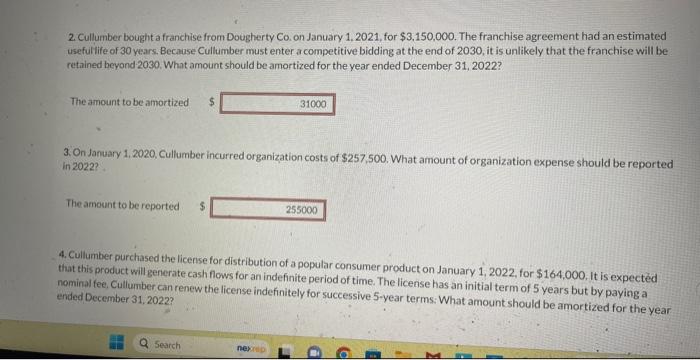

2030. What amount should be amortize The amount to be amortized 3 3. On January 1, 2020, Cullumber incurred organization c in 2022? The amount to be reported

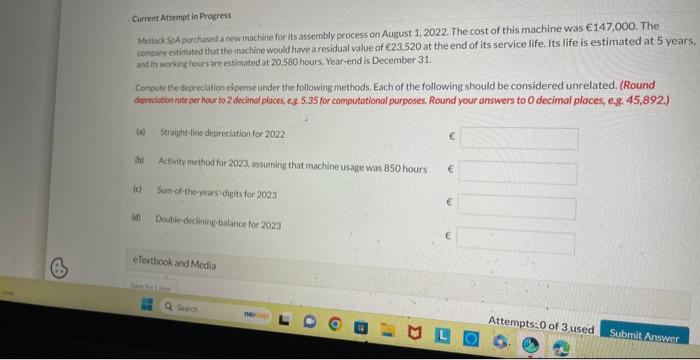

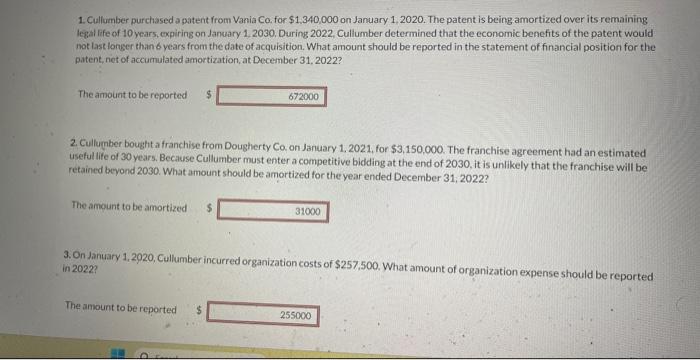

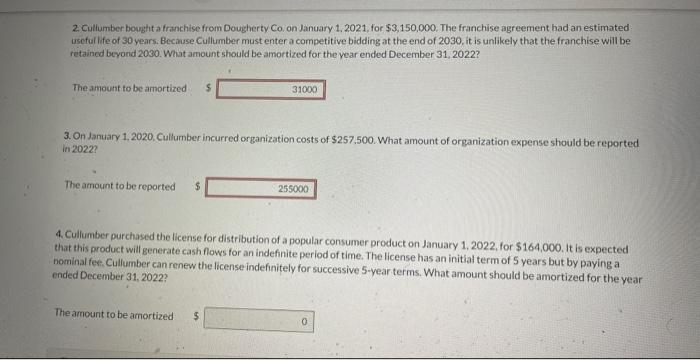

The amount to be amortized 3. On January 1,2020 , Cullumber incurred organization in 2022? Current Attempt in Progress Metod SoA purchased a now machine for its assembly process on August 1, 2022. The cost of this machine was 147,000. The company etimated that the machine would have a residual value of 623,520 at the end of its service life. Its life is estimated at 5 years and it working hours areestimated at 20,580 hours Year-end is December 31. Compote the depreciation espense under the following methods. Each of the following should be considered unrelated. (Round dexredation rate per hour to 2 decimal places, es 5.35 for computational purposes. Round your answers to 0 decimal places, e.8. 45.892.) 1. Cullumber purchased a patent from Vania Co, for $1,340,000 on January 1, 2020. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1,2030. During 2022. Cullumber determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the statement of financial position for the patent, net of accumulated amortization, at December 31, 2022? The amount to be reported 2. Cullughber bought a franchise from Dougherty Ca on January 1, 2021, for $3,150,000. The franchise agreement had an estimated useful life of 30 years. Because Cullumber must enter a competitive bidding at the end of 2030 , it is unlikely that the franchise will be retained beyond 2030. What amount should be amortized for the year ended December 31; 2022? The amount to be amortized in 2022? The amount to be reported 2. Cullumber bought a franchise from Dougherty Co on January 1,2021 , for $3,150,000. The franchise agreement had an estimated uscful ife of 30 years. Beciuse. Cullumber must enter a competitive bidding at the end of 2030 , it is unlikely that the franchise will be retained beyond 2030. What amount should be amortized for the vear ended December 31, 2022? The amount to be amortized 3. On January 1,2020, Cullumber incurred organization cost5 of $257.500. What amount of organization expense should be reported in 2022 ? The amount to be reported $ 4. Cullumber purchased the license for distribution of a popular consumer product on January 1,2022, for $164,000. It is expected that this product will generate cash flows for an indefinite period of time. The license has an initlal term of 5 years but by paying a nominal fer: Cullumber can renew the license indefinitely for successive 5 -year terms. What amount should be amortized for the year ended December 31, 2022? The amount to be amortized 2. Cullumber bought a franchise from Dougherty Co. on January 1, 2021, for $3,150,000. The franchise agreement had an estimated usefullife of 30 years. Because Cullumber must enter a competitive bidding at the end of 2030 , it is unlikely that the franchise will be retained beyond 2030. What amount should be amortized for the year ended December 31, 2022? The amount to be amortized 3. On January 1,2020, Cullumber incurred organization costs of $257,500. What amount of organization expense should be reported in 2022? The amount to be reported $ 4. Cullumber purchased the license for distribution of a popular consumer product on January 1,2022, for $164,000, It is expected that this product will generate cash flows for an indefinite period of time. The license has an initial term of 5 years but by paying a nominal fee, Cullumber can renew the license indefinitely for successive 5 -year terms: What amount should be amortized for the year ended December 31,2022