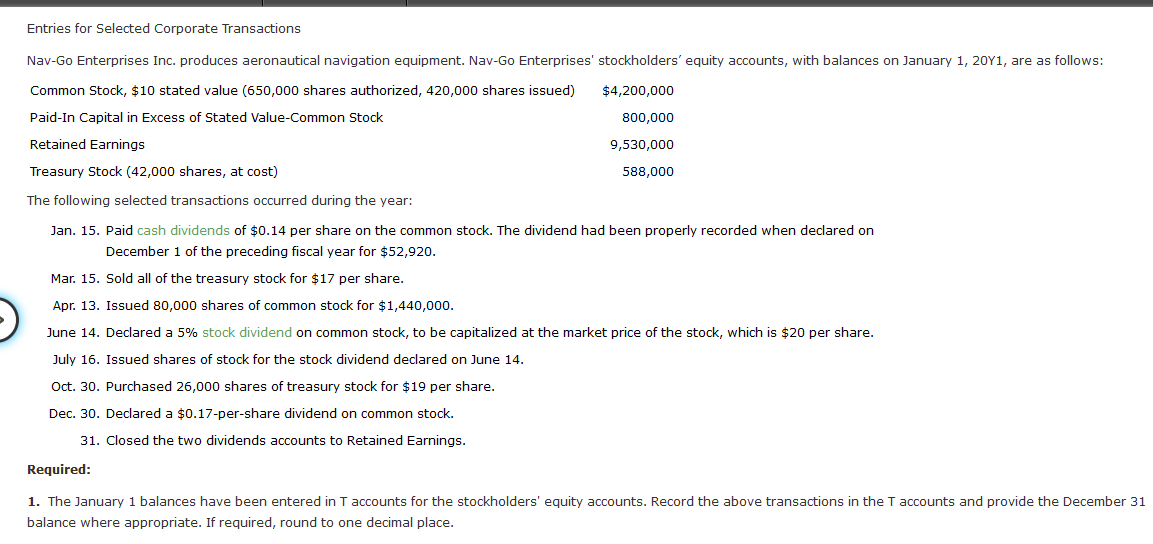

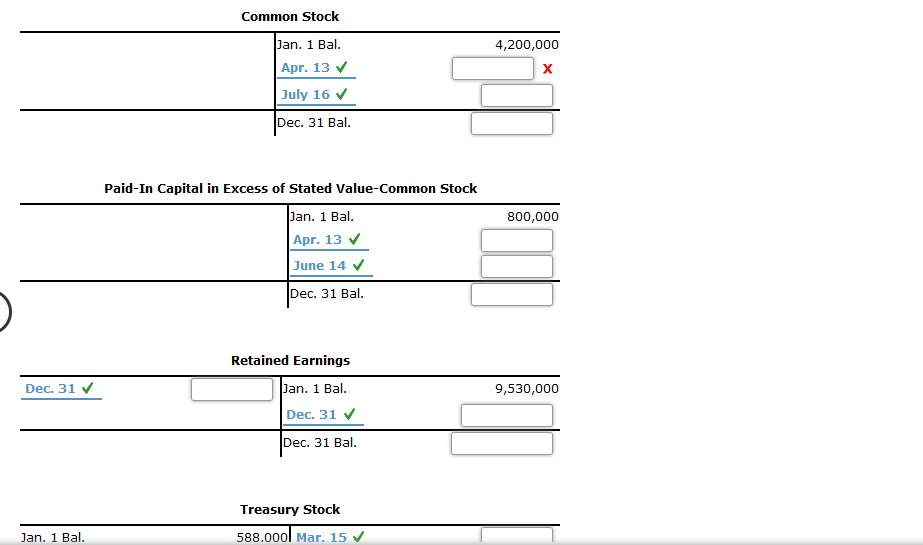

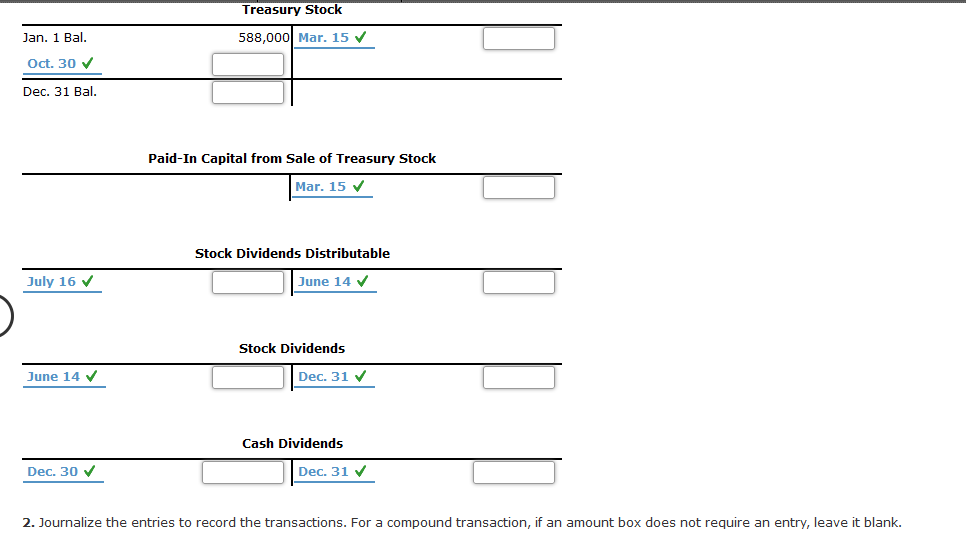

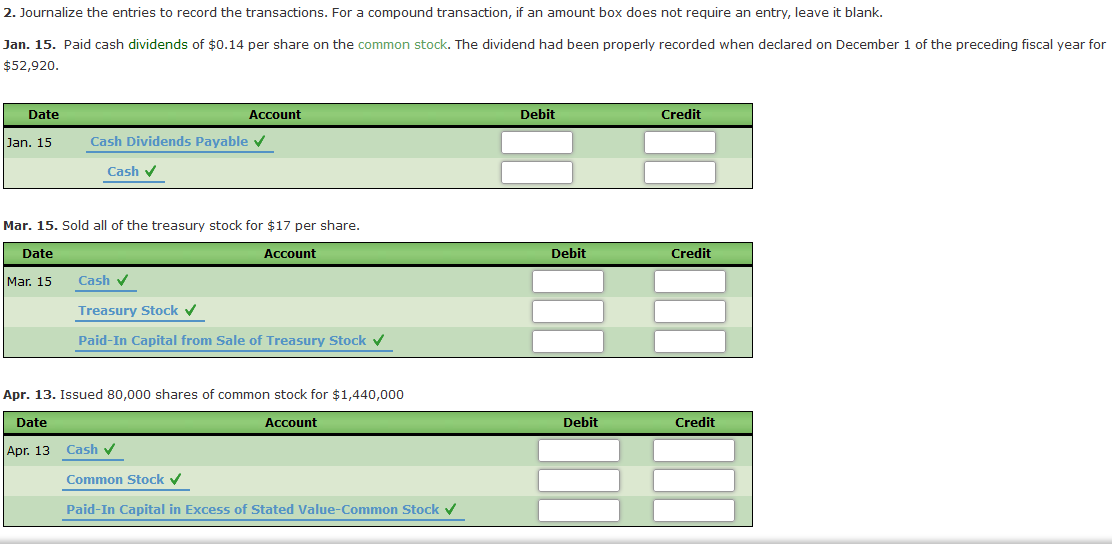

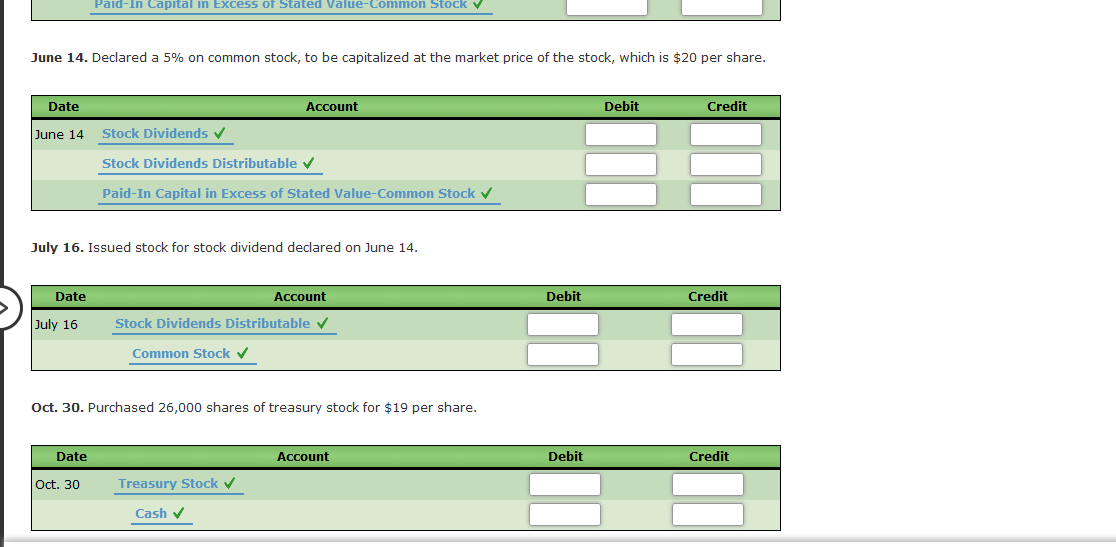

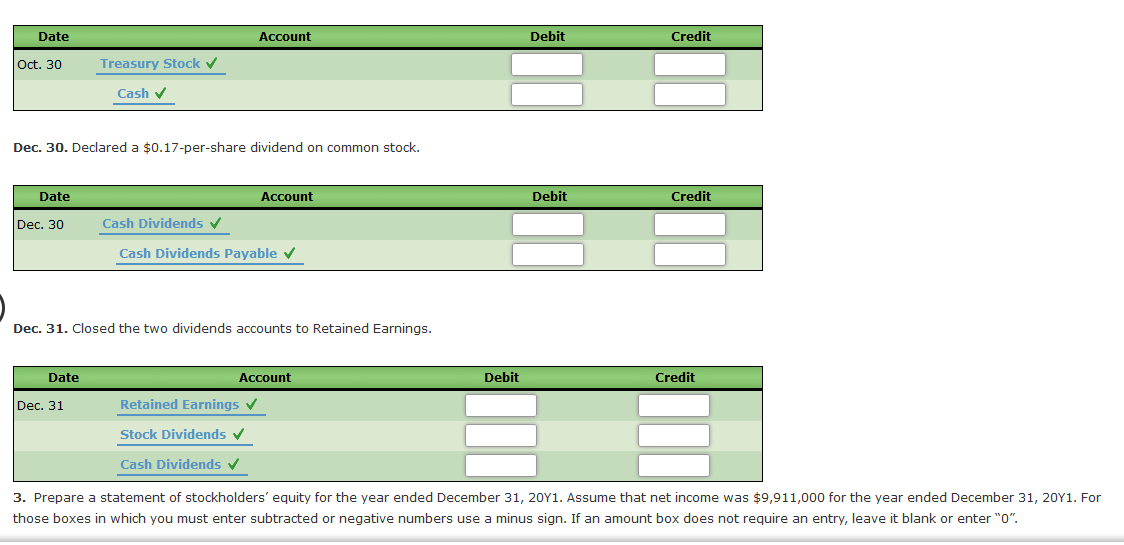

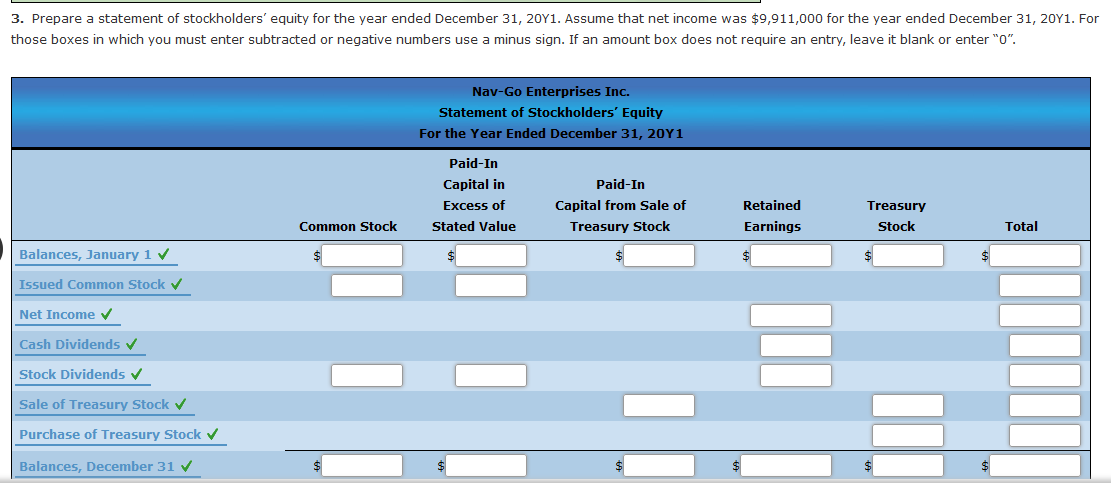

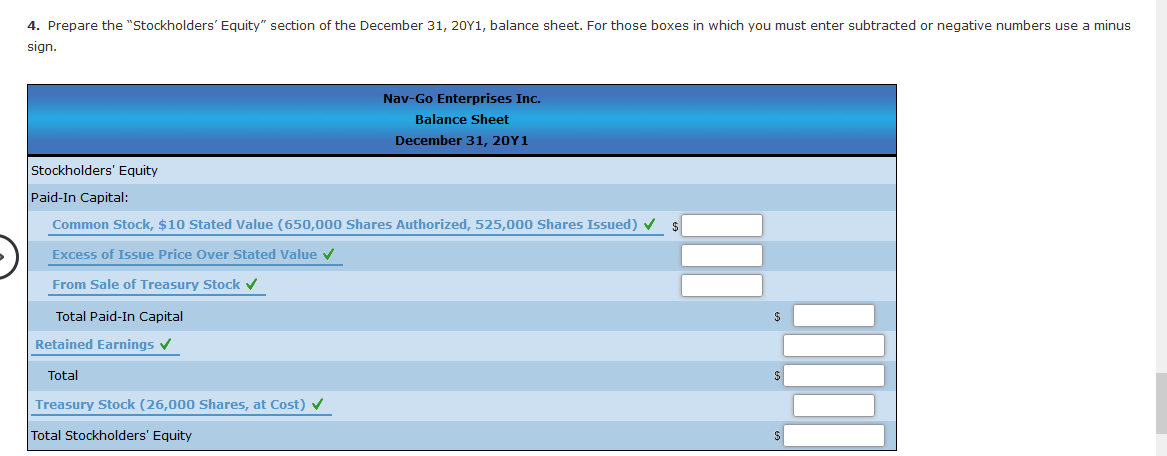

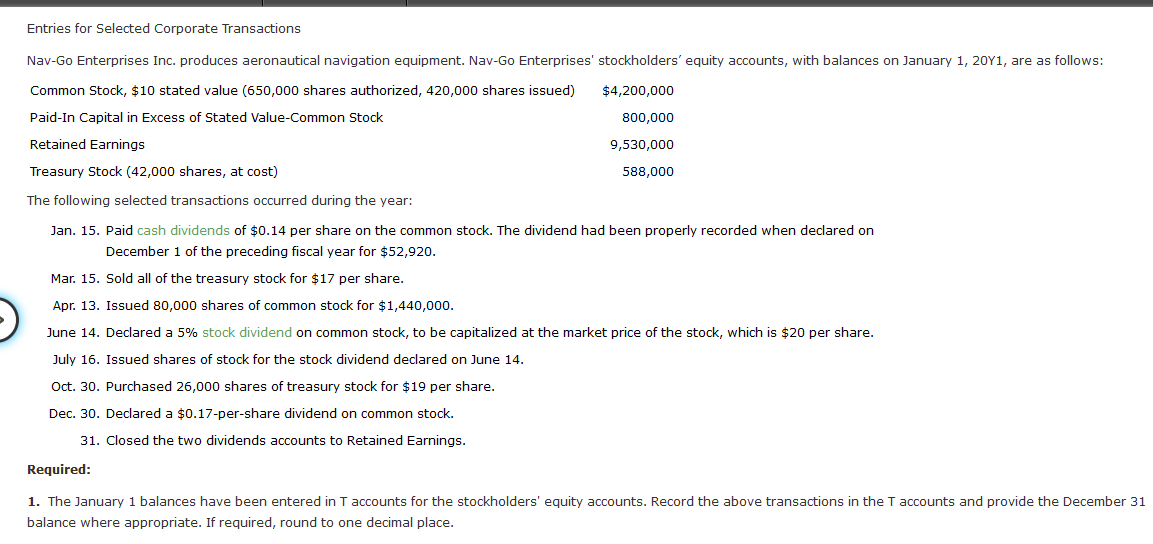

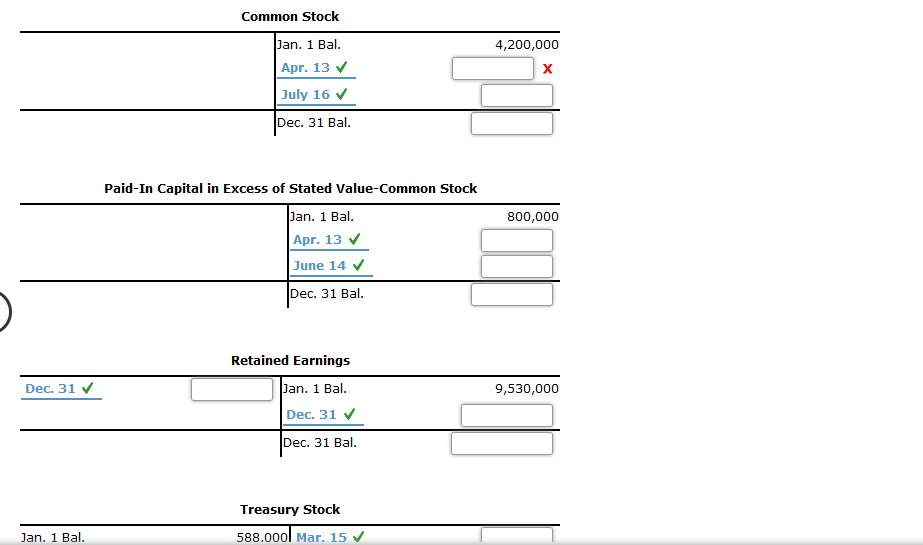

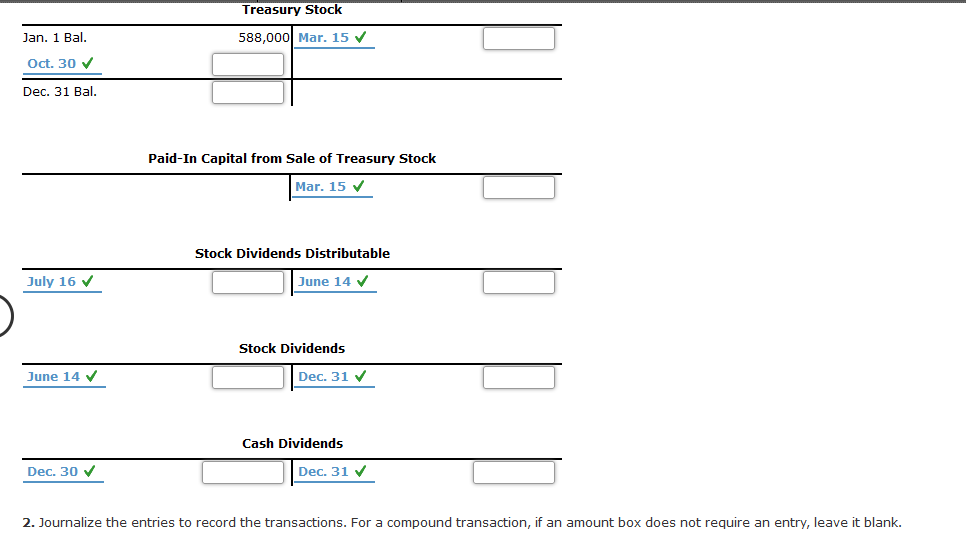

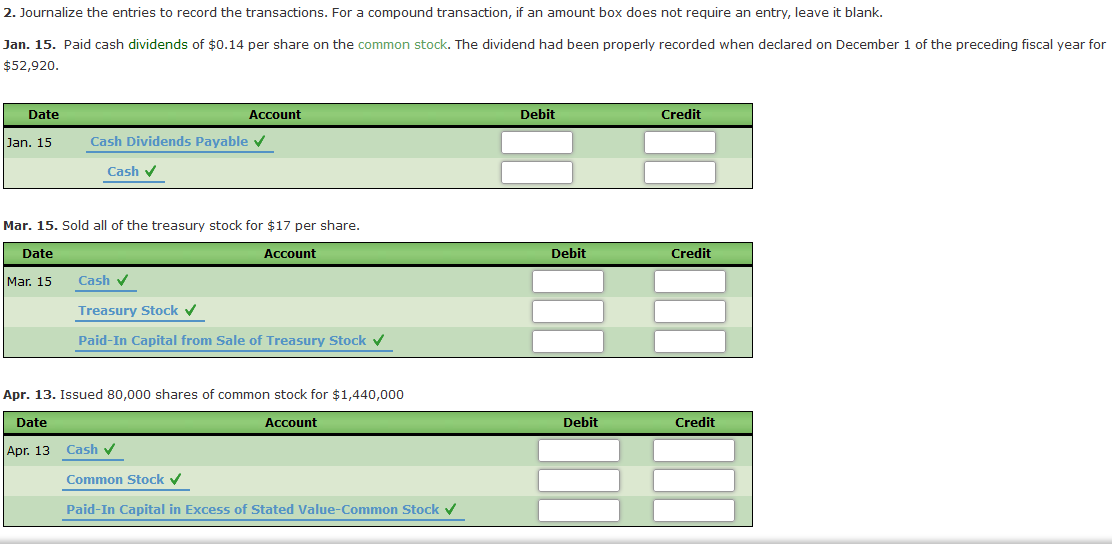

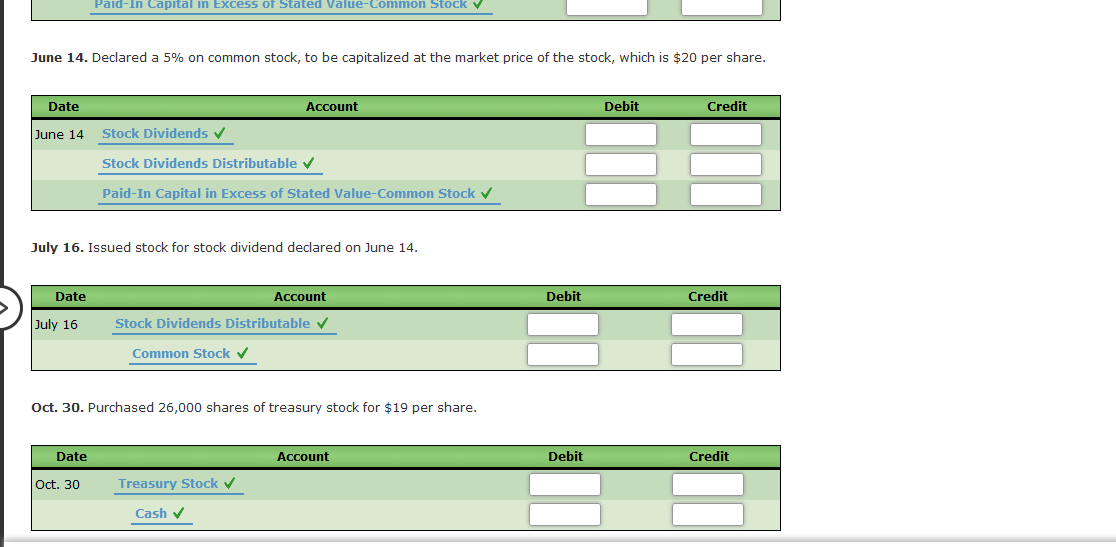

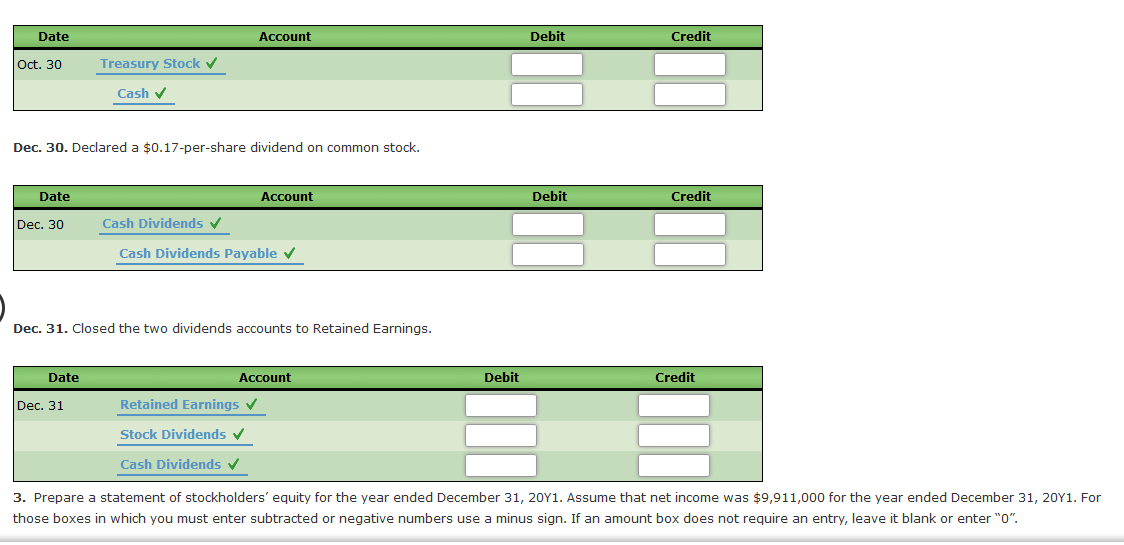

