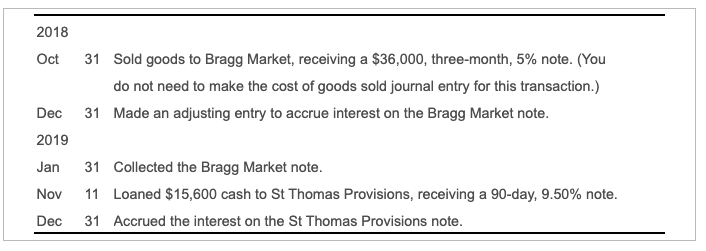

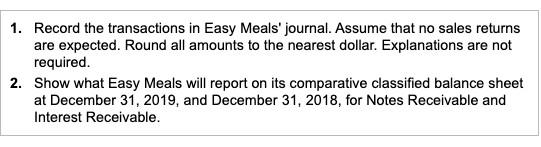

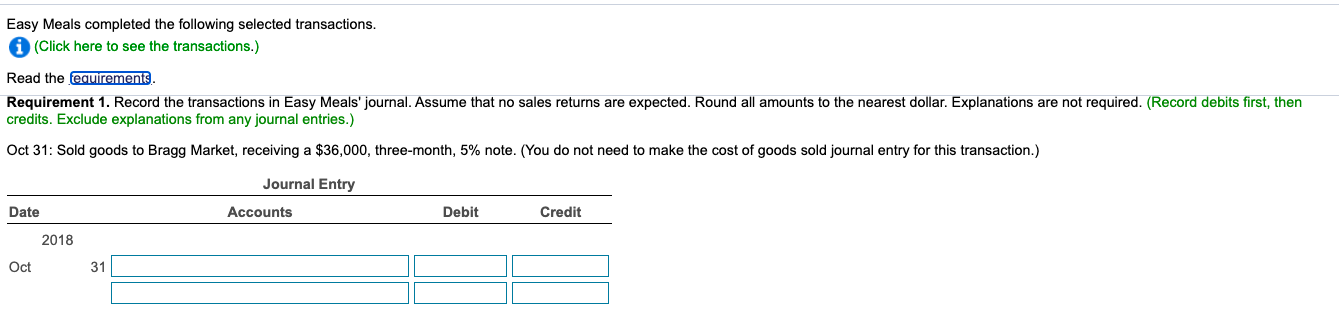

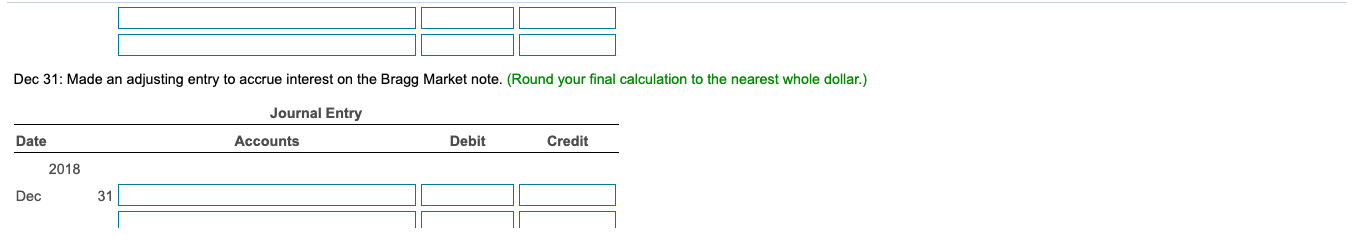

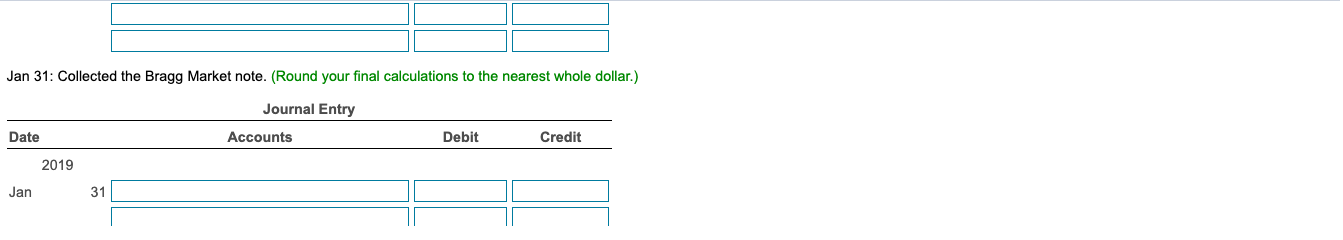

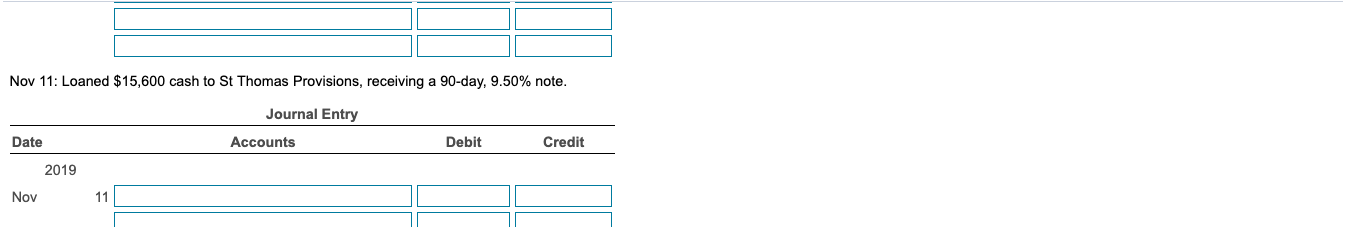

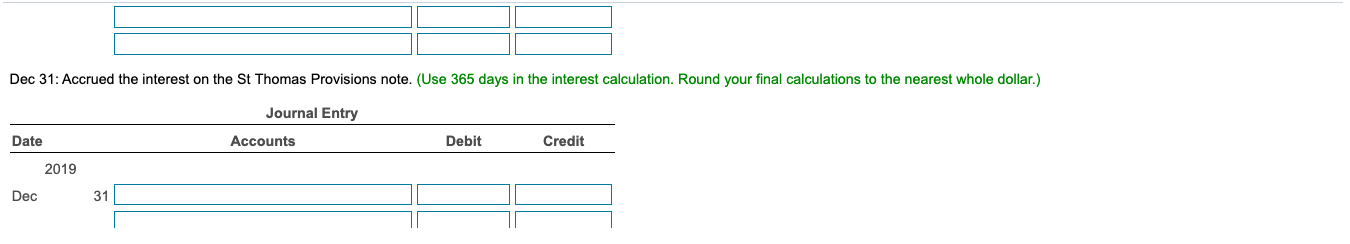

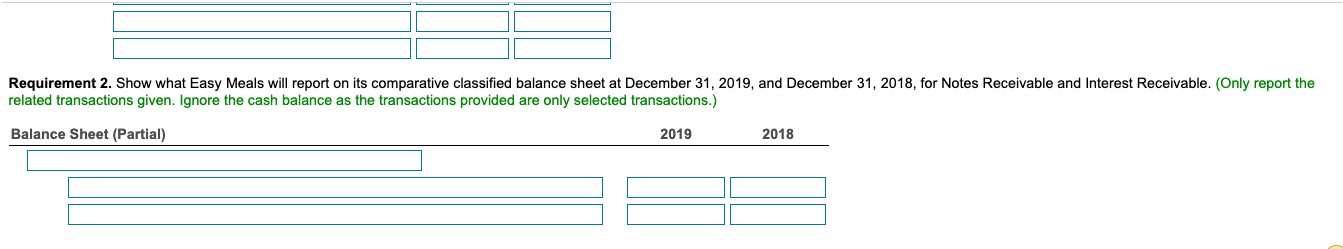

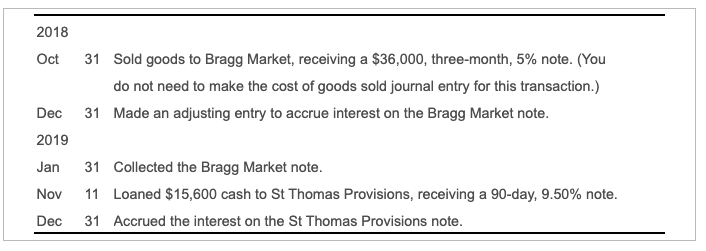

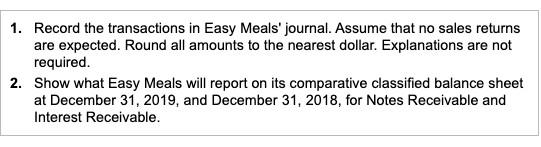

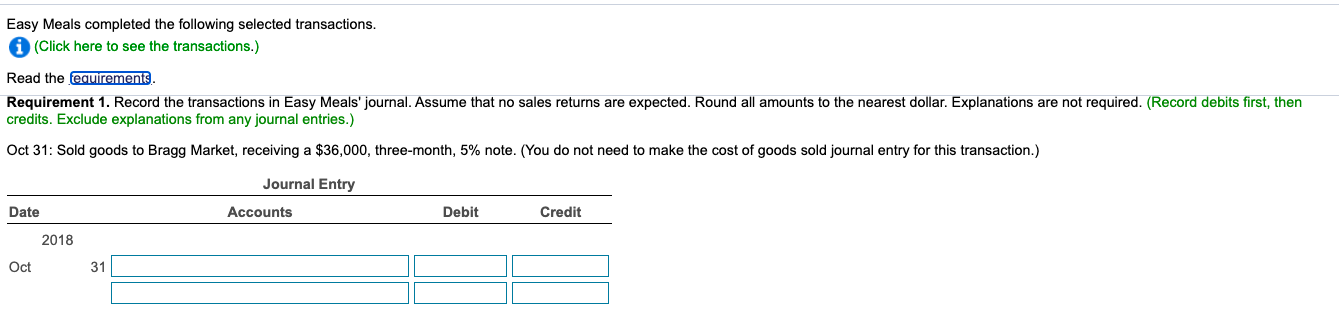

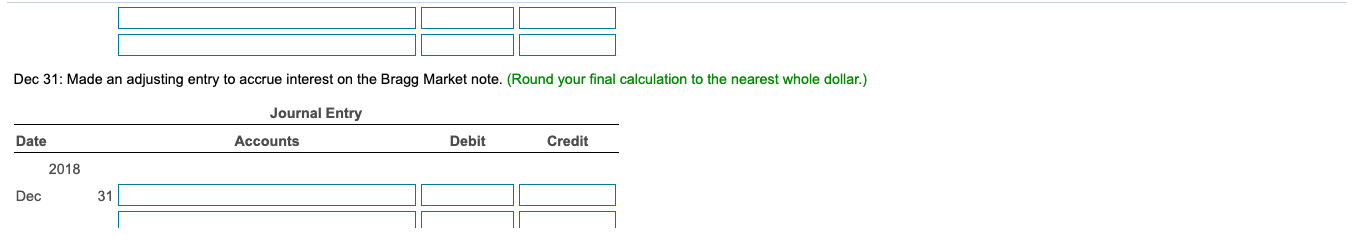

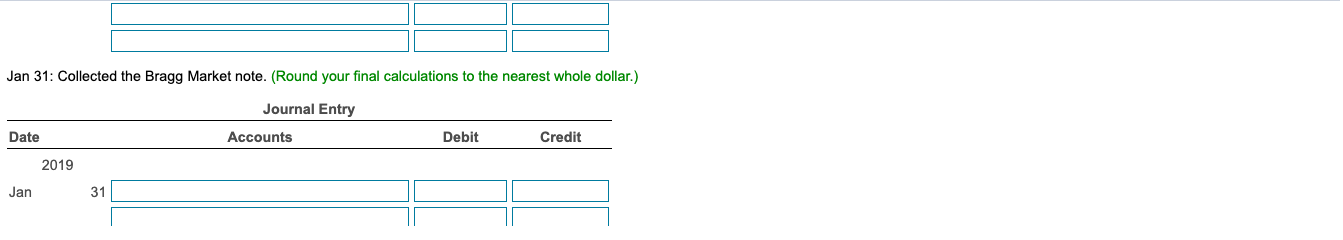

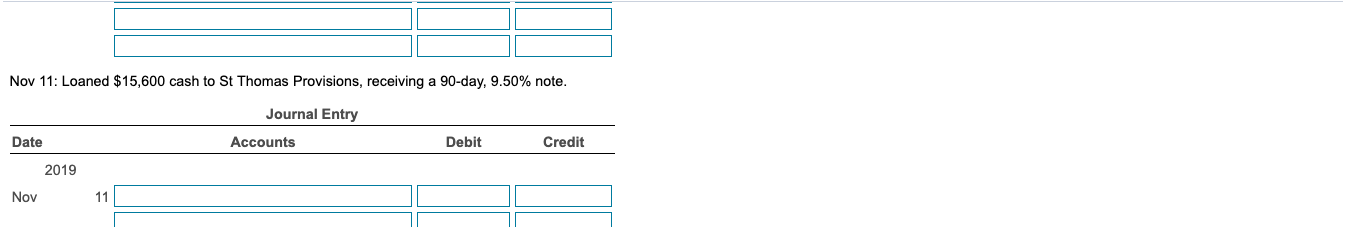

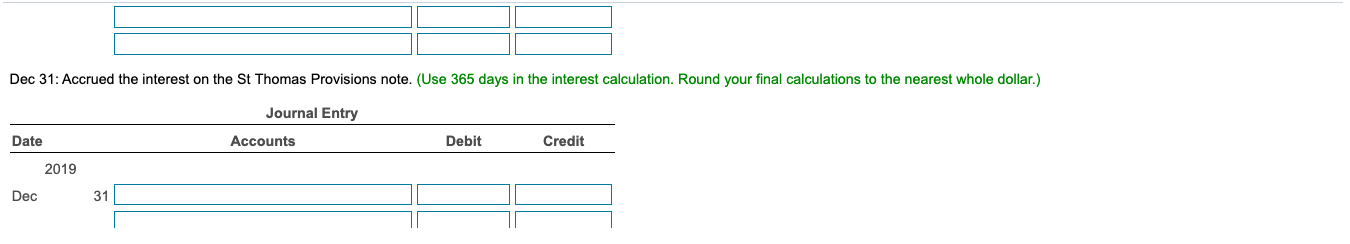

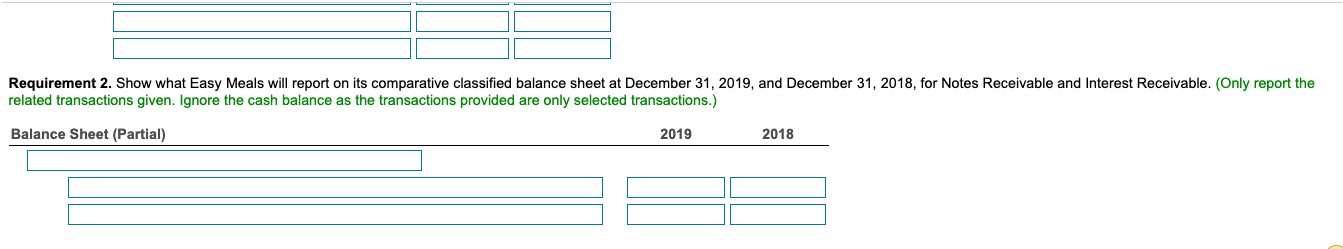

