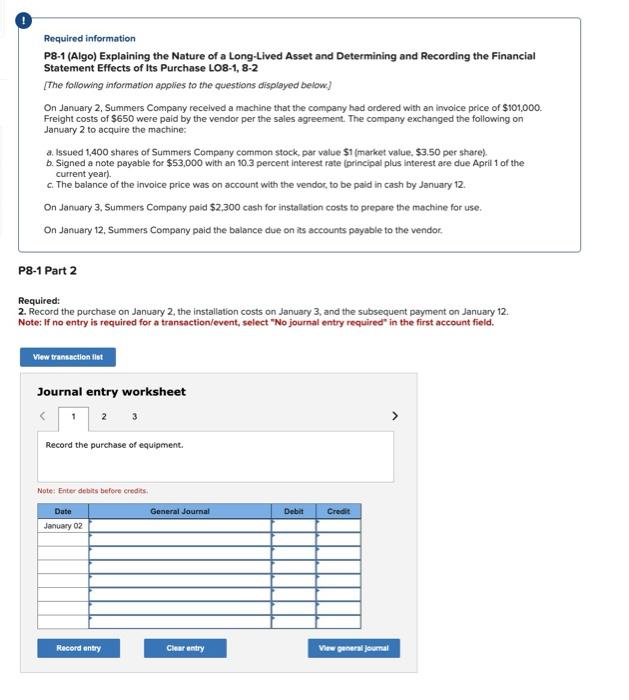

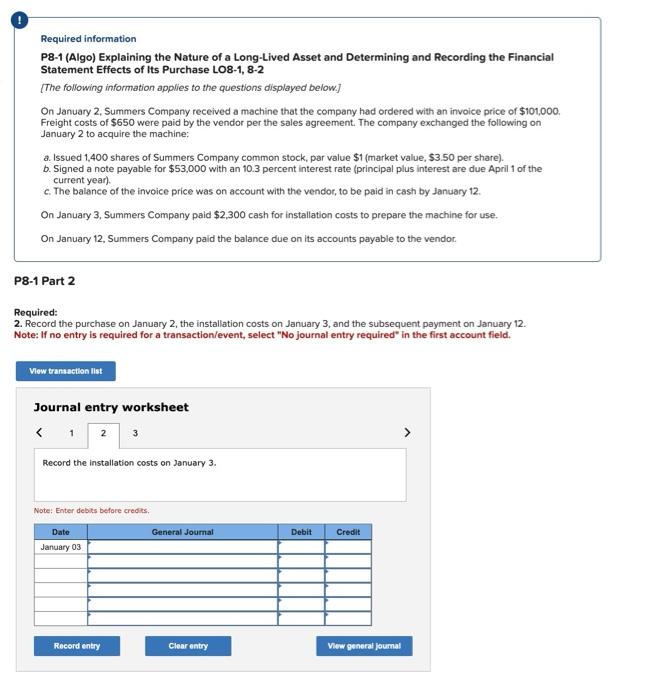

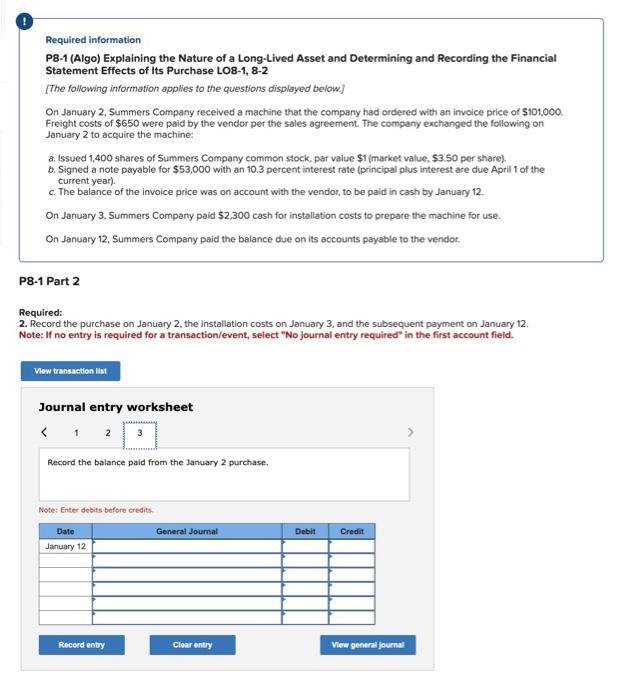

Required information P8-1 (Algo) Explaining the Nature of a Long-Lived Asset and Determining and Recording the Financial Statement Effects of Its Purchase LO8-1, 8-2 [The following information applies to the questions displayed below] On January 2, Summers Company received a machine that the company had ordered with an invoice price of $101,000. Freight costs of $650 were paid by the vendor per the saies agreement. The company exchanged the following on January 2 to acquire the machine: a. Issued 1,400 shares of Summers Company common stock, par value $1 (market value, $3.50 per share). b. Signed a note payable for $53,000 with an 10.3 percent interest rate (principal plus interest are due April 1 of the current year). c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12. On January 3, Summers Company paid \$2,300 cash for installation costs to prepare the machine for use. On January 12, Summers Company paid the balance due on its accounts payable to the vendor. P8-1 Part 2 Required: 2. Record the purchase on January 2 , the installation costs on January 3, and the subsequent payment on January 12. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 3 Record the purchase of equipment. Note: Enter debits before eredits. Required information P8-1 (Algo) Explaining the Nature of a Long-Lived Asset and Determining and Recording the Financial Statement Effects of Its Purchase LO8-1, 8-2 [The following information applies to the questions displayed below.] On January 2, Summers Company received a machine that the company had ordered with an invoice price of $101,000. Freight costs of $650 were paid by the vendor per the sales agreement. The company exchanged the following on January 2 to acquire the machine: a. Issued 1,400 shares of Summers Company common stock, par value $1 (market value, $3.50 per share). b. Signed a note payable for $53,000 with an 10.3 percent interest rate (principal plus interest are due April 1 of the current year). c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12. On January 3, Summers Company paid $2,300 cash for installation costs to prepare the machine for use. On January 12, Summers Company paid the balance due on its accounts payable to the vendor. P8-1 Part 2 Required: 2. Record the purchase on January 2 , the installation costs on January 3, and the subsequent payment on January 12. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 1 3 Record the installation costs on January 3. Note: Enter debits before credits. Required information P8-1 (Algo) Explaining the Nature of a Long-Lived Asset and Determining and Recording the Financial Statement Effects of Its Purchase LO8-1, 8-2 (The following information applies to the questions displayed below.] On January 2, Summers Company received a machine that the company had ordered with an invoice price of $101,000. Freight costs of $650 were paid by the vendor per the sales agreement. The company exchanged the following on January 2 to acquire the machine: a. Issued 1,400 shares of Summers Company common stock, par value $1 (market value, $3.50 per share). b. Signed a note payable for $53,000 with an 10.3 percent interest rate (principal plus interest are due April 1 of the current year). c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12. On January 3, Summers Company paid $2,300 cash for installation costs to prepare the machine for use. On January 12, Summers Company paid the balance due on its accounts payable to the vendor. P8-1 Part 2 Required: 2. Record the purchase on January 2, the installation costs on January 3, and the subsequent payment on January 12. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 12 Record the balance paid from the January 2 purchase. Note: Enter debits before credits