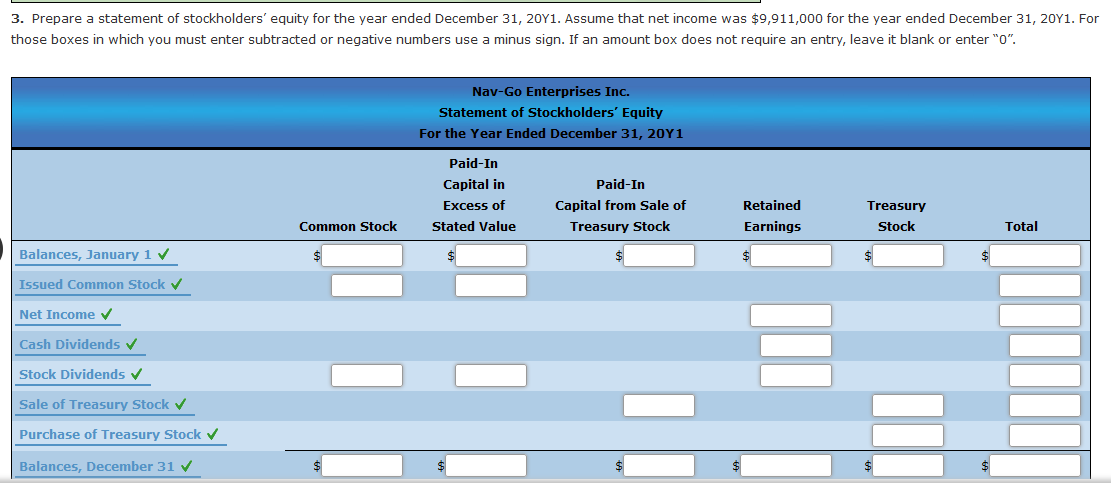

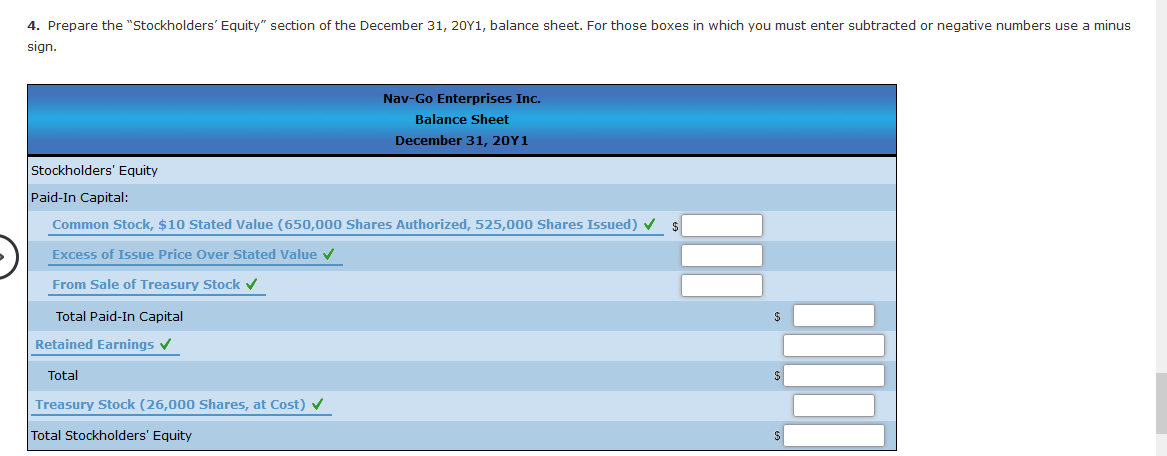

Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: $4,200,000 Common Stock, $10 stated value (650,000 shares authorized, 420,000 shares issued) Paid-In Capital in Excess of Stated Value-Common Stock Retained Earnings 800,000 9,530,000 Treasury Stock (42,000 shares, at cost) 588,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $52,920. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 80,000 shares of common stock for $1,440,000. June 14. