2019. Use Individual tax rate schedules, Standard deduction table and Tax rates for capital gains and qualified dividends. (Round all your intermediate calculations and final answers to the nearest whole dollar amount.)

2019. Use Individual tax rate schedules, Standard deduction table and Tax rates for capital gains and qualified dividends. (Round all your intermediate calculations and final answers to the nearest whole dollar amount.)

| Adjusted gross income (AGI) | |

| Taxable income | |

| Mr. and Mrs. Bensons regular income tax | |

| AMT | |

| Self employment tax | |

| Medicare contribution tax | |

| Mr. and Mrs. Benson's total tax liability | |

| Refund |

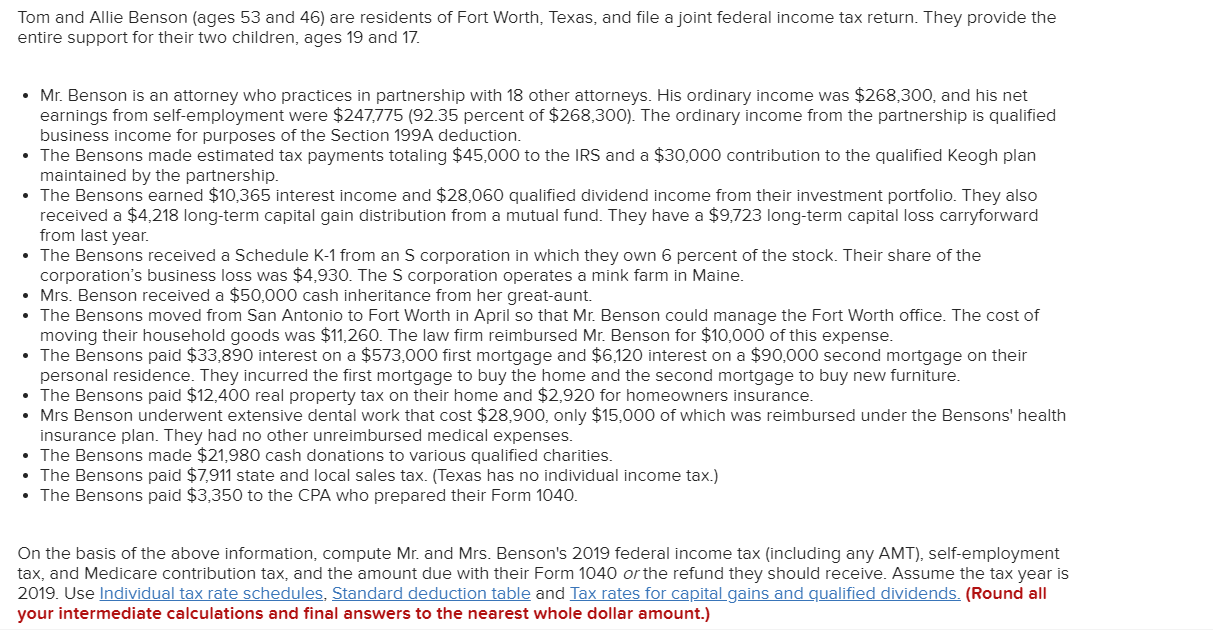

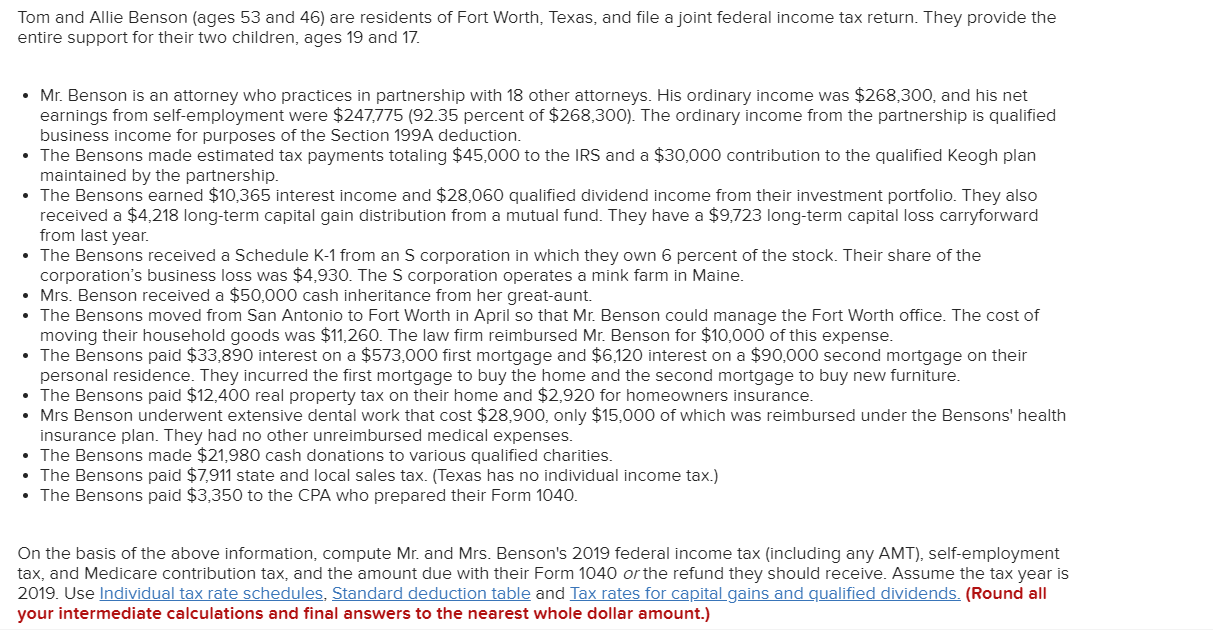

Tom and Allie Benson (ages 53 and 46) are residents of Fort Worth, Texas, and file a joint federal income tax return. They provide the entire support for their two children, ages 19 and 17. Mr. Benson is an attorney who practices in partnership with 18 other attorneys. His ordinary income was $268.300, and his net earnings from self-employment were $247,775 (92.35 percent of $268,300). The ordinary income from the partnership is qualified business income for purposes of the Section 199A deduction. The Bensons made estimated tax payments totaling $45,000 to the IRS and a $30,000 contribution to the qualified Keogh plan maintained by the partnership. The Bensons earned $10,365 interest income and $28,060 qualified dividend income from their investment portfolio. They also received a $4,218 long-term capital gain distribution from a mutual fund. They have a $9,723 long-term capital loss carryforward from last year. The Bensons received a Schedule K-1 from an S corporation in which they own 6 percent of the stock. Their share of the corporation's business loss was $4,930. The S corporation operates a mink farm in Maine. Mrs. Benson received a $50,000 cash inheritance from her great-aunt. The Bensons moved from San Antonio to Fort Worth in April so that Mr. Benson could manage the Fort Worth office. The cost of moving their household goods was $11,260. The law firm reimbursed Mr. Benson for $10,000 of this expense. The Bensons paid $33,890 interest on a $573,000 first mortgage and $6,120 interest on a $90,000 second mortgage on their personal residence. They incurred the first mortgage to buy the home and the second mortgage to buy new furniture. The Bensons paid $12,400 real property tax on their home and $2,920 for homeowners insurance. Mrs Benson underwent extensive dental work that cost $28,900, only $15,000 of which was reimbursed under the Bensons' health insurance plan. They had no other unreimbursed medical expenses. The Bensons made $21,980 cash donations to various qualified charities. The Bensons paid $7,911 state and local sales tax. (Texas has no individual income tax.) The Bensons paid $3,350 to the CPA who prepared their Form 1040. On the basis of the above information, compute Mr. and Mrs. Benson's 2019 federal income tax (including any AMT), self-employment tax, and Medicare contribution tax, and the amount due with their Form 1040 or the refund they should receive. Assume the tax year is 2019. Use Individual tax rate schedules, Standard deduction