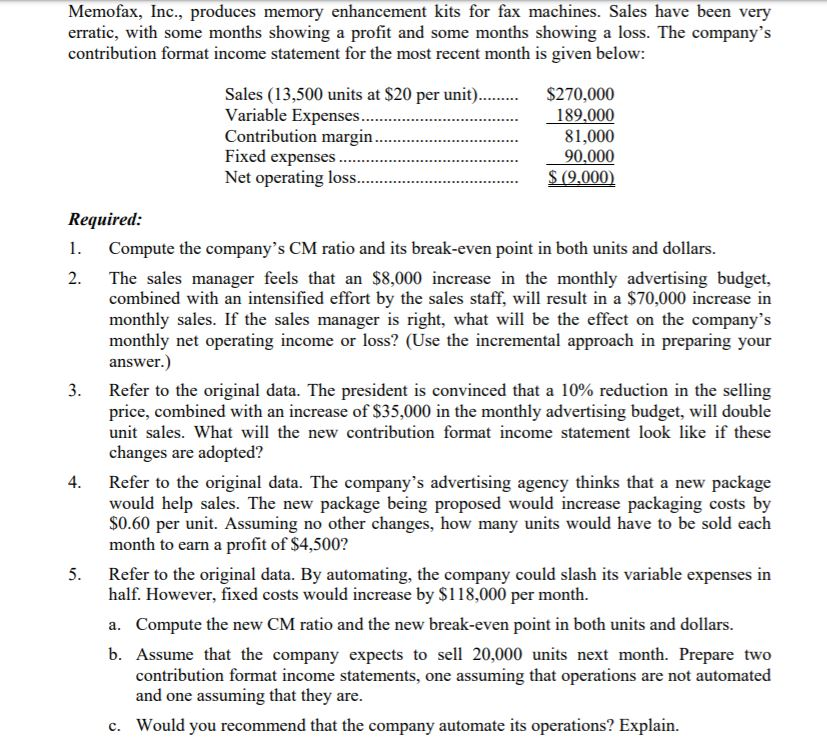

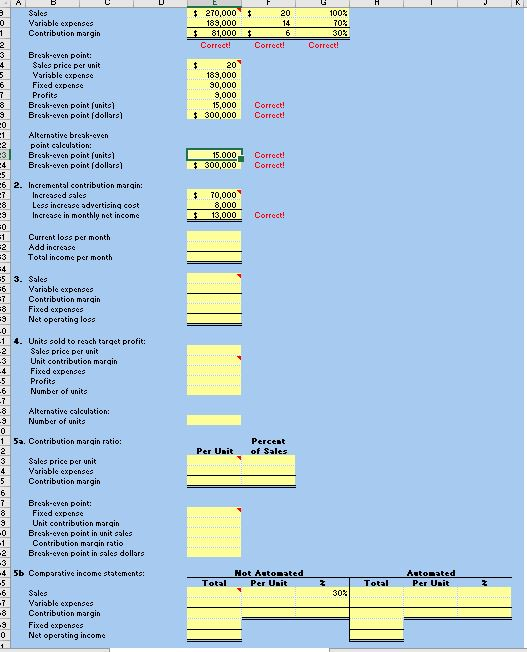

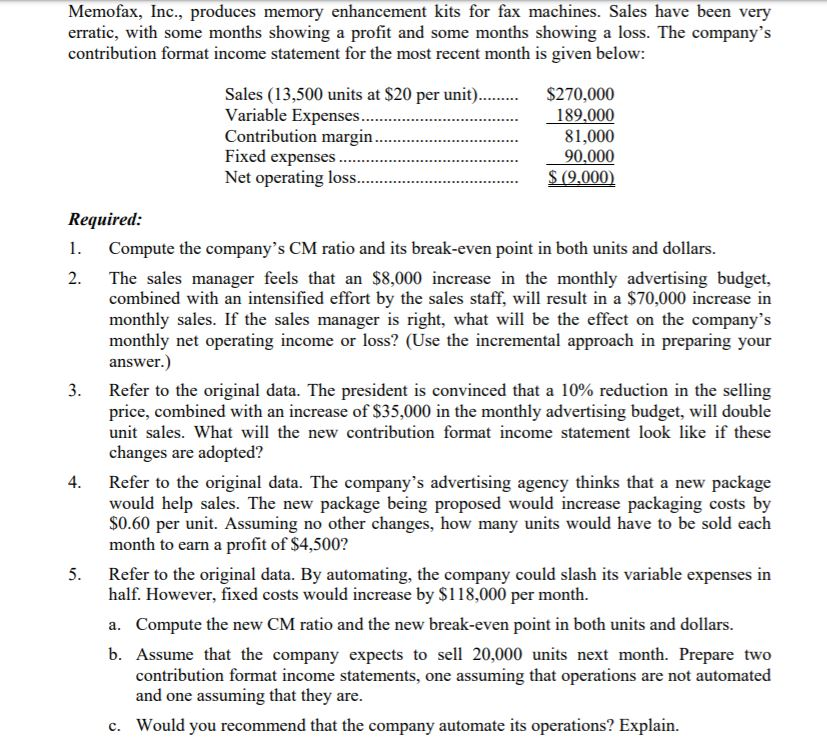

$ 20 Sales Variable expenses Contribution margin $ 270,000 189,000 $ 81,000 Correct! 6 Correct! Correct! Break-even point: Sales price per unit Variable expense Fixed expense Profits Break-even point (units) Break-even point (dollars) $ 20 109.000 90,000 9,000 15,000 $ 300,000 Correct! Correct! Alternative break-even point calculation: Break-even point (units) Break-even point dollars) 15.000 $ 300,000 Correct! Correct! Incremental contribution margin: Increased sales Less increase advertising cost Increase in monthly net income $ 70,000 8,000 13,000 $ Correct! Current lodo per month Add increase Total income per month 5 3. Sales Variable expenses Contribution margin Fixed expenses Net operating loss -1 4. Units sold to reach target profit: Sales price per unit Unit contribution margin Fixed expenses Profits Number of units Oromo Alternative calculation: Number of units 5a. Contribution margin ratio: Percent Sales price per unit Variable expenses Contribution margin ooOo-MN- Break-even point: Fixed expense Unit contribution margin Break-even point in unit sales Contribution margin ratio Break-even point in goles dollars Comparative income statements: Hot Automated Automated Per Unit Total Sales Variable expenses Contribution margin Fixed expenses Net operating income Memofax, Inc., produces memory enhancement kits for fax machines. Sales have been very erratic, with some months showing a profit and some months showing a loss. The company's contribution format income statement for the most recent month is given below: Sales (13,500 units at $20 per unit)........ Variable Expenses... Contribution margin....... Fixed expenses. Net operating loss.... $270,000 189,000 81,000 90,000 $ (9,000) ....... Required: 1. Compute the company's CM ratio and its break-even point in both units and dollars. 2. The sales manager feels that an $8,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will result in a $70,000 increase in monthly sales. If the sales manager is right, what will be the effect on the company's monthly net operating income or loss? (Use the incremental approach in preparing your answer.) 3. Refer to the original data. The president is convinced that a 10% reduction in the selling price, combined with an increase of $35,000 in the monthly advertising budget, will double unit sales. What will the new contribution format income statement look like if these changes are adopted? 4. Refer to the original data. The company's advertising agency thinks that a new package would help sales. The new package being proposed would increase packaging costs by $0.60 per unit. Assuming no other changes, how many units would have to be sold each month to earn a profit of $4,500? Refer to the original data. By automating, the company could slash its variable expenses in half. However, fixed costs would increase by $118,000 per month. a. Compute the new CM ratio and the new break-even point in both units and dollars. b. Assume that the company expects to sell 20,000 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. c. Would you recommend that the company automate its operations? Explain