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 26,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.17-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Required: 1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T accounts and provide the December 31 balance where appropriate. If required, round to one decimal place. Common Stock 4,200,000 Jan. 1 Bal. Apr. 13 X July 16 Dec. 31 Bal. 800,000 Paid-In Capital in Excess of Stated Value-Common Stock Jan. 1 Bal. Apr. 13 June 14 Dec. 31 Bal. Retained Earnings Dec. 31 9,530,000 Jan. 1 Bal. Dec. 31 Dec. 31 Bal. Treasury Stock 588.000l Mar. 15 Jan. 1 Bal. Treasury Stock Jan. 1 Bal. 588,000 Mar. 15 Oct. 30 V Dec. 31 Bal. Paid-In Capital from Sale of Treasury Stock Mar. 15 Stock Dividends Distributable July 16 June 14 Stock Dividends June 14 Dec. 31 Cash Dividends Dec. 30 V Dec. 31 2. Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. 2. Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $52,920. Date Account Debit Credit Jan. 15 Cash Dividends Payable Cash Mar. 15. Sold all of the treasury stock for $17 per share. Date Account Debit Credit Mar. 15 Cash Treasury Stock Paid-In Capital from Sale of Treasury Stock Apr. 13. Issued 80,000 shares of common stock for $1,440,000 Date Account Debit Credit Apr. 13 Cash Common