Question

2021 FEDERAL TAXATION CLASS Chapter 9: Withholding, Estimated Payments, and Retirement Plans Please address the following: Eric, your friend, received his Form W-2 from his

2021 FEDERAL TAXATION CLASS

Chapter 9: Withholding, Estimated Payments, and Retirement Plans

Please address the following:

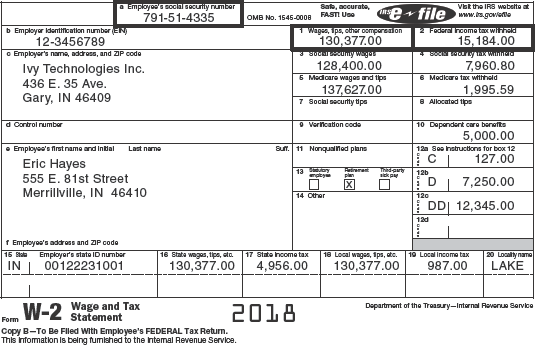

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Erics 2020 salary was $145,000 and he does not understand why the amounts in Boxes 1, 3 and 5 are not $145,000? His final paycheck for the year included the following information:

- Eric contributed 5 percent of his salary to the company 401(k) plan on a pre-tax basis.

- Eric is married with two children. He had $5,000 deducted from his wages for a Dependent Care Flexible Spending Account.

- Eric is enrolled in the company-sponsored life insurance program. He has a policy that provides a benefit of $145,000.

- Eric contributed $2,500 to the Health Care Flexible Spending Account (he keeps forgetting that the maximum deferral has increased over the years).

Using the information and Erics Form W-2, explain to Eric the reconciling of his salary of $145,000 to the amounts in Boxes 1, 3, and 5.

Please be sure to include at least one APA formatted references for your initial post. Always begin with your eText for a first source of information. This means that your eText will always be included as a reference in each initial post for each discussion board this semester. Also, please be sure to reference any IRS web addresses used.

Please check your initial post for comments or questions from me and be sure to provide a comprehensive response, as requested.

You are required to enter a minimum of three meaningful posts for full credit for the weekly discussions. These will include your initial post, your response to me, and a response to at least one classmate. If you enter your initial post late on Saturday, it's possible that I may not be able to provide any comments to your thread. If that is the case, please meet your minimum number of posts by responding to at least two classmates. I encourage you enter your initial post to the weekly discussion boards as early in the week as possible. This allows your hard work to be read by your classmates. Additionally, posting early in the week gives you the time needed to develop thoughtful initial posts that will likely earn the maximum number of points.

Please include information about self-employed individuals and the self-employment tax from Chapter 9 in your eText in responses to classmates.

a Employee socially number 791-51-4335 b Employer Identification number EN 12-3456789 Employer's name, address, and ZIP code Ivy Technologies Inc. 436 E. 35 Ave. Gary, IN 46409 Sato, accurate, Visit the IRS website at WS OMB No. 1545-0003 FASTI U e file www.lrs.gowerte 1 Wages, 1p, Ciner comprendon 2 Ferncome tax with 130,377.00 15,184.00 3 cmy wegd Minnea 128,400.00 7,960.80 5 Medicare wages and tips 6 Medicare tax withheld 137,627.00 1,995.59 7 Social securtty tips 8 Allocated lips d Control rumber o Vernication code Sun.11 Nonqualified plans . Employee's first name and Intial Last name Eric Hayes 555 E. 81st Street Merrillville, IN 46410 13 Ant TO pler lepy 10 Dependent care benefts 5,000.00 12 See Instructions for box 12 127.00 12b 7,250.00 120 DD 12,345.00 12d 14 Other f Employee's address and ZIP code 15 Sale Employer's state ID number 17 State Income tax IN | 00122231001 16 Stata wegas, tips, sto. 130,377.00 4,956.00 18 Local wages, Ips, etc. 130,377.00 10 Local income tax 987.00 20 Losatyna LAKE Department of the Treasury-Internal Revenue Service Fem W-2 Wage and Tax 2018 Statement Copy B-To Be Flled with Employee's FEDERAL Tax Return This information is being fumished to the Internal Revenue Service. a Employee socially number 791-51-4335 b Employer Identification number EN 12-3456789 Employer's name, address, and ZIP code Ivy Technologies Inc. 436 E. 35 Ave. Gary, IN 46409 Sato, accurate, Visit the IRS website at WS OMB No. 1545-0003 FASTI U e file www.lrs.gowerte 1 Wages, 1p, Ciner comprendon 2 Ferncome tax with 130,377.00 15,184.00 3 cmy wegd Minnea 128,400.00 7,960.80 5 Medicare wages and tips 6 Medicare tax withheld 137,627.00 1,995.59 7 Social securtty tips 8 Allocated lips d Control rumber o Vernication code Sun.11 Nonqualified plans . Employee's first name and Intial Last name Eric Hayes 555 E. 81st Street Merrillville, IN 46410 13 Ant TO pler lepy 10 Dependent care benefts 5,000.00 12 See Instructions for box 12 127.00 12b 7,250.00 120 DD 12,345.00 12d 14 Other f Employee's address and ZIP code 15 Sale Employer's state ID number 17 State Income tax IN | 00122231001 16 Stata wegas, tips, sto. 130,377.00 4,956.00 18 Local wages, Ips, etc. 130,377.00 10 Local income tax 987.00 20 Losatyna LAKE Department of the Treasury-Internal Revenue Service Fem W-2 Wage and Tax 2018 Statement Copy B-To Be Flled with Employee's FEDERAL Tax Return This information is being fumished to the Internal Revenue ServiceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started