Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2021 tax year In January. Jan and Morris, who file a joint tax return, took out a $900,000 mortgage to purchase their primary residence. They

2021 tax year

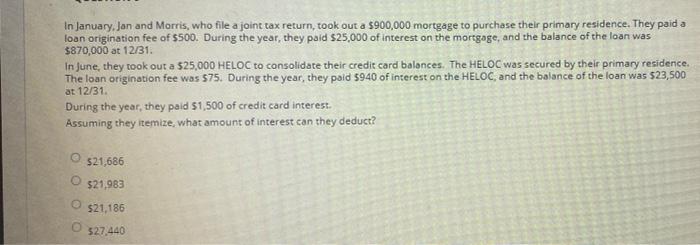

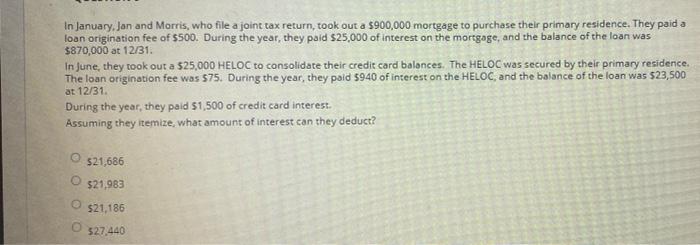

In January. Jan and Morris, who file a joint tax return, took out a $900,000 mortgage to purchase their primary residence. They paid a loan origination fee of $500. During the year, they paid $25,000 of interest on the mortgage, and the balance of the loan was $870,000 at 12/31 In June, they took out a $25,000 HELOC to consolidate their credit card balonces. The HELOC was secured by their primary residence The loan origination fee was 575. During the year, they paid 5940 of interest on the HELOC, and the balance of the loan was $23,500 at 12/31 During the year, they paid $1,500 of credit card interest Assuming they itemize, what amount of interest can they deduct? $21,686 $21.983 $21,186 527,440

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started