Stock Paid-In Capital in Excess of Stated Value-Common Stock Paid-In Capital in Excess of Stated Value-Common Stock June 14. Declared a 5% on common stock, to be capitalized at the market price of the stock, which is $20 per share. Date Account Debit Credit June 14 Stock Dividends Stock Dividends Distributable Paid-In Capital in Excess of Stated Value-Common Stock July 16. Issued stock for stock dividend declared on June 14. Date Account Debit Credit July 16 Stock Dividends Distributable Common Stock Oct. 30. Purchased 26,000 shares of treasury stock for $19 per share. Date Account Debit Credit Oct. 30 Treasury Stock Cash II Date Account Debit Credit Oct. 30 Treasury Stock II Cash Dec. 30. Declared a $0.17-per-share dividend on common stock. Date Account Debit Credit Dec. 30 Cash Dividends Cash Dividends Payable Dec. 31. Closed the two dividends accounts to Retained Earnings. Date Account Debit Credit Dec. 31 Retained Earnings Stock Dividends III Cash Dividends 3. Prepare a statement of stockholders' equity for the year ended December 31, 20Y1. Assume that net income was $9,911,000 for the year ended December 31, 2011. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount box does not require an entry, leave it blank or enter "o". 3. Prepare a statement of stockholders' equity for the year ended December 31, 20Y1. Assume that net income was $9,911,000 for the year ended December 31, 20Y1. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount box does not require an entry, leave it blank or enter "0". Nav-Go Enterprises Inc. Statement of Stockholders' Equity For the Year Ended December 31, 2011 Paid-In Paid-In Capital in Excess of Stated Value Capital from Sale of Treasury Stock Retained Earnings Treasury Stock Common Stock Total Balances, January 1 Issued Common Stock Net Income Cash Dividends Stock Dividends Sale of Treasury Stock Purchase of Treasury Stock Balances, December 31 4. Prepare the "Stockholders' Equity" section of the December 31, 20Y1, balance sheet. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Nav-Go Enterprises Inc. Balance Sheet December 31, 20Y1 Stockholders' Equity Paid-In Capital: Common Stock, $10 Stated Value (650,000 Shares Authorized, 525,000 Shares Issued) $ Excess of Issue Price Over Stated Value From Sale of Treasury Stock $ Total Paid-In Capital Retained Earnings Total Treasury Stock (26,000 Shares, at Cost) Total Stockholders' Equity $