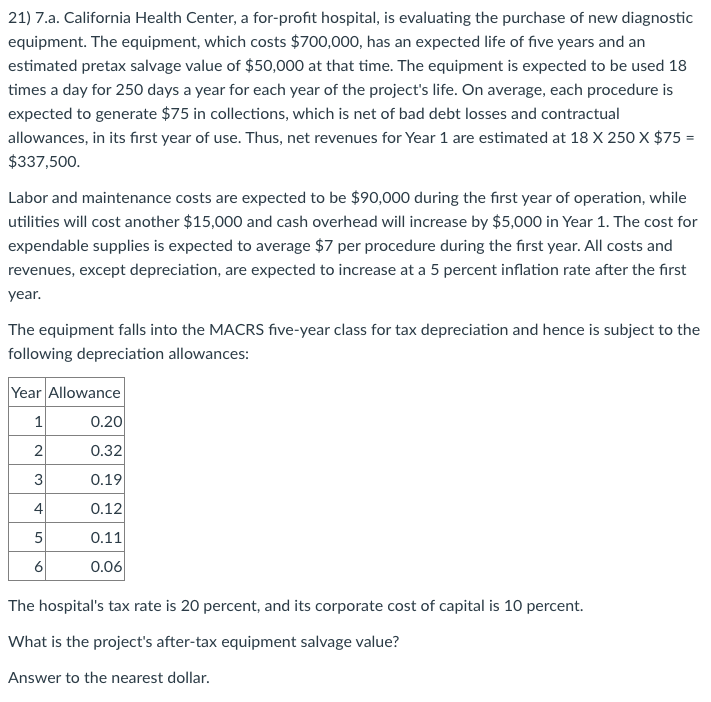

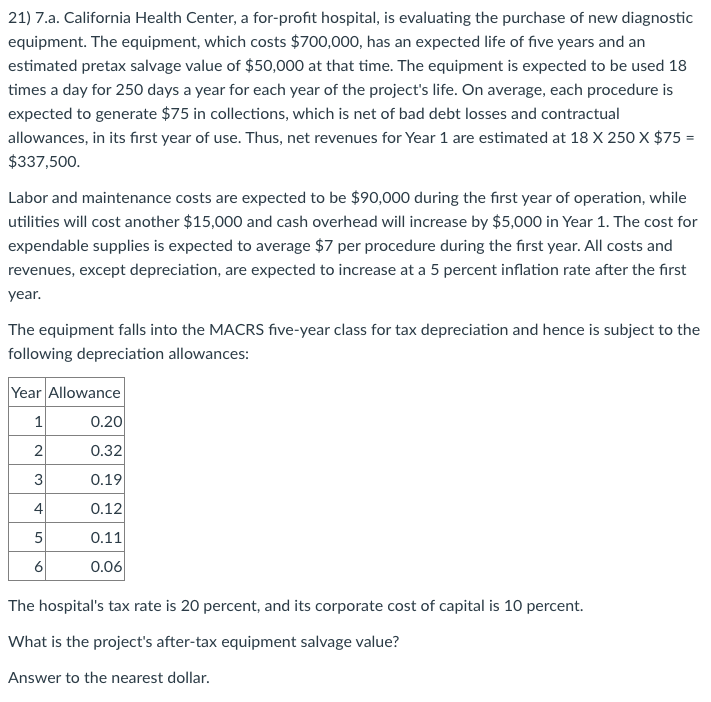

21) 7.a. California Health Center, a for-profit hospital, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $700,000, has an expected life of five years and an estimated pretax salvage value of $50,000 at that time. The equipment is expected to be used 18 times a day for 250 days a year for each year of the project's life. On average, each procedure is expected to generate $75 in collections, which is net of bad debt losses and contractual allowances, in its first year of use. Thus, net revenues for Year 1 are estimated at 18 X 250 X $75 = $337,500. Labor and maintenance costs are expected to be $90,000 during the first year of operation, while utilities will cost another $15,000 and cash overhead will increase by $5,000 in Year 1. The cost for expendable supplies is expected to average $7 per procedure during the first year. All costs and revenues, except depreciation, are expected to increase at a 5 percent inflation rate after the first year. The equipment falls into the MACRS five-year class for tax depreciation and hence is subject to the following depreciation allowances: Year Allowance 1 0.20 N 2 0.32 3 0.19 4 0.12 5 0.11 6 0.06 The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 percent. What is the project's after-tax equipment salvage value? Answer to the nearest dollar. 22) 7.b. Using the information in the previous question, what is the project's net cash flow at date 02 Answer to the nearest dollar. Question 23 1 pts 23) 7.c. Using the information in the previous questions, what is the project's net cash flow at date 1? Answer to the nearest dollar. Question 24 1 pts 24) 7.d. Using the information in the previous questions, what is the project's net cash flow at date 2? Answer to the nearest dollar. 25) 7.e. Using the information in the previous questions, what is the project's net cash flow at date 3? Answer to the nearest dollar. Question 26 1 pts 26) 7.f. Using the information in the previous questions, what is the project's net cash flow at date 4? Answer to the nearest dollar. Question 27 1 pts 27) 7.g. Using the information in the previous questions, what is the project's net cash flow at date 5? Answer to the nearest dollar. 28) 7.h. Given your answers to the previous questions, what is the project's NPV? Answer to the nearest dollar. Question 29 29) 7.i. Given your answers to the previous questions, what is the project's IRR? Type your answer as a percentage. Round to one decimal place. 21) 7.a. California Health Center, a for-profit hospital, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $700,000, has an expected life of five years and an estimated pretax salvage value of $50,000 at that time. The equipment is expected to be used 18 times a day for 250 days a year for each year of the project's life. On average, each procedure is expected to generate $75 in collections, which is net of bad debt losses and contractual allowances, in its first year of use. Thus, net revenues for Year 1 are estimated at 18 X 250 X $75 = $337,500. Labor and maintenance costs are expected to be $90,000 during the first year of operation, while utilities will cost another $15,000 and cash overhead will increase by $5,000 in Year 1. The cost for expendable supplies is expected to average $7 per procedure during the first year. All costs and revenues, except depreciation, are expected to increase at a 5 percent inflation rate after the first year. The equipment falls into the MACRS five-year class for tax depreciation and hence is subject to the following depreciation allowances: Year Allowance 1 0.20 N 2 0.32 3 0.19 4 0.12 5 0.11 6 0.06 The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 percent. What is the project's after-tax equipment salvage value? Answer to the nearest dollar. 22) 7.b. Using the information in the previous question, what is the project's net cash flow at date 02 Answer to the nearest dollar. Question 23 1 pts 23) 7.c. Using the information in the previous questions, what is the project's net cash flow at date 1? Answer to the nearest dollar. Question 24 1 pts 24) 7.d. Using the information in the previous questions, what is the project's net cash flow at date 2? Answer to the nearest dollar. 25) 7.e. Using the information in the previous questions, what is the project's net cash flow at date 3? Answer to the nearest dollar. Question 26 1 pts 26) 7.f. Using the information in the previous questions, what is the project's net cash flow at date 4? Answer to the nearest dollar. Question 27 1 pts 27) 7.g. Using the information in the previous questions, what is the project's net cash flow at date 5? Answer to the nearest dollar. 28) 7.h. Given your answers to the previous questions, what is the project's NPV? Answer to the nearest dollar. Question 29 29) 7.i. Given your answers to the previous questions, what is the project's IRR? Type your answer as a percentage. Round to one decimal place