Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2021 tax year Kathy is a single taxpayer. She had the following unreimbursed medical expenses for 2021: $5,000 of medical expenses related to an auto

2021 tax year

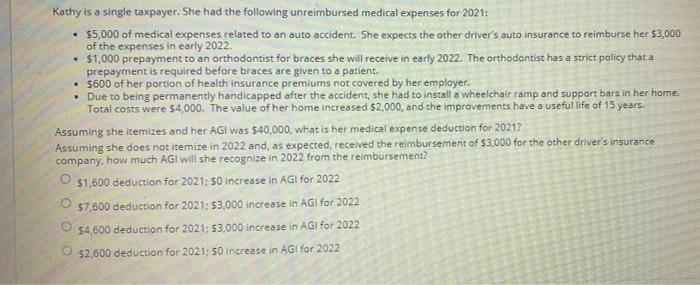

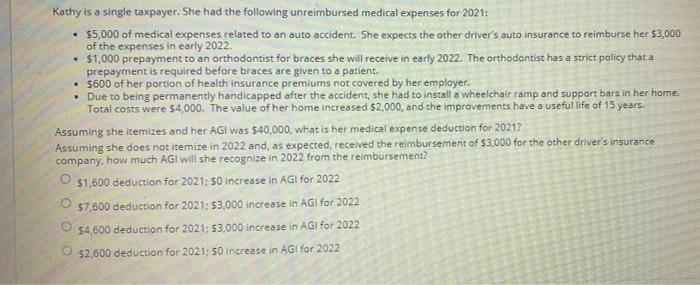

Kathy is a single taxpayer. She had the following unreimbursed medical expenses for 2021: $5,000 of medical expenses related to an auto accident. She expects the other driver's auto insurance to reimburse her $3,000 of the expenses in early 2022. $1,000 prepayment to an orthodontist for braces she will receive in early 2022. The orthodontist has a strict policy that a prepayment is required before braces are given to a patient. $600 of her portion of health insurance premiums not covered by her employer. . Due to being permanently handicapped after the accident, she had to install a wheelchair ramp and support bars in her home. Total costs were $4,000. The value of her home increased $2,000, and the improvements have a useful life of 15 years. Assuming she itemizes and her AG was 540,000, what is her medical expense deduction for 2021? Assuming she does not itemize in 2022 and, as expected, received the reimbursement of $3,000 for the other driver's insurance company, how much AG will she recognize in 2022 from the reimbursement? $1,600 deduction for 2021; 50 increase in AG for 2022 57,600 deduction for 2021: $3,000 increase in AGI for 2022 54,600 deduction for 2021: $3,000 increase in AGI for 2022 52,600 deduction for 2021: 50 increase in AG for 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started