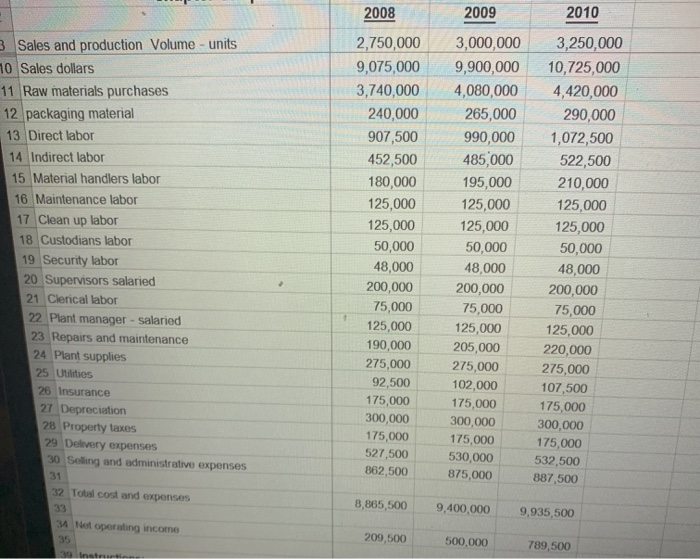

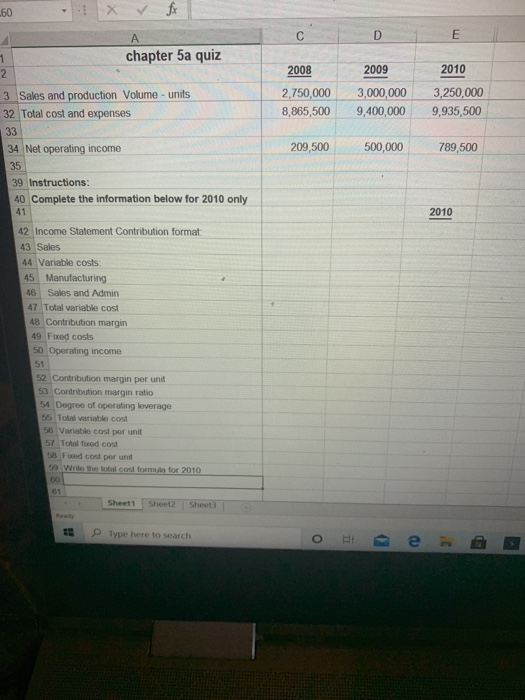

2008 2009 2010 3 Sales and production Volume - units 10 Sales dollars 11 Raw materials purchases 12 packaging material 13 Direct labor 14 Indirect labor 15 Material handlers labor 16 Maintenance labor 17 Clean up labor 18 Custodians labor 19 Security labor 20 Supervisors salaried 21 Clerical labor 22 Plant manager - salaried 23 Repairs and maintenance 24 Plant supplies 25 Utilities 26 Insurance 27 Depreciation 28 Property taxes 29 Delivery expenses 30 Selling and administrative expenses 31 32 Total cost and expenses 33 34 Net operating income 35 30 Inst 2,750,000 9,075,000 3,740,000 240,000 907,500 452,500 180,000 125,000 125,000 50,000 48,000 200,000 75,000 125,000 190,000 275,000 92,500 175,000 300,000 175,000 527,500 862,500 3,000,000 9,900,000 4,080,000 265,000 990,000 485,000 195,000 125,000 125,000 50,000 48,000 200,000 75,000 125,000 205,000 275,000 102,000 175,000 300,000 175,000 530,000 875,000 3,250,000 10,725,000 4,420,000 290,000 1,072,500 522,500 210,000 125,000 125,000 50,000 48,000 200,000 75,000 125,000 220,000 275,000 107,500 175,000 300,000 175,000 532,500 887,500 8,865,500 9,400,000 9,935,500 209,500 500.000 789,500 .60 A C D E 1 2 chapter 5a quiz 2008 2009 2010 2,750,000 8,865,500 3,000,000 9,400,000 3,250,000 9,935,500 3 Sales and production Volume - units 32 Total cost and expenses 33 34 Net operating income 35 39 Instructions: 40 Complete the information below for 2010 only 41 209,500 500,000 789,500 2010 42 Income Statement Contribution format 43 Sales 44 Variable costs: 45 Manufacturing 46 Sales and Admin 47 Total variable cost 48 Contribution margin 49 Fixed costs 50 Operating income 51 52 Contribution margin per unit 53 Contribution margin ratio 54 Degree of operating leverage 55 Total variable cost 56 Variable cost per unit 57 Tooed cost 58 Faed cos por un 5 Write the total cost formula for 2010 00 61 Sheet1 Sheet2 Sheets Type here to search o - e C 2008 2009 2010 3 Sales and production Volume - units 10 Sales dollars 11 Raw materials purchases 12 packaging material 13 Direct labor 14 Indirect labor 15 Material handlers labor 16 Maintenance labor 17 Clean up labor 18 Custodians labor 19 Security labor 20 Supervisors salaried 21 Clerical labor 22 Plant manager - salaried 23 Repairs and maintenance 24 Plant supplies 25 Utilities 26 Insurance 27 Depreciation 28 Property taxes 29 Delivery expenses 30 Selling and administrative expenses 31 32 Total cost and expenses 33 34 Net operating income 35 30 Inst 2,750,000 9,075,000 3,740,000 240,000 907,500 452,500 180,000 125,000 125,000 50,000 48,000 200,000 75,000 125,000 190,000 275,000 92,500 175,000 300,000 175,000 527,500 862,500 3,000,000 9,900,000 4,080,000 265,000 990,000 485,000 195,000 125,000 125,000 50,000 48,000 200,000 75,000 125,000 205,000 275,000 102,000 175,000 300,000 175,000 530,000 875,000 3,250,000 10,725,000 4,420,000 290,000 1,072,500 522,500 210,000 125,000 125,000 50,000 48,000 200,000 75,000 125,000 220,000 275,000 107,500 175,000 300,000 175,000 532,500 887,500 8,865,500 9,400,000 9,935,500 209,500 500.000 789,500 .60 A C D E 1 2 chapter 5a quiz 2008 2009 2010 2,750,000 8,865,500 3,000,000 9,400,000 3,250,000 9,935,500 3 Sales and production Volume - units 32 Total cost and expenses 33 34 Net operating income 35 39 Instructions: 40 Complete the information below for 2010 only 41 209,500 500,000 789,500 2010 42 Income Statement Contribution format 43 Sales 44 Variable costs: 45 Manufacturing 46 Sales and Admin 47 Total variable cost 48 Contribution margin 49 Fixed costs 50 Operating income 51 52 Contribution margin per unit 53 Contribution margin ratio 54 Degree of operating leverage 55 Total variable cost 56 Variable cost per unit 57 Tooed cost 58 Faed cos por un 5 Write the total cost formula for 2010 00 61 Sheet1 Sheet2 Sheets Type here to search o - e C