Answered step by step

Verified Expert Solution

Question

1 Approved Answer

21 Help me to answer this in 1 and a half - 2 hours please give me a correct answer 21. On January 01, 2019,

21 Help me to answer this in 1 and a half - 2 hours please give me a correct answer

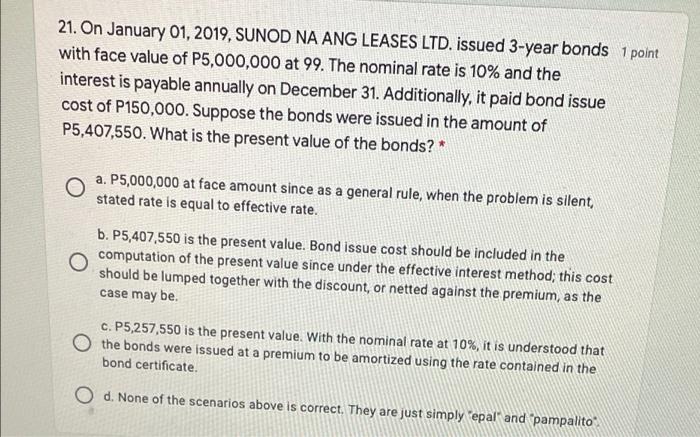

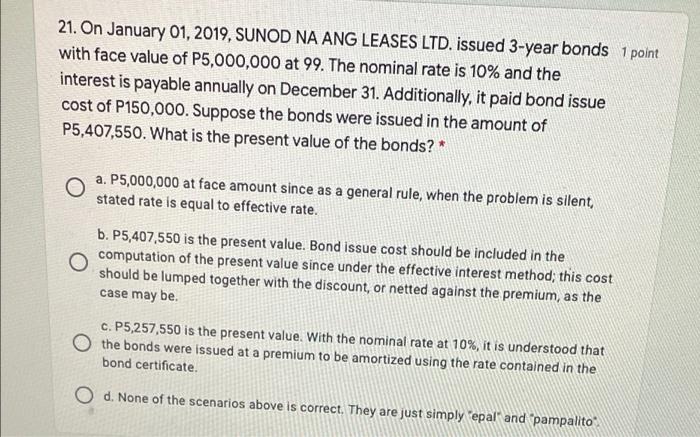

21. On January 01, 2019, SUNOD NA ANG LEASES LTD. issued 3-year bonds 1 point with face value of P5,000,000 at 99. The nominal rate is 10% and the interest is payable annually on December 31. Additionally, it paid bond issue cost of P150,000. Suppose the bonds were issued in the amount of P5,407,550. What is the present value of the bonds? * O a. P5,000,000 at face amount since as a general rule, when the problem is silent stated rate is equal to effective rate. b. P5,407,550 is the present value. Bond issue cost should be included in the o computation of the present value since under the effective interest method; this cost should be lumped together with the discount, or netted against the premium, as the case may be. c. P5,257,550 is the present value. With the nominal rate at 10%, it is understood that the bonds were issued at a premium to be amortized using the rate contained in the bond certificate O d. None of the scenarios above is correct. They are just simply epal and pampalito

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started