Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20. You are considering a portfolio of three stocks with 30% of your money invested in company X, 45% of your money in company Y.

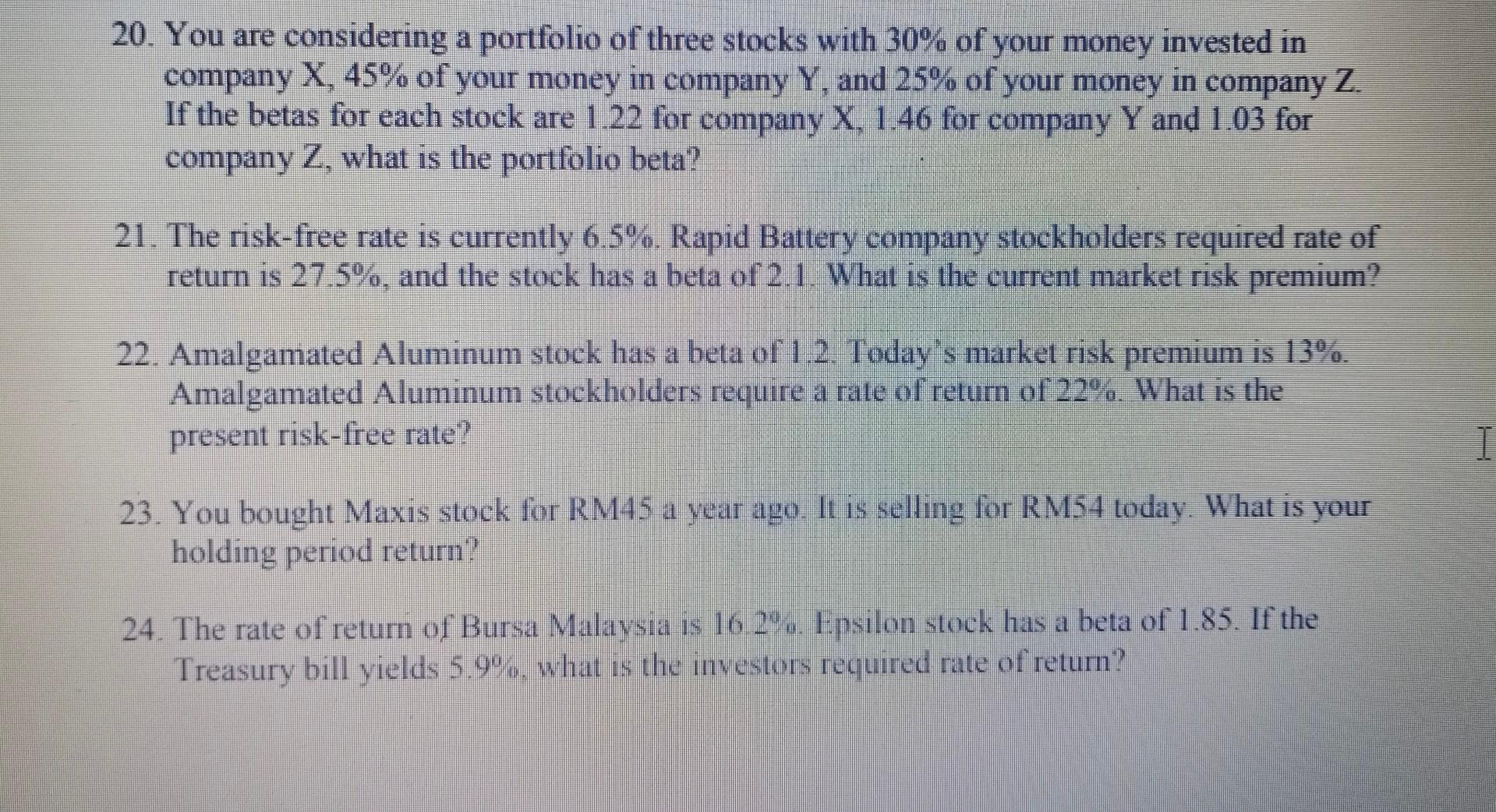

20. You are considering a portfolio of three stocks with 30% of your money invested in company X, 45% of your money in company Y. and 25% of your money in company Z. If the betas for each stock are 1.22 for company X. 1.46 for company Y and 1.03 for company Z, what is the portfolio beta? 21. The risk-free rate is currently 6.5%. Rapid Battery company stockholders required rate of return is 27.5%, and the stock has a beta of 2.1. What is the current market risk premium? a 22. Amalgamated Aluminum stock has a beta of 1.2. Today's market risk premium is 13%. Amalgamated Aluminum stockholders require a rate of return of 229. What is the present risk-free rate? ... 23. You bought Maxis stock for RMS ar Ois selling for RM54 today. What is your holding period return? 24. The rate of retum of Bursa Malaysia is 16.2%. Epsilon stock has a beta of 1.85. If the Treasury bill yields 5.9%. what is the investors required rate of retur

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started