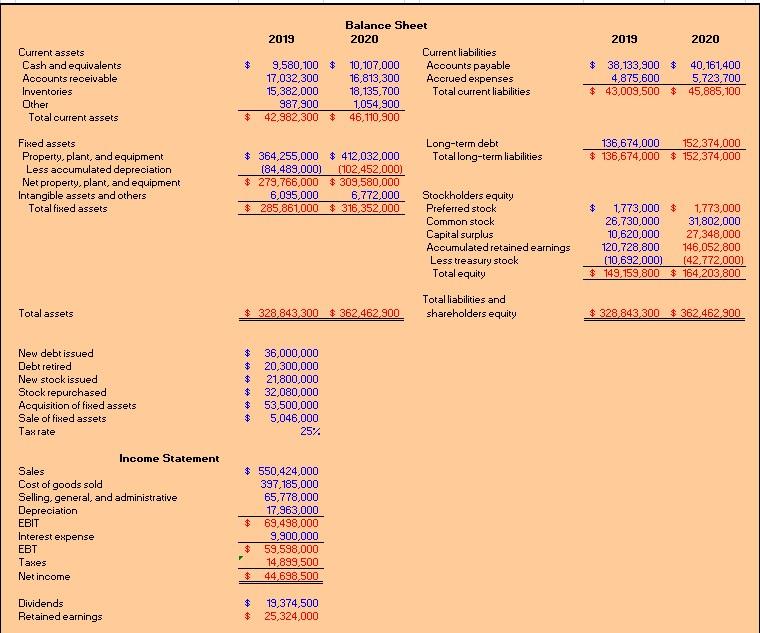

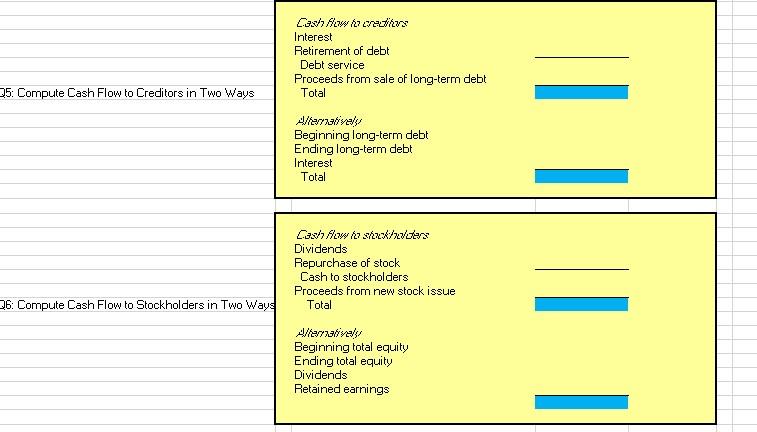

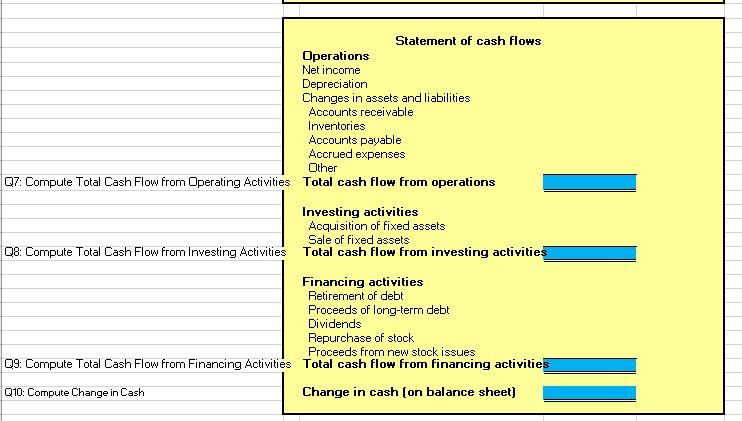

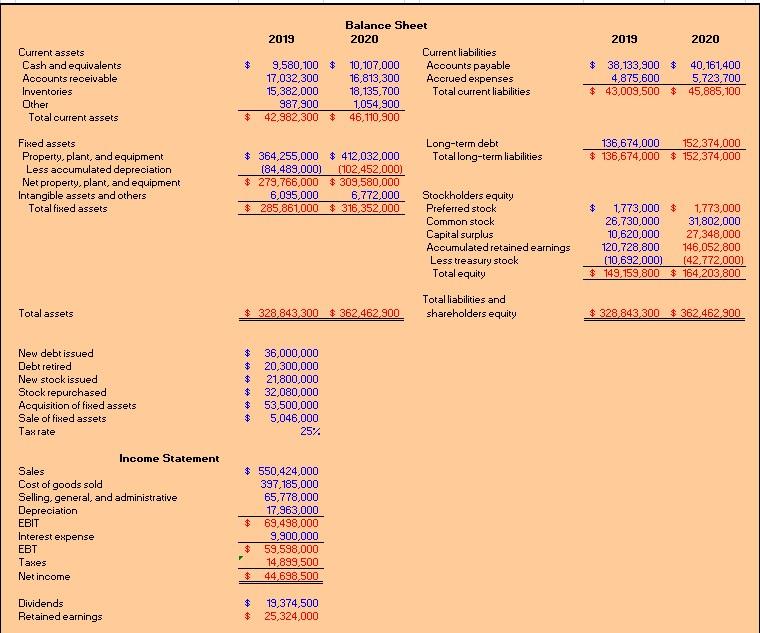

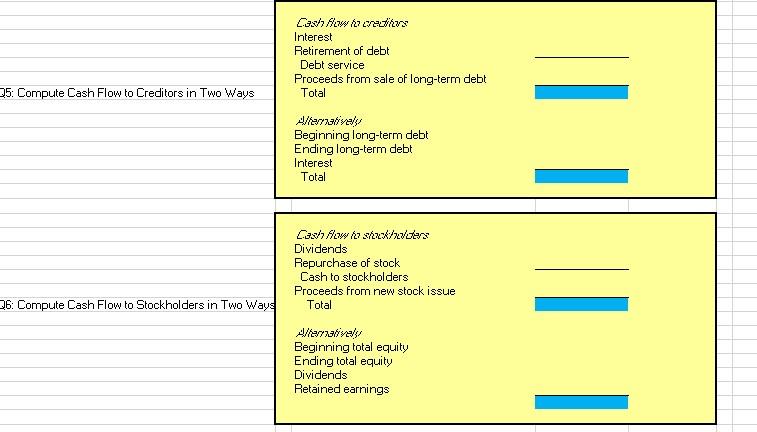

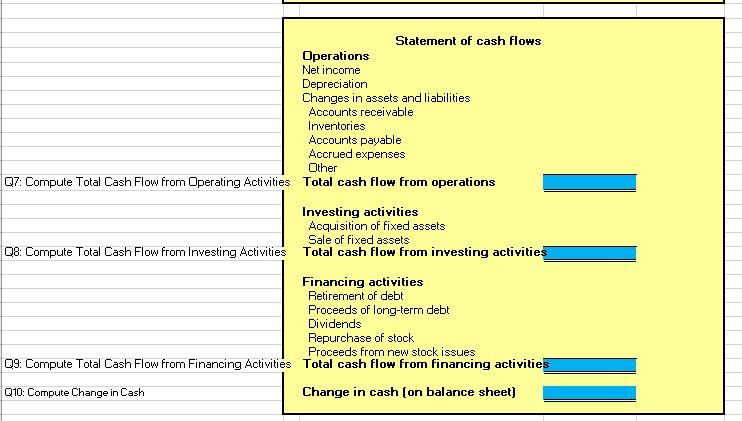

2019 2019 2020 $ Current assets Cash and equivalents Accounts receivable Inventories Other Total current assets 9,580,100 $ 17,032,300 15,382,000 987,900 42,982,300 $ Balance Sheet 2020 Current liabilities 10,107,000 Accounts payable 16,813,300 Accrued expenses 18,135,700 Total current liabilities 1,054,900 46,110,900 $ 38,133,900 $ 40,161,400 4,875,600 5,723,700 $ 43,009,500 $ 45,885,100 $ Long-term debt Total long-term liabilities 136,674,000 152,374,000 $ 136,674,000 $152,374,000 Fixed assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Intangible assets and others Total fixed assets $364,255,000 $ 412,032,000 (84,489,000) (102,452,000) $ 279,766,000 $ 309,580,000 6,095,000 6,772,000 $285,861,000 $ 316,352,000 $ Stockholders equity Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity Total liabilities and shareholders equity 1,773,000 $ 1,773,000 26,730,000 31,802,000 10,620,000 27,348,000 120,728,800 146,052,800 (10,692,000) (42,772,000) 149.159,800 $ 164,203,800 Total assets $ 328.843,300 $362.462.900 $ 328.843,300 $ 362.462.900 New debt issued Debt retired New stook issued Stock repurchased Acquisition of fixed assets Sale of fixed assets Tax rate $ $ $ $ $ $ 36,000,000 20,300,000 21,800,000 