Answered step by step

Verified Expert Solution

Question

1 Approved Answer

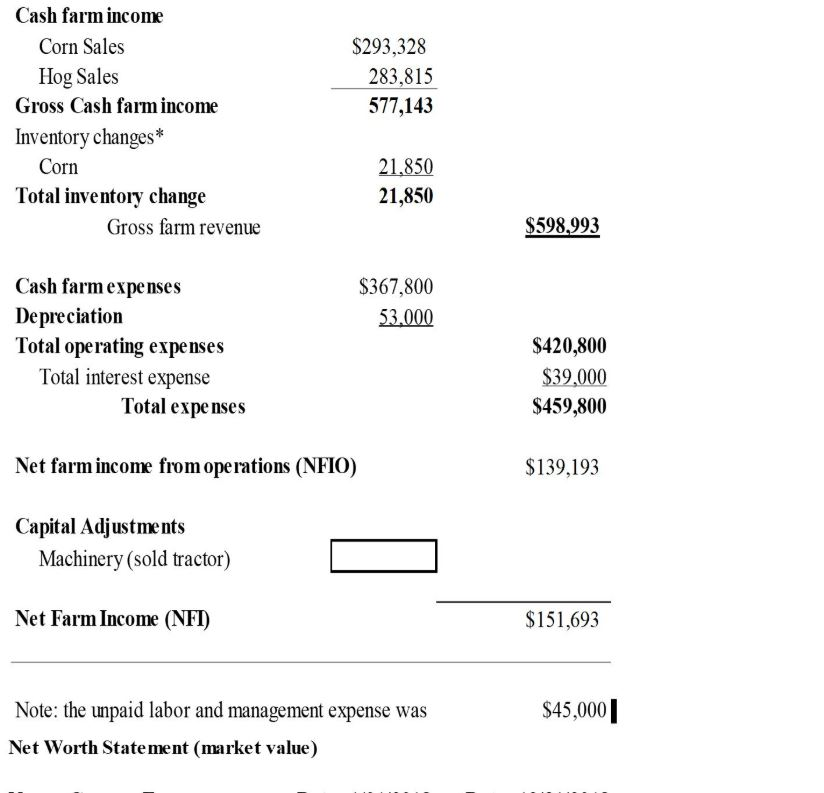

2018 Net income STATMENT Calculate and evalute return on assets (ROA) for 2018 Given the values for NFIO and NFI, what is the value for

2018 Net income STATMENT

Calculate and evalute return on assets (ROA) for 2018

Given the values for NFIO and NFI, what is the value for capital adjustment for 2018

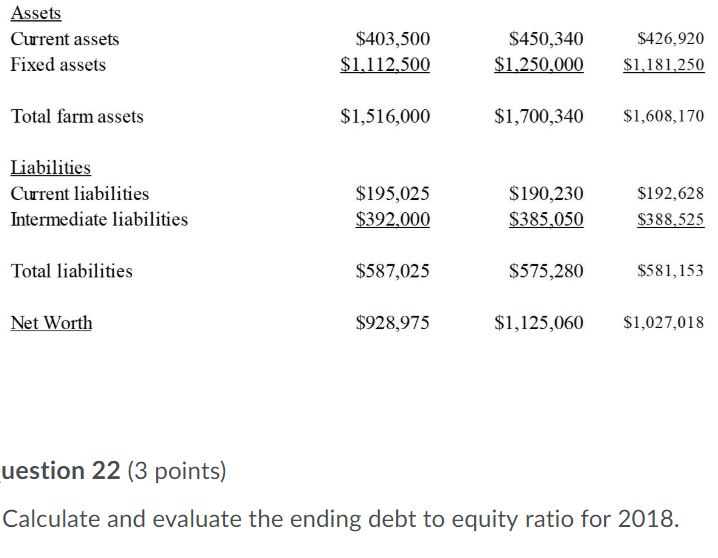

$293,328 283,815 577,143 Cash farm income Corn Sales Hog Sales Gross Cash farm income Inventory changes* Corn Total inventory change Gross farm revenue 21.850 21,850 $598,993 $367,800 53,000 Cash farm expenses Depreciation Total operating expenses Total interest expense Total expenses $420,800 $39,000 $459,800 Net farm income from operations (NFIO) $139,193 Capital Adjustments Machinery (sold tractor) Net Farm Income (NFI) $151,693 $45,000 Note: the unpaid labor and management expense was Net Worth Statement (market value) Assets Current assets Fixed assets $403,500 $1,112,500 $450,340 $1.250.000 $426,920 $1,181,250 Total farm assets $1,516,000 $1,700,340 $1,608,170 Liabilities Current liabilities Intermediate liabilities $195,025 $392,000 $190,230 $385,050 $192,628 $388,525 Total liabilities $587,025 $575,280 $581,153 Net Worth $928,975 $1,125,060 $1,027,018 uestion 22 (3 points) Calculate and evaluate the ending debt to equity ratio for 2018. $293,328 283,815 577,143 Cash farm income Corn Sales Hog Sales Gross Cash farm income Inventory changes* Corn Total inventory change Gross farm revenue 21.850 21,850 $598,993 $367,800 53,000 Cash farm expenses Depreciation Total operating expenses Total interest expense Total expenses $420,800 $39,000 $459,800 Net farm income from operations (NFIO) $139,193 Capital Adjustments Machinery (sold tractor) Net Farm Income (NFI) $151,693 $45,000 Note: the unpaid labor and management expense was Net Worth Statement (market value) Assets Current assets Fixed assets $403,500 $1,112,500 $450,340 $1.250.000 $426,920 $1,181,250 Total farm assets $1,516,000 $1,700,340 $1,608,170 Liabilities Current liabilities Intermediate liabilities $195,025 $392,000 $190,230 $385,050 $192,628 $388,525 Total liabilities $587,025 $575,280 $581,153 Net Worth $928,975 $1,125,060 $1,027,018 uestion 22 (3 points) Calculate and evaluate the ending debt to equity ratio for 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started