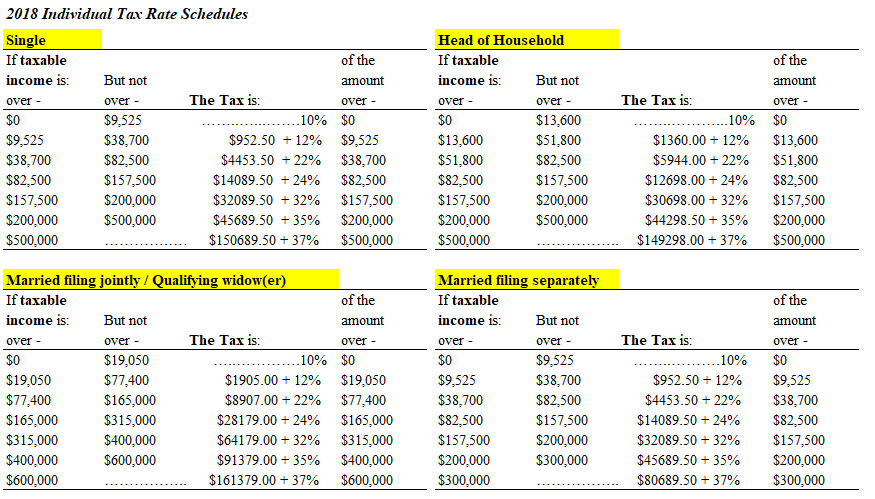

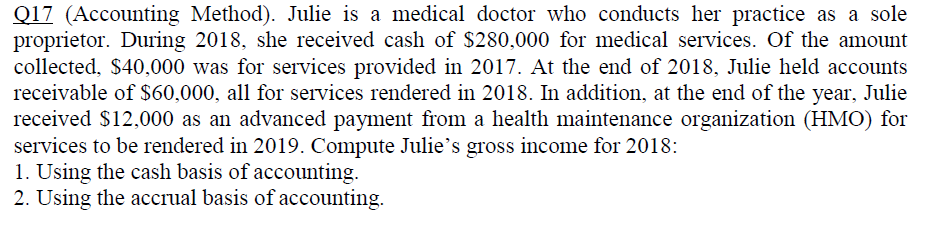

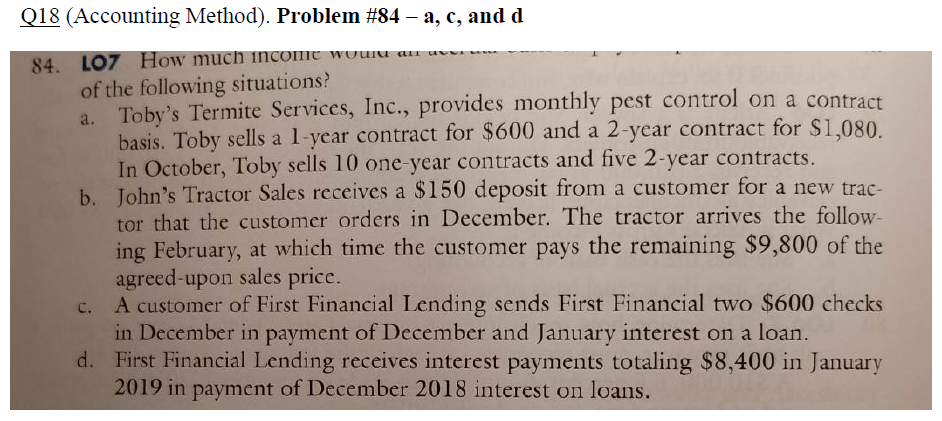

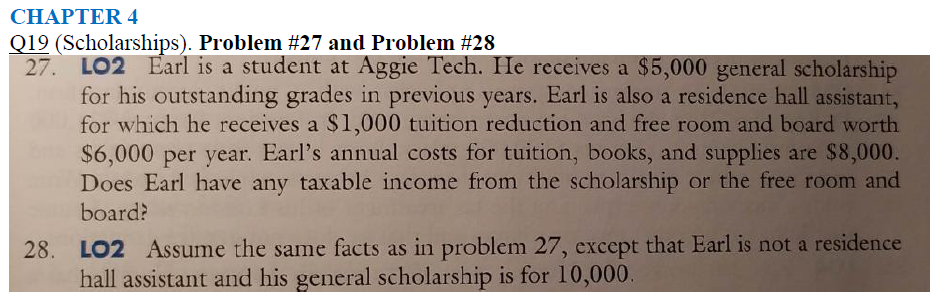

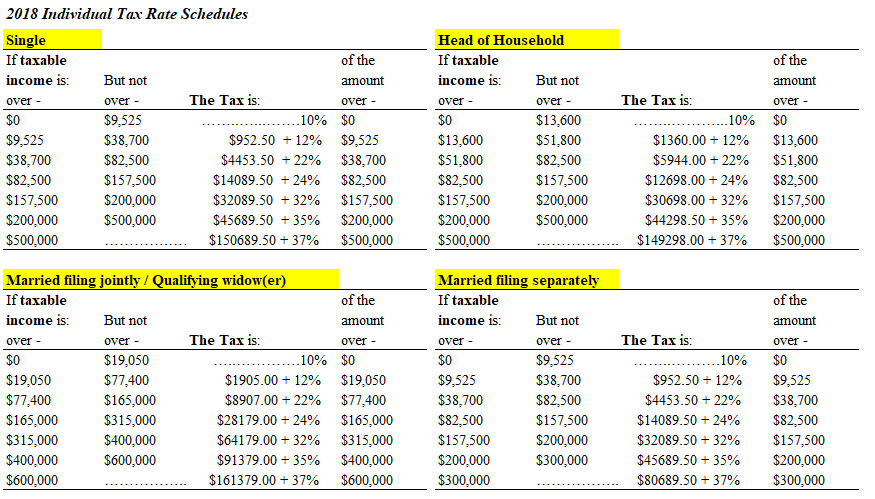

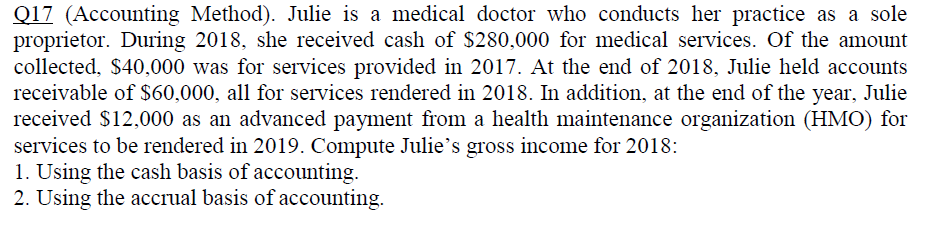

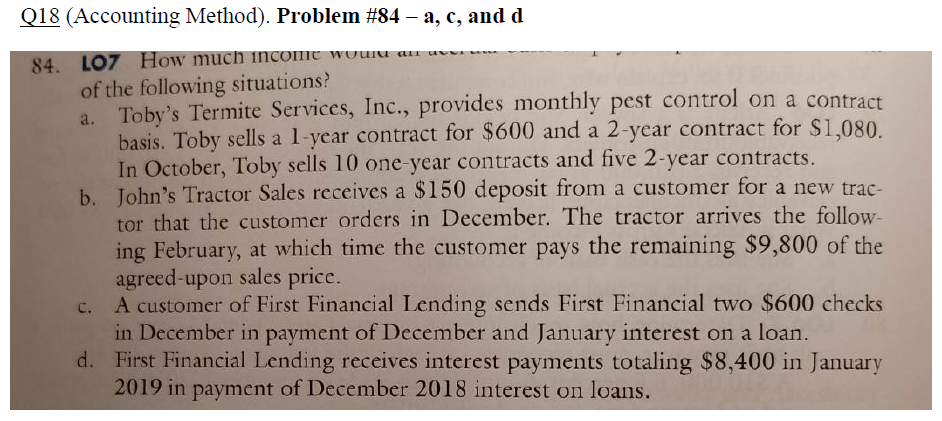

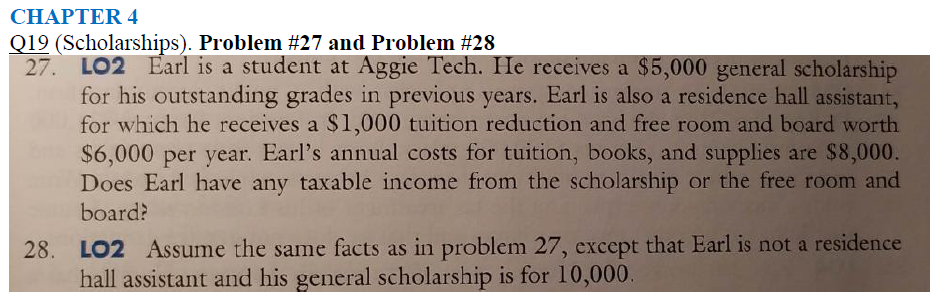

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 Head of Household If taxable income 1s: over - S0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount But not over - $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount The Tax is: The Tax is: $952.50+12% $4453.50+22% $14089.50+24% $32089.50+32% $45689.50+35% $150689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $1360.00 + 12% $5944.00 + 22% $12698.00 24% $30698.00 + 32% $44298.50+35% $149298.00 37% $13,600 $51.800 $82,500 $157,500 $200,000 $500,000 Married filing jointly/ Qualifying widow(er) If taxable income 1s: over - S0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 But not over - $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 Married filing separate If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount The Tax is: The Tax is: $1905.00 + 12% $8907.00 + 22% $28179.00 24% $64179.00 + 32% $91379.00 + 35% $161379.00 37% $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $952.50 12% $4453.50 22% $14089.50+24% $32089.50 + 32% $45689.50+35% $80689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 Q17 (Accounting Method). Julie is a medical doctor who conducts her practice as a sole proprietor. During 2018, she received cash of $280,000 for medical services. Of the amount collected, S40,000 was for services provided in 2017. At the end of 2018. Julie held accounts receivable of $60,000, all for services rendered in 2018. In addition, at the end of the year, Julie received S12,000 as an advanced payment from a health maintenance organization (HMO) for services to be rendered in 2019. Compute Julie's gross income for 2018: 1. Using the cash basis of accounting. 2. Using the accrual basis of accounting. Q18 (Accounting Method). Problem #84-a, c, and d 84. L07 How mucn t of the following situations? a. Toby's Termite Services, Inc., provides monthly pest control on a ite Serviccs, Inc., provides monthly pest control on a contract 600 and a 2-year contract for $1,080 basis. Toby sells a 1-ycar contract for $ In October, Toby sells 10 one-year contracts and five 2-year contracts. b. John's Tractor Sales receives a $150 deposit from a customer for a new trac tor that the customer orders in December. The tractor arrives the follow ing February, at which time the customer pays the remaining S9,800 of the agreed-upon sales price c. A customer of First Financial ILending sends First Financial two $600 checks in December in payment of December and January interest on a loarn d. First Financial Lending receives interest payments totaling $8,400 in January 2019 in payment of December 2018 interest on loans. CHAPTER 4 19 (Scholarships). Problem #27 and Problem #28 27. LO2 Earl is a student at Aggie Tech. He receives a $5,000 general scholarship for his outstanding grades in previous years. Earl is also a residence hall assistant, for which he receives a $1,000 tuition reduction and free room and board worth $6,000 per year. Earl's annual costs for tuition, books, and supplies are $8,000. Does Earl have any taxable income from the scholarship or the free room and board LO2 Assume the same facts as in problem 27, except that Earl is not a residence hall assistant and his general scholarship is for 10,000 28