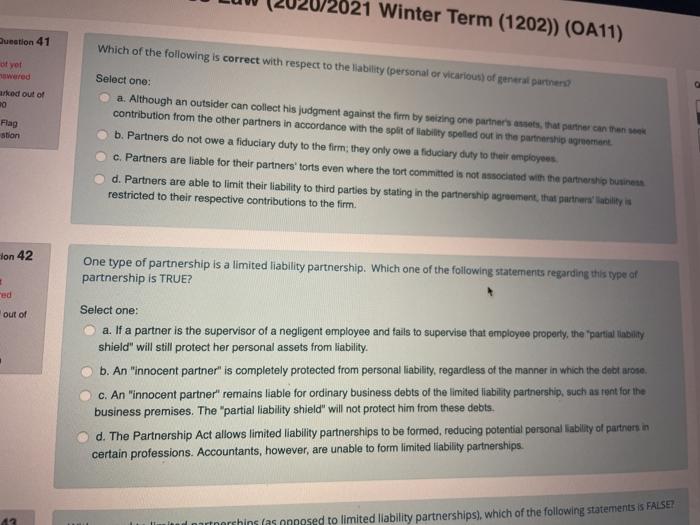

2021 Winter Term (1202)) (OA11) Question 41 Which of the following is correct with respect to the liability (personal or vicarious) of general partners of yol wered arked out of Flap stion Select one: a. Although an outsider can collect his judgment against the firm by seizing one partner's assets, that partner can then contribution from the other partners in accordance with the split of liabilty spelled out in the partnership agreement b. Partners do not owe a fiduciary duty to the firm; they only owe a fiduciary duty to their employees c. Partners are liable for their partners forts even where the tort committed is not associated with the partnership business d. Partners are able to limit their liability to third parties by stating in the partnership agreement, that partners ability is restricted to their respective contributions to the firm. Hon 42 One type of partnership is a limited liability partnership. Which one of the following statements regarding this type of partnership is TRUE? ed out of Select one: a. If a partner is the supervisor of a negligent employee and fails to supervise that employee property, the partial ability shield" will still protect her personal assets from liability. b. An "innocent partner" is completely protected from personal liability, regardless of the manner in which the debt arose. c. An "innocent partner" remains liable for ordinary business debts of the limited liability partnership, such as rent for the business premises. The "partial liability shield" will not protect him from these debts. d. The Partnership Act allows limited liability partnerships to be formed, reducing potential personal ability of partners in certain professions. Accountants, however, are unable to form limited liability partnerships 42 partnershins fasonposed to limited liability partnerships), which of the following statements is FALSE? With regard to limited partnerships (as opposed to limited liability partnerships), which of the following statements is FALSE? Select one: a. A limited partner has unlimited liability for the debts of the firm. b. A limited partnership is formed once a certificate is completed by the partners and is registered by the Registrar. c. A limited partnership is an arrangement in which a partner may limit his liability to his capital contribution, in other words, his investment d. A limited partner who takes an active part in the management of the firm loses the protection of being a limited partner and becomes liable for the firm's losses together with the other general partners. Kelly and her mother have decided to open a pizzeria. As Kelly's mother is very wealthy, she is concerned about personal liability. You therefore advise her to consider creating a limited partnership. If Kelly's mother does become a limited partner, which of the following could she do, without becoming personally liable for the debts of the business? Select one: a. Participate in the management of the business. b. Contribute $10,000 to the business. c. Contribute services to the business. d. Insist that the pizzeria be named after her. Which one of the following statements regarding Alberta corporations is FALSE? Catal