Answered step by step

Verified Expert Solution

Question

1 Approved Answer

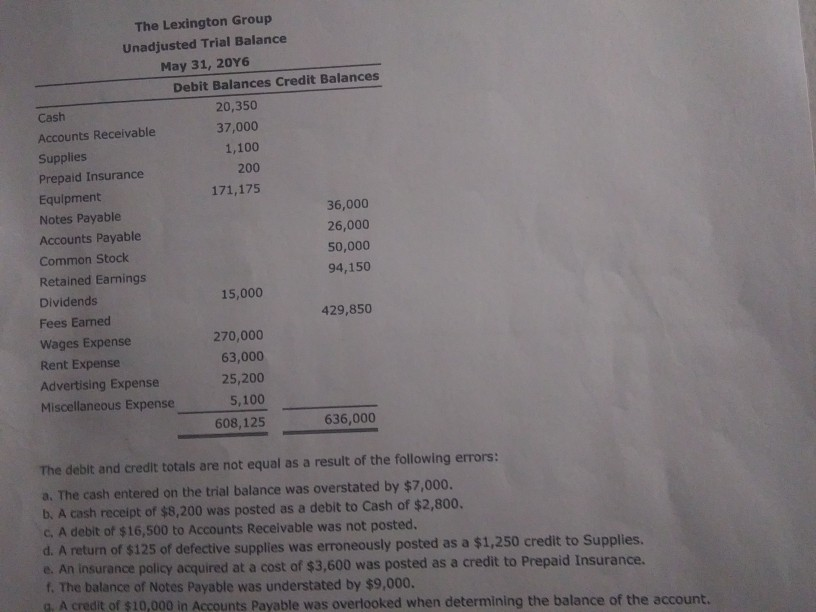

200 The Lexington Group Unadjusted Trial Balance May 31, 2016 Debit Balances Credit Balances Cash 20,350 Accounts Receivable 37,000 Supplies 1,100 Prepaid Insurance Equipment 171,175

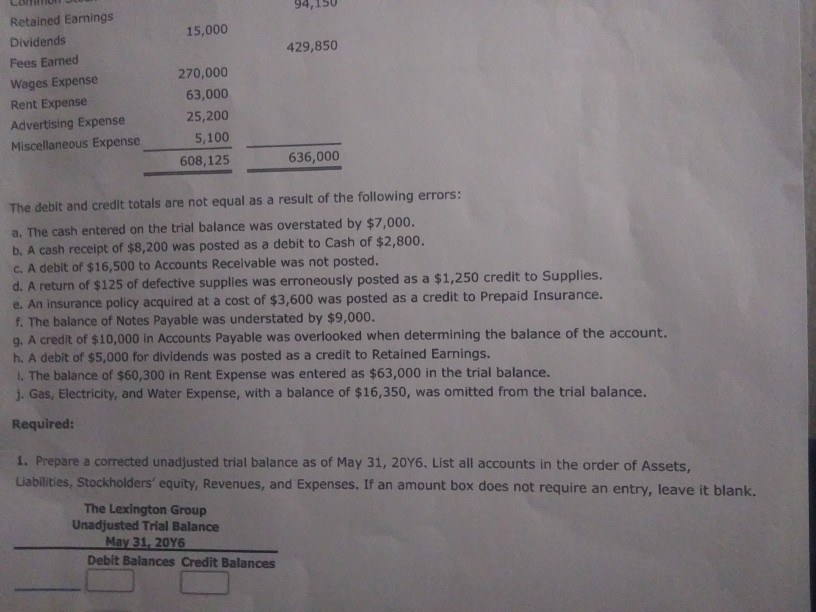

200 The Lexington Group Unadjusted Trial Balance May 31, 2016 Debit Balances Credit Balances Cash 20,350 Accounts Receivable 37,000 Supplies 1,100 Prepaid Insurance Equipment 171,175 36,000 Notes Payable 26,000 Accounts Payable Common Stock 50,000 94,150 Retained Earnings Dividends 15,000 Fees Earned 429,850 Wages Expense 270,000 Rent Expense 63,000 Advertising Expense 25,200 Miscellaneous Expense 5,100 608,125 636,000 The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was overstated by $7,000. b. A cash receipt of $8,200 was posted as a debit to Cash of $2,800. c. A debit of $ 16,500 to Accounts Receivable was not posted. d. A return of $125 of defective supplies was erroneously posted as a $1,250 credit to Supplies. e. An insurance policy acquired at a cost of $3,600 was posted as a credit to Prepaid Insurance. f. The balance of Notes Payable was understated by $9,000. 9. A credit of $10,000 in Accounts Payable was overlooked when determining the balance of the account. LOT JU 94,150 15,000 429,850 Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Advertising Expense Miscellaneous Expense 270,000 63,000 25,200 5,100 608,125 636,000 The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was overstated by $7,000. b. A cash receipt of $8,200 was posted as a debit to Cash of $2,800. C. A debit of $16,500 to Accounts Receivable was not posted. d. A return of $125 of defective supplies was erroneously posted as a $1,250 credit to Supplies. e. An insurance policy acquired at a cost of $3,600 was posted as a credit to Prepaid Insurance. f. The balance of Notes Payable was understated by $9,000. 9. A credit of $10,000 in Accounts Payable was overlooked when determining the balance of the account. h. A debit of $5,000 for dividends was posted as a credit to Retained Earnings. 1. The balance of $60,300 in Rent Expense was entered as $63,000 in the trial balance. 1. Gas, Electricity, and Water Expense, with a balance of $16,350, was omitted from the trial balance. Required: 1. Prepare a corrected unadjusted trial balance as of May 31, 2026. List all accounts in the order of Assets, Liabilities, Stockholders' equity, Revenues, and Expenses. If an amount box does not require an entry, leave it blank. The Lexington Group Unadjusted Trial Balance May 31, 2046 Debit Balances Credit Balances 9/23/2019 2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? 6 more Check My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started