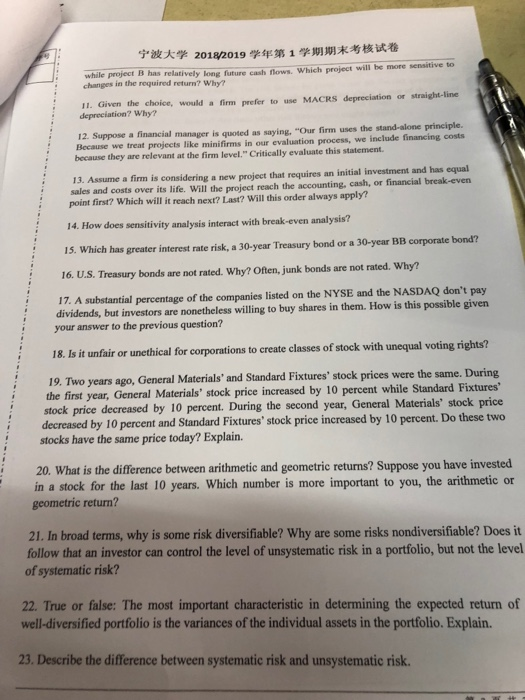

201820191 while project B has relatively long future cash flows. Which project will be more sensitive to 11. Given the choice, would a fim prefer to use MACRS depreciation or straight-line 12. Suppose a financial manager is quoted as saying, "Our firm uses the stand-alone principle. changes in the required return? Why? depreciation? Why? Because we treat projects like minifirms in our evaluation process, we include financing costs because they are relevant at the firm level." Critically evaluate this statement. 13. Assume a firm is considering a new project that requires an initial investment and has equal sales and costs over its life. Will the project reach the accounting, cash, or financial break-even point first? Which will it reach next? Last? Will this order always apply? 14. How does sensitivi ty analysis interact with break-even analysis? 15. Which has greater interest rate risk, a 30-year Treasury bond or a 30-year BB corporate bond? 16. U.S. Treasury bonds are not rated. Why? Often, junk bonds are not rated. Why? 17. A substantial percentage of the companies listed on the NYSE and the NASDAQ don't pay dividends, but investors are nonetheless willing to buy shares in them. How is this possible given your answer to the previous question? 18. Is it unfair or unethical for corporations to create classes of stock with unequal voting rights? 19. Two years ago, General Materials' and Standard Fixtures' s tock prices were the same. During the first year, General Materials' stock price increased by 10 percent while Standard Fixtures stock price decreased by 10 percent. During the second year, General Materials decreased by 10 percent and Standard Fixtures' stock price increased by 10 percent. Do these two stocks have the same price today? Explain. 20. What is the difference between arithmetic and geometric returns? Suppose you have invested in a stock for the last 10 years. Which number is more important to you, the arithmetic or geometric return? 21. In broad terms, why is some risk diversifiable? Why are some risks nondiversifiable? Does it follow that an investor can control the level of unsystematic risk in a portfolio, but not the level of systematic risk? 22. True or false: The most important characteristic in determining the expected return of well-diversified portfolio is the variances of the individual assets in the portfolio. Explain. 23. Describe the difference between systematic risk and unsystematic risk. 201820191 while project B has relatively long future cash flows. Which project will be more sensitive to 11. Given the choice, would a fim prefer to use MACRS depreciation or straight-line 12. Suppose a financial manager is quoted as saying, "Our firm uses the stand-alone principle. changes in the required return? Why? depreciation? Why? Because we treat projects like minifirms in our evaluation process, we include financing costs because they are relevant at the firm level." Critically evaluate this statement. 13. Assume a firm is considering a new project that requires an initial investment and has equal sales and costs over its life. Will the project reach the accounting, cash, or financial break-even point first? Which will it reach next? Last? Will this order always apply? 14. How does sensitivi ty analysis interact with break-even analysis? 15. Which has greater interest rate risk, a 30-year Treasury bond or a 30-year BB corporate bond? 16. U.S. Treasury bonds are not rated. Why? Often, junk bonds are not rated. Why? 17. A substantial percentage of the companies listed on the NYSE and the NASDAQ don't pay dividends, but investors are nonetheless willing to buy shares in them. How is this possible given your answer to the previous question? 18. Is it unfair or unethical for corporations to create classes of stock with unequal voting rights? 19. Two years ago, General Materials' and Standard Fixtures' s tock prices were the same. During the first year, General Materials' stock price increased by 10 percent while Standard Fixtures stock price decreased by 10 percent. During the second year, General Materials decreased by 10 percent and Standard Fixtures' stock price increased by 10 percent. Do these two stocks have the same price today? Explain. 20. What is the difference between arithmetic and geometric returns? Suppose you have invested in a stock for the last 10 years. Which number is more important to you, the arithmetic or geometric return? 21. In broad terms, why is some risk diversifiable? Why are some risks nondiversifiable? Does it follow that an investor can control the level of unsystematic risk in a portfolio, but not the level of systematic risk? 22. True or false: The most important characteristic in determining the expected return of well-diversified portfolio is the variances of the individual assets in the portfolio. Explain. 23. Describe the difference between systematic risk and unsystematic risk