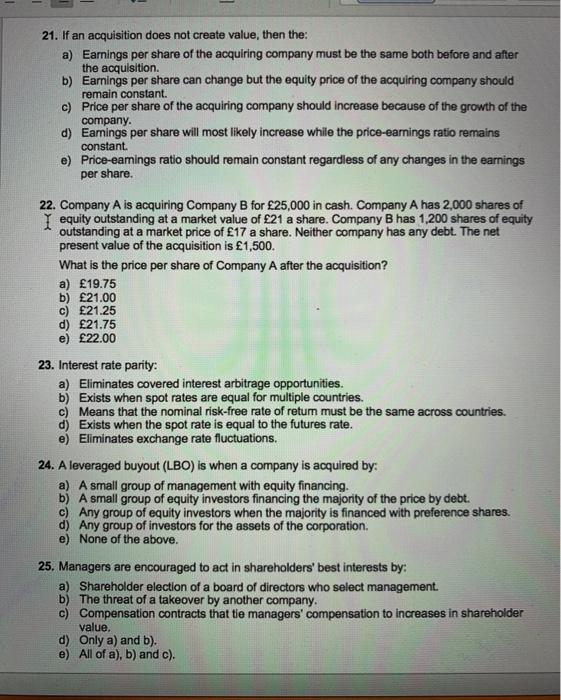

21. If an acquisition does not create value, then the: a) Earnings per share of the acquiring company must be the same both before and after the acquisition b) Earnings per share can change but the equity price of the acquiring company should remain constant. c) Price per share of the acquiring company should increase because of the growth of the company. d) Eamings per share will most likely increase while the price-earnings ratio remains constant. e) Price-earings ratio should remain constant regardless of any changes in the earnings per share. 22. Company A is acquiring Company B for 25,000 in cash. Company A has 2,000 shares of I equity outstanding at a market value of 21 a share. Company B has 1,200 shares of equity outstanding at a market price of 17 a share. Neither company has any debt. The net present value of the acquisition is 1,500. What is the price per share of Company A after the acquisition? a) 19.75 b) 21.00 c) 21.25 d) 21.75 e) 22.00 23. Interest rate parity: a) Eliminates covered interest arbitrage opportunities. b) Exists when spot rates are equal for multiple countries. c) Means that the nominal risk-free rate of retum must be the same across countries. d) Exists when the spot rate is equal to the futures rate. e) Eliminates exchange rate fluctuations. 24. A leveraged buyout (LBO) is when a company is acquired by: a) A small group of management with equity financing. b) A small group of equity investors financing the majority of the price by debt. c) Any group of equity investors when the majority is financed with preference shares. d) Any group of investors for the assets of the corporation. e) None of the above. 25. Managers are encouraged to act in shareholders' best interests by: a) Shareholder election of a board of directors who select management. b) The threat of a takeover by another company. c) Compensation contracts that tie managers' compensation to increases in shareholder value. d) Only a) and b). e) All of a), b) and c)