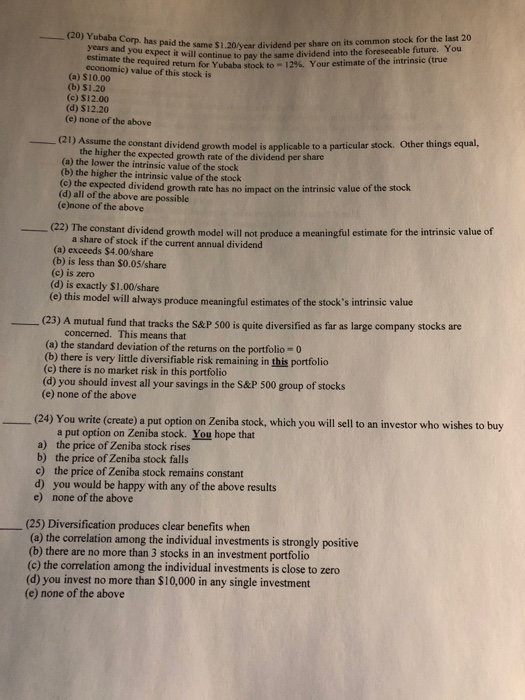

(20) Yubaba Corp. has paid the same $1.20 year di years and you expect it will continue to pa paid the same $1.20/year dividend per share on its common stock for the last 20 will continue to pay the same dividend into the foreseeable future. You the required return for Yubabe stock to 129. Your estimate of the intrinsic (true economic) value of this stock is (a) S10.00 (b) $1.20 (c) $12.00 (d) $12.20 (e) none of the above particular stock. Other things equal, (1) Assume the constant dividend rowth model is aplicable to the higher the expected growth rate of the dividend per share (a) the lower the intrinsic value of the stock (b) the higher the intrinsic value of the stock (c) the expected dividend growth me has no impact on the intrinsic value of the stock (d) all of the above are possible (e)none of the above (22) The constant dividend growth metal will not produce a meaningful estimate for the intrinsic value of a share of stock if the current annual dividend (a) exceeds $4.00/share (b) is less than 0.05/share (c) is zero (d) is exactly $1.00/share (e) this model will always produce meaningful estimates of the stock's intrinsic value (23) A mutual fund that tracks the S&P 500 is quite diversified as far as large company stocks are concerned. This means that (a) the standard deviation of the returns on the portfolio - 0 (b) there is very little diversifiable risk remaining in this portfolio (c) there is no market risk in this portfolio (d) you should invest all your savings in the S&P 500 group of stocks (e) none of the above (24) You write (create) a put option on Zeniba stock, which you will sell to an investor who wishes to buy a put option on Zeniba stock. You hope that a) the price of Zeniba stock rises b) the price of Zeniba stock falls c) the price of Zeniba stock remains constant d) you would be happy with any of the above results e) none of the above (25) Diversification produces clear benefits when (a) the correlation among the individual investments is strongly positive (b) there are no more than 3 stocks in an investment portfolio (c) the correlation among the individual investments is close to zero (d) you invest no more than $10,000 in any single investment (e) none of the above