Question

(20pts) A gasoline distributor had 110,000 gallons of gasoline valued at $2.35/gallon. They bought 120,000 more gallons at $2.45/gallon, and subsequenly 100,000 more gallons

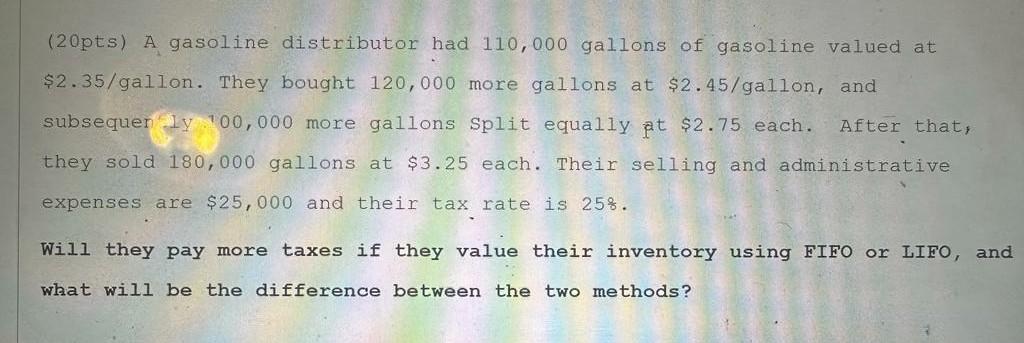

(20pts) A gasoline distributor had 110,000 gallons of gasoline valued at $2.35/gallon. They bought 120,000 more gallons at $2.45/gallon, and subsequenly 100,000 more gallons Split equally at $2.75 each. After that, they sold 180,000 gallons at $3.25 each. Their selling and administrative expenses are $25,000 and their tax rate is 25%. Will they pay more taxes if they value their inventory using FIFO or LIFO, and what will be the difference between the two methods?

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the gasoline distributor will pay more taxes using FIFO or LIFO we must compute the cost of goods sold COGS using each method FIF...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting in Canada

Authors: Hilton Murray, Herauf Darrell

8th edition

1259087557, 1057317623, 978-1259087554

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App