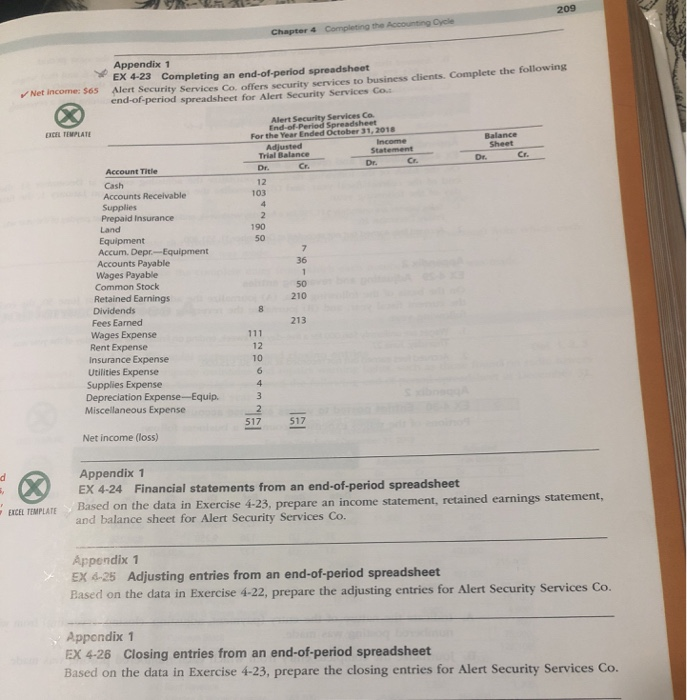

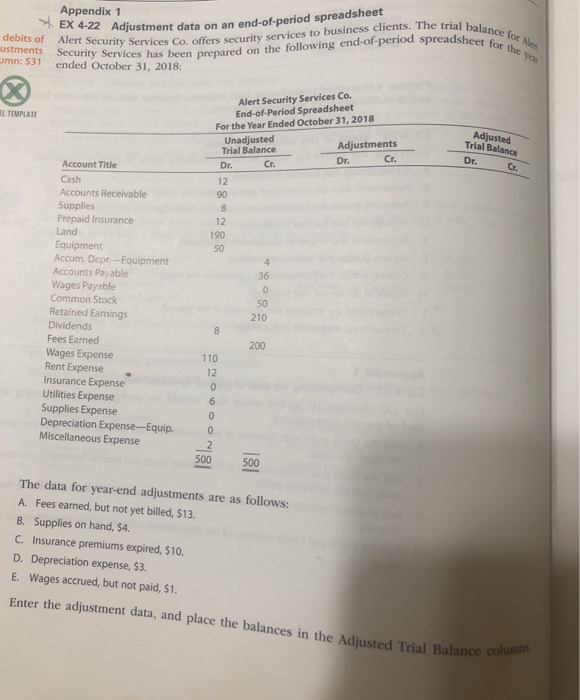

209 Completing the Accounting Cycle Chapter 4 Appendix 1 EX 4-23 Completing an end-of-period spreadsheet Alert Security Services Co. offers security services to business clients. Complete the following end-of-period spreadsheet for Alert Security Services Co Net income: $65 Alert Security Services Co End-of Period Spreadsheet For the Year Ended October 31, 2018 Income Statement EXCEL TEMPLATE Balance Adjusted Trial Balance Sheet Cr. Dr. Cr. Dr. Cr. Account Title Dr. Cash 12 Accounts Receivable 103 Supplies Prepaid Insurance Land 4 2 190 Equipment Accum. Depr-Equipment Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Insurance Expense Utilities Expense Supplies Expense Depreciation Expense-Equip. Miscellaneous Expense 50 7 36 50 210 213 111 12 10 6 4 2 517 517 Net income (loss) Appendix 1 EX 4-24 Financial statements from an X end-of-period spreadsheet Based on the data in Exercise 4-23, prepare an income statement, retained earnings statement, and balance sheet for Alert Security Services Co. EXCEL TEMPLATE Appendix 1 EX 4-25 Adjusting entries from an Based on the data in Exercise 4-22, prepare the adjusting entries for Alert Security Services Co. end-of-period spreadsheet Appondix 1 EX 4-26 Closing entries from an end-of-period spreadsheet Based on the data in Exercise 4-23, prepare the closing entries for Alert Security Services Co. Appendix 1 EX 4-22 Adjustment data on an end-of-period spreadsheet Alert Security Services Co. offers security services to business clients. The trial balance for Men Security Services has been prepared on the following end-of-period spreadsheet for the year debits of ustments umn: $31 ended October 31, 2018: Alert Security Services Co. End-of-Period Spreadsheet For the Year Ended October 31, 2018 Unadjusted Trial Balance EL TEMPLATE Adjusted Trial Balance Adjustments Cr. Dr. Dr. Cr. Cr. Dr. Account Title 12 Cash 90 Accounts Receivable 8 Supplies Prepaid Insurance 12 190 Land Equipment Accum. Depr-Equipment Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Insurance Expense Utilities Expense Supplies Expense Depreciation Expense-Equip. Miscellaneous Expense 50 4 36 50 210 8 200 110 12 2 500 500 The data for year-end adjustments are as follows: A. Fees earned, but not yet billed, $13. B. Supplies on hand, $4. C. Insurance premiums expired, $10. D. Depreciation expense, $3. Wages accrued, but not paid, $1. E. Enter the adjustment data, and place the balances in the Adjusted Trial Balance columns