2018 Oct 31 Sold goods to Bragg Market, receiving a $36,000, three-month, 5% note. (You do not need to make the cost of goods sold journal entry for this transaction.) 31 Made an adjusting entry to accrue interest on the Bragg Market note. Dec 2019 Jan Nov 31 Collected the Bragg Market note. 11 Loaned $15,600 cash to St Thomas Provisions, receiving a 90-day, 9.50% note. 31 Accrued the interest on the St Thomas Provisions note. Dec 1. Record the transactions in Easy Meals' journal. Assume that no sales returns are expected. Round all amounts to the nearest dollar. Explanations are not required. 2. Show what Easy Meals will report on its comparative classified balance sheet at December 31, 2019, and December 31, 2018, for Notes Receivable and Interest Receivable. Easy Meals completed the following selected transactions. (Click here to see the transactions.) Read the requirements Requirement 1. Record the transactions in Easy Meals' journal. Assume that no sales returns are expected. Round all amounts to the nearest dollar. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) Oct 31: Sold goods to Bragg Market, receiving a $36,000, three-month, 5% note. (You do not need to make the cost of goods sold journal entry for this transaction.) Journal Entry Date Accounts Debit Credit 2018 Oct 31 Dec 31: Made an adjusting entry to accrue interest on the Bragg Market note. (Round your final calculation to the nearest whole dollar.) Journal Entry Date Accounts Debit Credit 2018 Dec 31 Jan 31: Collected the Bragg Market note. (Round your final calculations to the nearest whole dollar.) Journal Entry Date Accounts Debit Credit 2019 Jan 31 Nov 11: Loaned $15,600 cash to St Thomas Provisions, receiving a 90-day, 9.50% note. Journal Entry Date Accounts Debit Credit 2019 Nov 11 Dec 31: Accrued the interest on the St Thomas Provisions note. (Use 365 days in the interest calculation. Round your final calculations to the nearest whole dollar.) Journal Entry Date Accounts Debit Credit 2019 Dec 31 Requirement 2. Show what Easy Meals will report on its comparative classified balance sheet at December 31, 2019, and December 31, 2018, for Notes Receivable and Interest Receivable. (Only report the related transactions given. Ignore the cash balance as the transactions provided are only selected transactions.) Balance Sheet (Partial) 2019 2018