32,080,000 53,500,000 5,046,000 25% Income Statement Sales Cost of goods sold Selling, general, and administrative Depreciation EBIT Interest expense EBT Taxes Net income $ 550,424,000 397,185,000 65,778,000 17,963,000 $ 69,498,000 9,900,000 $ 59,598,000 14,899,500 $ 44,698,500 Dividends Retained earnings $ $ 19,374,500 25,324,000 Aw Latin Interest Retirement of debt Debt service Proceeds from sale of long-term debt Total 05: Compute Cash Flow to Creditors in Two Ways Verivaly Beginning long-term debt Ending long-term debt Interest Total Low 7 12/27 Dividends Repurchase of stock Cash to stockholders Proceeds from new stock issue Total Q6: Compute Cash Flow to Stockholders in Two Ways Privals Beginning total equity Ending total equity Dividends Retained earnings Statement of cash flows Operations Net income Depreciation Changes in assets and liabilities Accounts receivable Inventories Accounts payable Accrued expenses Other Q7: Compute Total Cash Flow from Operating Activities Total cash flow from operations Investing activities Acquisition of fixed assets Sale of fixed assets 08: Compute Total Cash Flow from Investing Activities Total cash flow from investing activities Financing activities Retirement of debt Proceeds of long-term debt Dividends Repurchase of stock Proceeds from new stock issues Q9: Compute Total Cash Flow from Financing Activities Total cash flow from financing activities Q10: Compute Change in Cash Change in cash (on balance sheet)