table and Tax rates for capital gains and qualified dividends. (Round all your intermediate calculations and final answers to the nearest whole dollar amount.) Tom and Allie Benson (ages 53 and 46) are residents of Fort Worth, Texas, and file a joint federal income tax return. They provide the entire support for their two children, ages 19 and 17. Mr. Benson is an attorney who practices in partnership with 18 other attorneys. His ordinary income was $268.300, and his net earnings from self-employment were $247,775 (92.35 percent of $268,300). The ordinary income from the partnership is qualified business income for purposes of the Section 199A deduction. The Bensons made estimated tax payments totaling $45,000 to the IRS and a $30,000 contribution to the qualified Keogh plan maintained by the partnership. The Bensons earned $10,365 interest income and $28,060 qualified dividend income from their investment portfolio. They also received a $4,218 long-term capital gain distribution from a mutual fund. They have a $9,723 long-term capital loss carryforward from last year. The Bensons received a Schedule K-1 from an S corporation in which they own 6 percent of the stock. Their share of the corporation's business loss was $4,930. The S corporation operates a mink farm in Maine. Mrs. Benson received a $50,000 cash inheritance from her great-aunt. The Bensons moved from San Antonio to Fort Worth in April so that Mr. Benson could manage the Fort Worth office. The cost of moving their household goods was $11,260. The law firm reimbursed Mr. Benson for $10,000 of this expense. The Bensons paid $33,890 interest on a $573,000 first mortgage and $6,120 interest on a $90,000 second mortgage on their personal residence. They incurred the first mortgage to buy the home and the second mortgage to buy new furniture. The Bensons paid $12,400 real property tax on their home and $2,920 for homeowners insurance. Mrs Benson underwent extensive dental work that cost $28,900, only $15,000 of which was reimbursed under the Bensons' health insurance plan. They had no other unreimbursed medical expenses. The Bensons made $21,980 cash donations to various qualified charities. The Bensons paid $7,911 state and local sales tax. (Texas has no individual income tax.) The Bensons paid $3,350 to the CPA who prepared their Form 1040. On the basis of the above information, compute Mr. and Mrs. Benson's 2019 federal income tax (including any AMT), self-employment tax, and Medicare contribution tax, and the amount due with their Form 1040 or the refund they should receive. Assume the tax year is 2019. Use Individual tax rate schedules, Standard deduction table and Tax rates for capital gains and qualified dividends. (Round all your intermediate calculations and final answers to the nearest whole dollar amount.)

2019. Use Individual tax rate schedules, Standard deduction table and Tax rates for capital gains and qualified dividends. (Round all your intermediate calculations and final answers to the nearest whole dollar amount.)

2019. Use Individual tax rate schedules, Standard deduction table and Tax rates for capital gains and qualified dividends. (Round all your intermediate calculations and final answers to the nearest whole dollar amount.)